In 1990, the New York Mercantile Exchange, a leading energy futures market, introduced futures contracts on U.S. natural gas for delivery at the Henry Hub in Erath, Louisiana. The price opened at $1.61 per MMBtu, with each contract representing 10,000 MMBtu of the energy commodity.

For years, the U.S. pipeline network limited the domestic natural gas flow. Massive discoveries in the Marcellus and Utica Shale regions increased supplies, and technological advances to extract the gas from the earth’s crust reduced production costs. While significant supply increases and falling output costs weighed on natural gas prices, a pair of storms in 2005 and 2008 pushed natural gas to over $10 per MMBtu. In 2005, the price exploded to a record $15.65; in 2008, the peak was lower at $13.694 per MMBtu. Wild price swings cause speculators to flock to the natural gas arena, and many lose their shirts.

Since necessity is the mother of invention, technology expanded natural gas’s fundamental demand as the energy commodity replaced coal in U.S. power generation. Moreover, liquefication expanded the addressable market far beyond the pipeline network. Today, U.S. natural gas travels worldwide by ocean vessels to regions with significantly higher prices. The Henry Hub price is little more than a benchmark as local supply and demand dictate its cost.

In early 2022, Russia’s invasion of Ukraine, sanctions on Russia, and Russian retaliation changed natural gas fundamentals. NYMEX natural gas futures had not eclipsed $10 per MMBtu since 2008 until returning to probe slightly above that level in August 2022 as European benchmark futures prices exploded to record highs. NATO members in Western Europe depend on Russian gas pipeline exports, and the war caused Moscow to turn the energy commodity into an economic weapon.

NYMEX natural gas has a long history of punishing market participants that overstay their welcome by ignoring price trends. The price action since June 2020 has been a painful reminder for more than a few market participants that ignored the path of least resistance of NYMEX natural gas prices.

