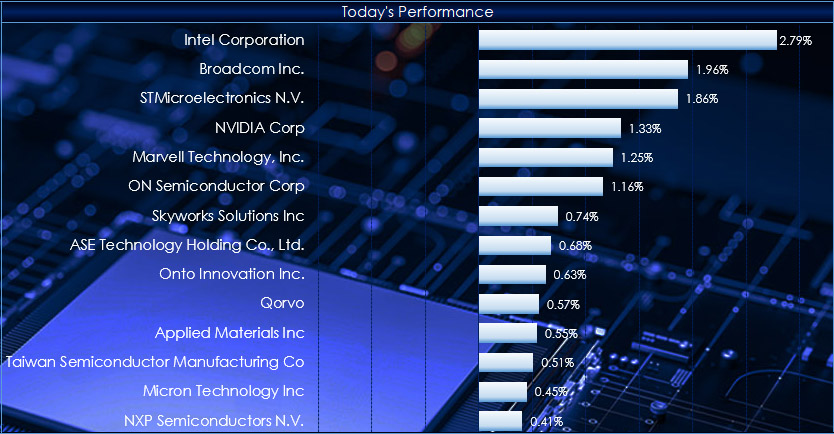

This macro-enabled Microsoft Excel® spreadsheet tracks the holdings of the iShares Semiconductor ETF (SOXX). The ETF tracks the investment results of an index composed of listed US equities in the… more

Workspaces

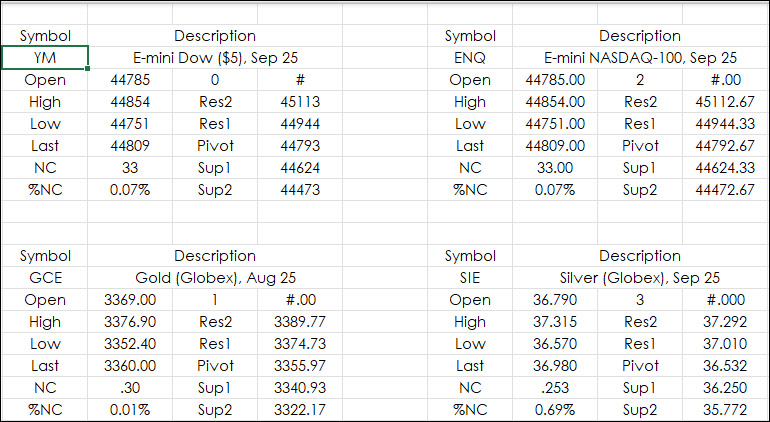

This post details bringing in the Pivot Points study values from IC or QTrader into Excel.

The pivot point is the arithmetic average of the high (H), low (L), and closing (C) prices of the… more

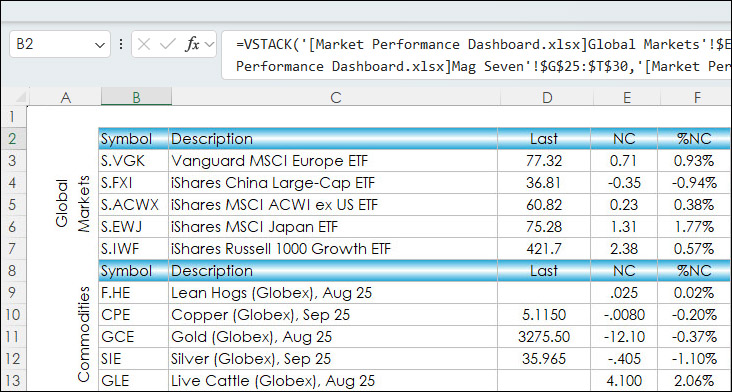

The Excel VSTACK function appends arrays vertically and in sequence to return a larger array.