A massive range in 2022

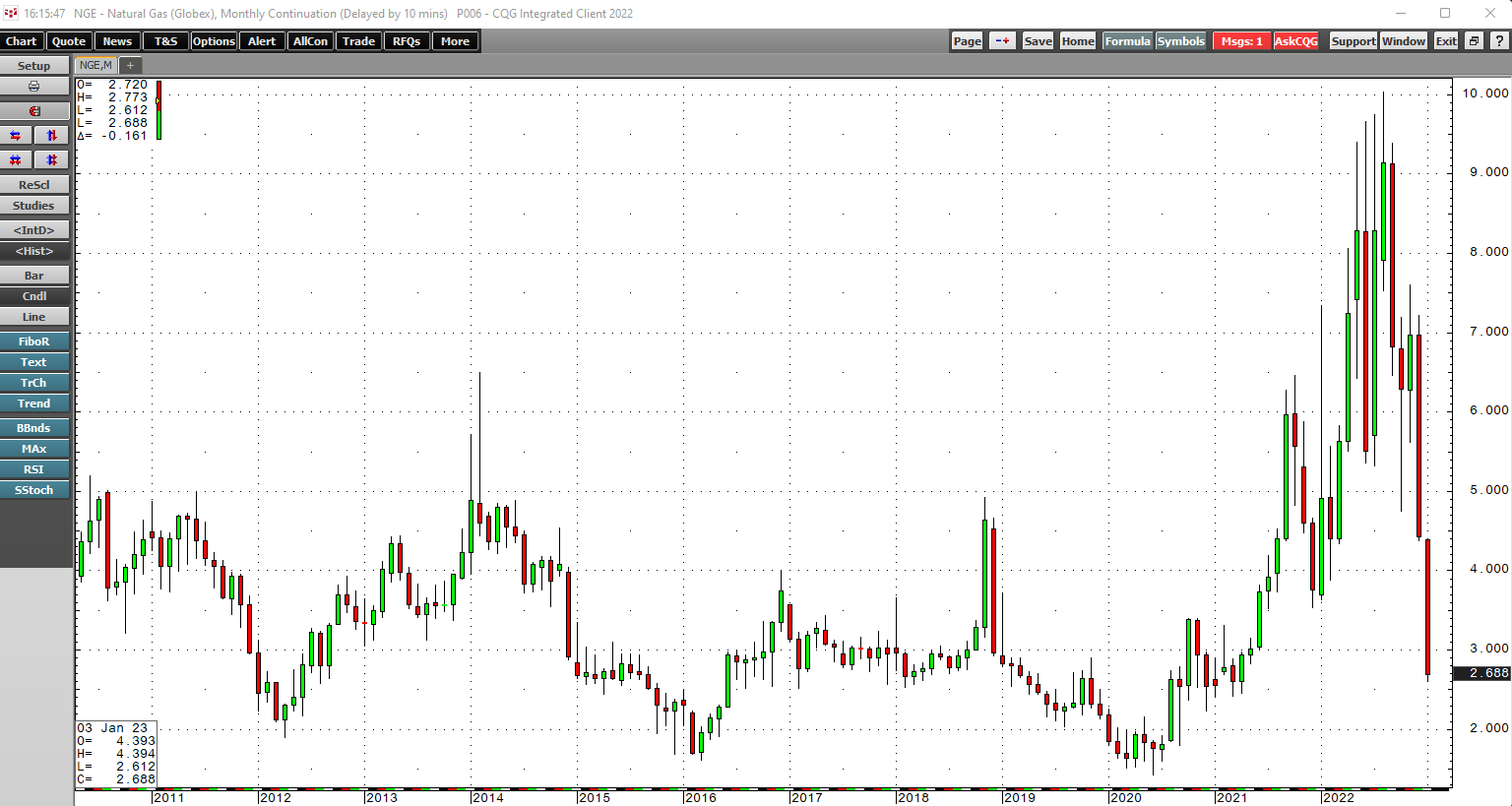

NYME natural gas futures traded in a $6.39 range from low to high in 2022.

The monthly chart highlights U.S. natural gas futures ranging from $3.638 to $10.028 in 2022. After reaching the highest price since 2008 in August 2022, natural gas imploded and continued to drop below the $3 level, the lowest price since May 2021, in early 2023.

Explosion and implosion since the 2020 low

The monthly chart highlights the energy commodity’s explosive and implosive price behavior. More than a few market participants have lost their shirts in the futures market, which can be like riding a psychotic horse through a burning barn.

In June 2020, the $1.432 per MMBtu low was the lowest price for natural gas futures since 1995. The rally that took nearby natural gas over 600 % higher to $10.028 twenty-six months later was a fourteen-year peak. Natural gas had made lower highs, and lower lows from 2005 through 2020, but the bearish trend broke with the move above the November 2018 $4.929 high in September 2021. The explosive price move that followed led to another implosion and prices below $3 at the end of January 2023.

Technical analysis says natural gas is oversold - Europe remains bullish, but the price action is all that matters

After probing over $10 in August and turning lower, many market participants have tried to pick bottoms, only to get burned by the volatile and unpredictable natural gas market.

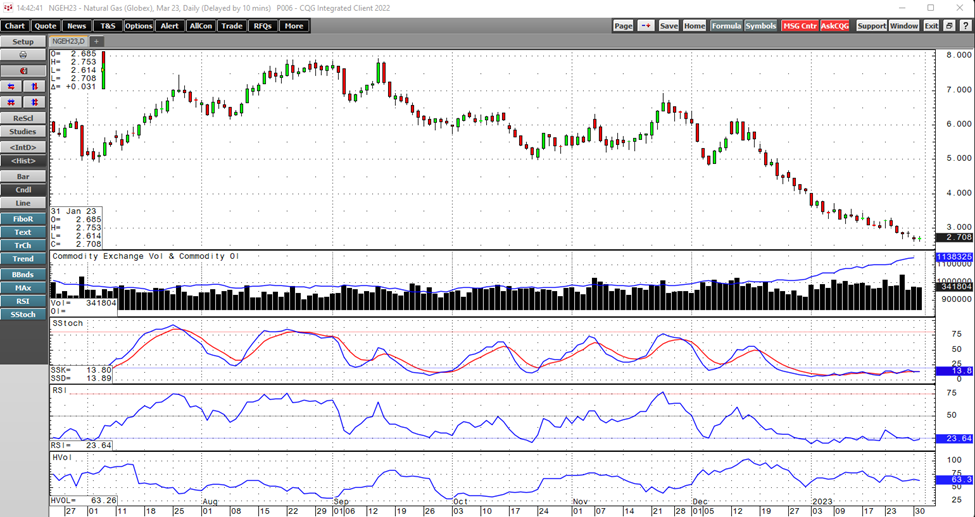

The daily chart highlights at around the $2.70 per MMBtu level on January 31, 2023, the slow stochastic, a momentum indicator, was in oversold territory. Relative strength at 24.3 was also oversold, and daily historical volatility at 63.7% had come down from readings over 100% in late December. Meanwhile, open interest, the total number of open long and short positions in the NYMEX natural gas futures contracts, has risen steadily since early December 2022, moving from below 995,000 to over 1.138 million contracts. Increasing open interest when a futures price declines tends to be a technical validation of a bearish trend. Meanwhile, the plunge from over $10 to below $2.75 per MMBtu needs little technical proof.

U.S. natural gas prices remain under extreme pressure even though natural gas is a more international commodity, and futures prices for delivery in the U.K. and the Netherlands remain at multi-year highs. The war in Ukraine has caused supply and price concerns as Western Europe depends on Russian exports. Russia has used natural gas and oil as economic weapons against “unfriendly” countries supporting Ukraine. Meanwhile, over the past weeks, a warmer-than-average European winter and sufficient U.S. stocks have weighed on prices.

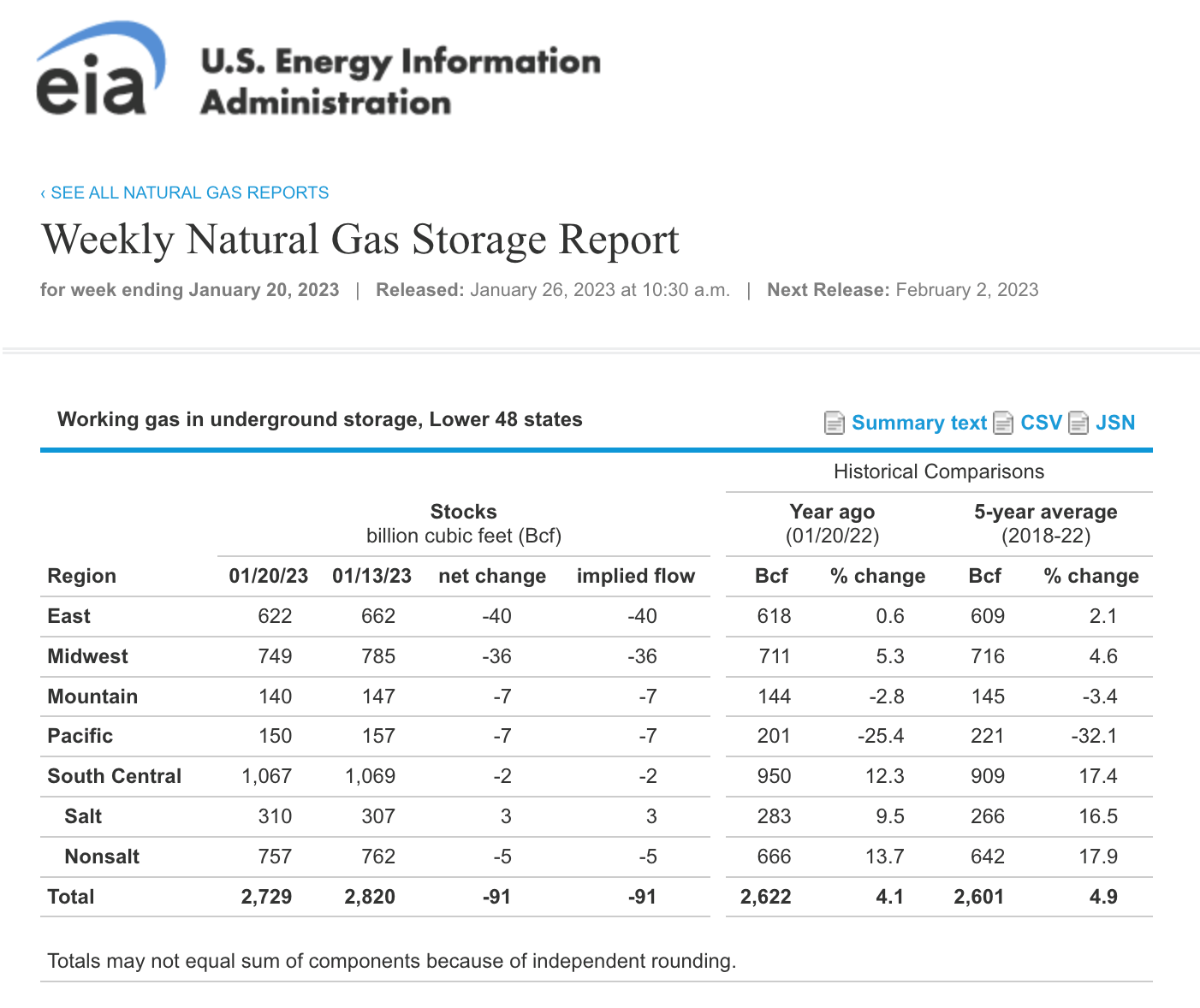

Source: EIA

As of the week ending on January 20, 2023, U.S. natural gas inventories at 2.729 trillion cubic feet were 4.1% above the level at the same time in 2022 and 4.9% over the five-year average for this time of the year.