Syntax:

=VSTACK(array1,[array2],...)As an example, the post "Market Performance Dashboard… more

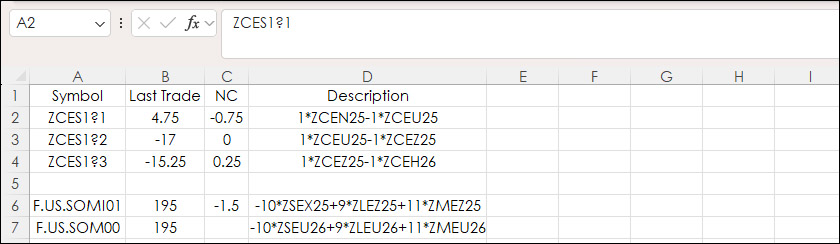

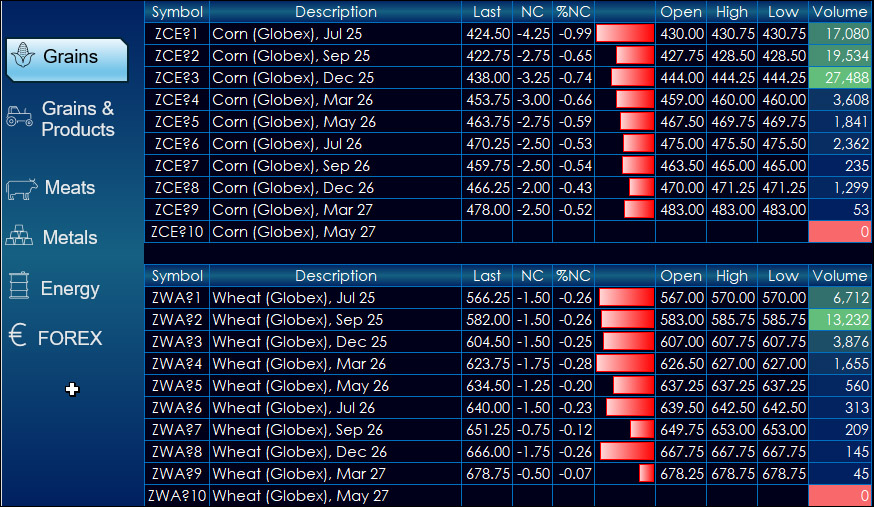

One important step when building Excel market dashboards is managing screen real estate. For example, in a recent post "CQG CME Markets Dashboards" a section displayed Corn 1-month Calendar… more

This dashboard provides market data for CME products. The dashboard uses a navigation bar instead of tabs.

The left-hand side provides market data for products. The right-hand side… more

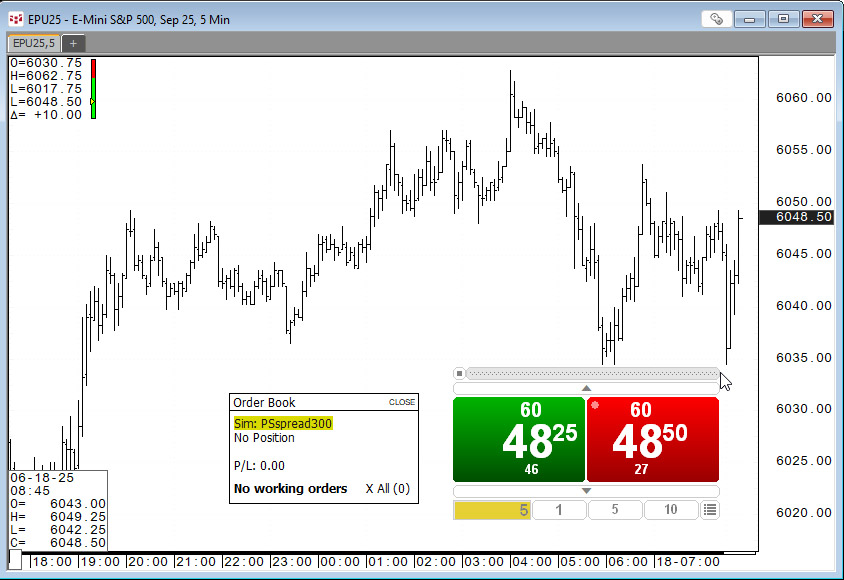

For those who trade based on the price action unfolding on a chart the appropriate trade routing interface is the SnapTrader 2, the topic of this post.