March NYMEX natural gas futures settled at $2.684 per MMBtu on January 31, 2023. The energy commodity may be oversold, but faces bullish and bearish forces. While the war in Ukraine and oversold readings remain bullish, inventories and the trend since the August 2022 high are bearish.

Oil taught is zero may not be the low

NYMEX futures for delivery at the Henry Hub is a benchmark price and local prices across the U.S. trade at premiums or discounts to the futures. Over the past years, prices for local delivery have been significantly higher or lower than the then-current futures price. Natural gas has traded below zero on a regional basis, and a futures price under that level is not out of the question.

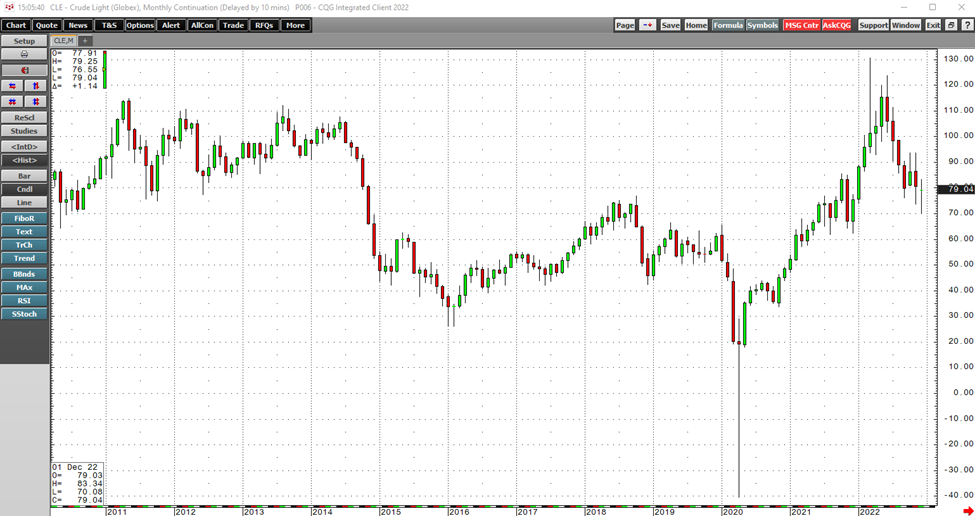

In 2020, the nearby NYMEX crude oil futures market taught us that zero is not an absolute low for the energy commodity.

The chart highlights the decline to negative $40.32 per barrel in April 2020. Market participants holding long positions had nowhere to store the petroleum and found themselves in a situation where they had to sell at any price, paying others to take the oil off their hands.

The volatile natural gas has the potential to experience the same type of downside spike into negative territory, so zero is not an absolute low.

The three critical factors for natural gas trading

Natural gas is a trading paradise, but the volatility creates a nightmare for investors. Therefore, passive investors undertake substantial risks. Traders must follow three rules that are critical for success:

- Plan - Before executing a buy or sell transaction, have a clear plan for risk and potential reward. At a minimum, in volatile natural gas, risk should be equal to or less than the potential reward.

- Respect the trend - The trend is your friend, even if fundamentals and technical signals indicate otherwise. Remember that Newton’s first law of motion states that a body in motion tends to remain in motion in the same direction unless acted upon by an outside force. Therefore, respect the trend and realize the market price is always correct.

- Stick to risk-reward dynamics - A plan is useless followed. It is acceptable to adjust risk-reward dynamics when the market moves in your favor, adjusting a stop higher or lower to enhance a potential reward and protect capital. However, modifying a stop when the market moves contrary to expectations equates to ignoring a trend and believing the market price is incorrect, which is a tragic mistake over time. Sticking to a plan requires discipline, a crucial factor for success.

Volatility creates opportunities, but it also increases the risk of significant losses. Natural gas futures are ground zero for those seeking action because of the historical price variance. Trade with a plan and the discipline to stick to a predetermined program.

When it comes to nearby natural gas futures, the trend remains bearish at the end of January 2023. However, the oversold condition and ongoing war in Ukraine could change the path of least resistance in the blink of an eye. Be nimble and respect the market that offers substantial rewards for disciplined traders and tragic consequences who ignore risk dynamics.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.