Below, the SnapTrader 2 (horizontal… more

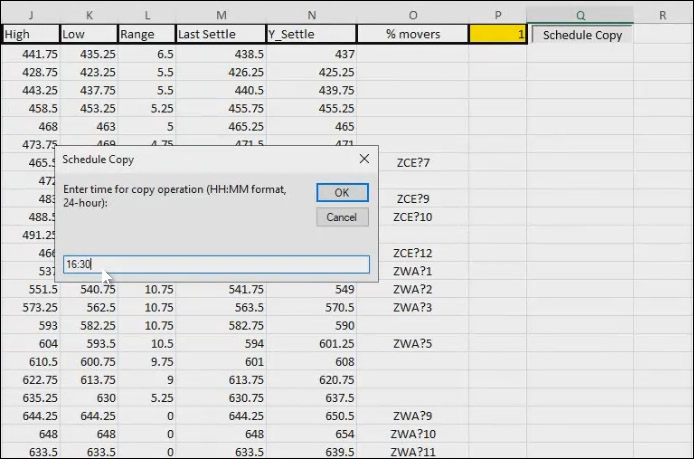

With the advent of nearly 24-hour electronic trading, one technical issue is market data servers require to be cleared of today's trading activity before the opening of the evening sessions. This… more

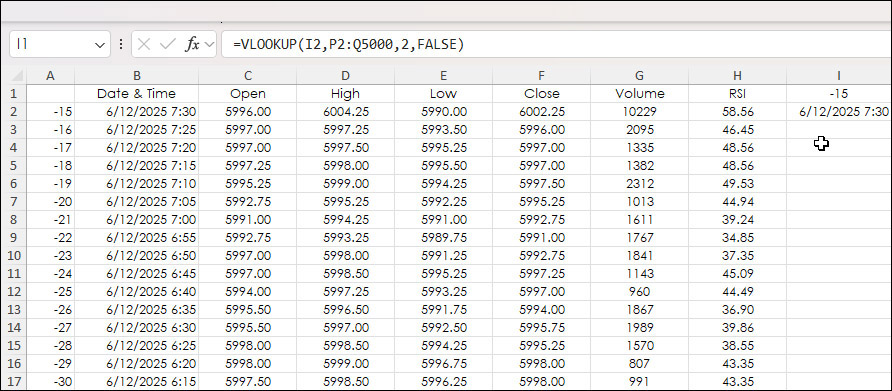

A typical historical Excel RTD dashboard pulls in market data using the bar index parameter. Below, the bar index is in column A. The most current bar is "0". The previous bar is "-1", etc.

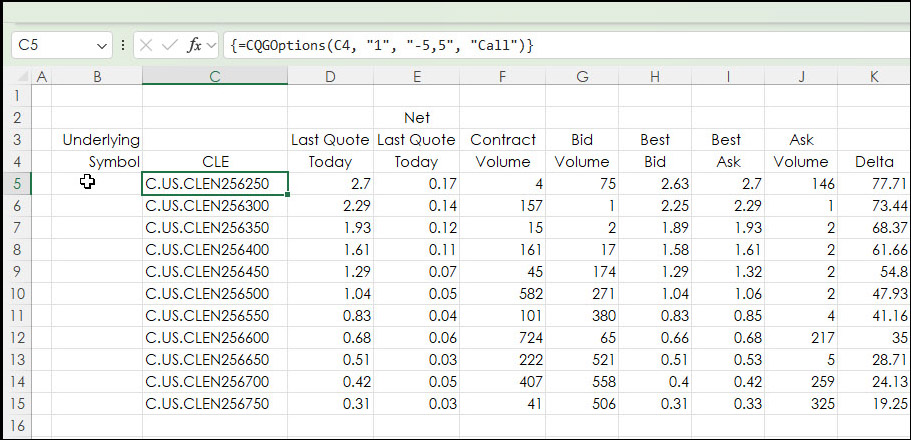

… moreThis post walks the reader through building option chains in Excel. The CQG RTD Toolkit offers this functionality, however, the same feature can be implemented using Excel's CONCATENATE function.… more

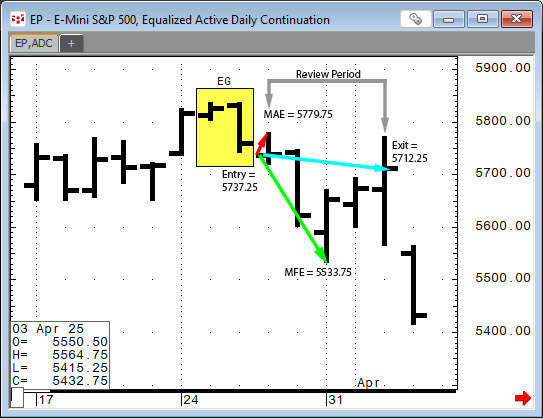

This post provides a guideline to reviewing the outcomes of a pattern recognition approach to the markets.

Two recent posts on Workspaces discussed CQG's Candlestick Formations Study.

… more