- Gold soars to new highs

- Silver goes parabolic

- Platinum and palladium take off on the upside

- A commentary on fiat currency values

- The prospects for 2026- Cyclicality versus fundamental trends

Precious metals became a lot more precious in 2025 as prices of the four metals trading on the CME's COMEX and NYMEX divisions posted extraordinary gains. Gold had been making new record highs for years after eclipsing $875 per ounce in 2008. After bullish key reversals in Q2 2025, silver, platinum, and palladium joined the parabolic gold rally.

The trend is always a trader's or investor's best friend, and as the precious metals sector heads into 2026, it remains more than bullish. However, commodity cyclicality suggests that explosive rallies often lead to significant corrections, so the higher the prices rise, the greater the risk of substantial downside price action.

Gold soars to new highs

Gold closed 2024 at $2,641 per ounce on the nearby COMEX gold futures contract.

The monthly chart highlights gold's 72.5% rally, which took the price to a $4,556.30 per ounce high in December 2025.

The quarterly chart shows that gold reached new record highs over the past 9 consecutive quarters, as the bull market has lifted the precious metal by more than 18 times from its 1999 low of $252.50 per ounce.

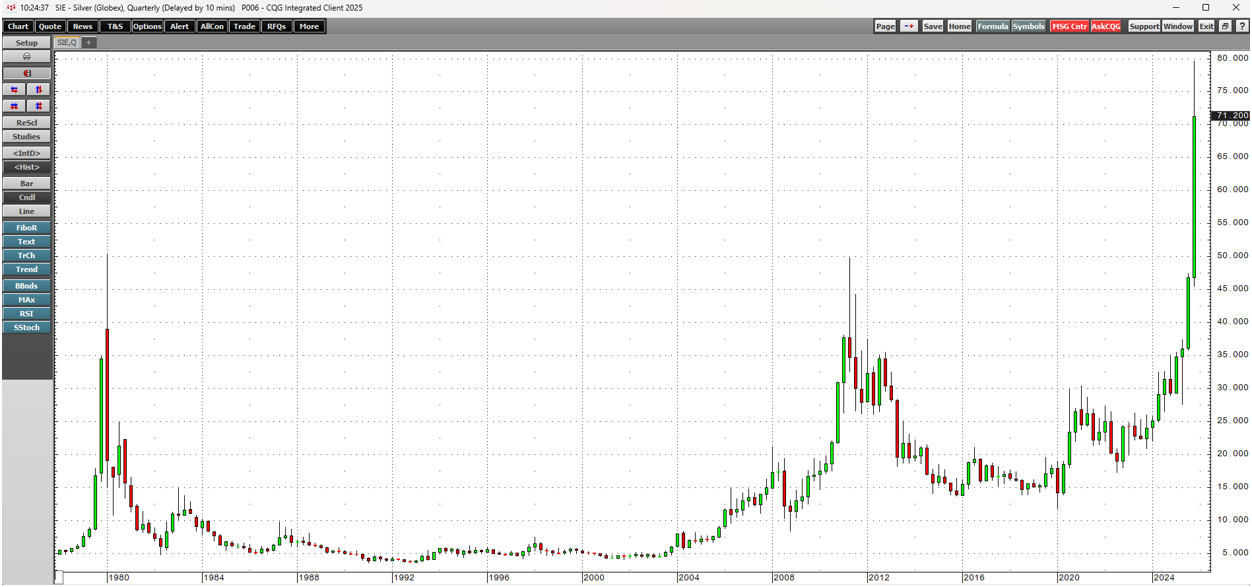

Silver goes parabolic

Silver, gold's more volatile sibling, outperformed gold on a percentage basis in 2025.

The monthly continuous contract COMEX silver futures chart highlights silver's 172.6% rally, which took the price from $29.242 at the end of 2024 to a $79.70 per ounce high in December 2025.

The quarterly chart illustrates silver's Q2 2025 bullish key reversal formation, which launched the price higher. Silver fell below the Q1 2025 low in Q2 before closing above the Q1 high, igniting the rally that drove silver prices above the 1980 high of $50.36 in October and to successive new record high prices in November and December 2025.

Platinum and palladium take off on the upside

Platinum and palladium are rare precious metals with industrial applications that trade in the futures market on the CME's NYMEX division.

The quarterly continuous NYMEX platinum futures chart highlights the same Q2 quarterly bullish key reversal formation that pushed platinum prices above $2,000 for the first time since 2008. Platinum prices rose 186.7% from $894.00 at the end of 2024 to the most recent $2,563.50 per ounce high in December 2025. Platinum futures eclipsed the previous 2008 all-time high of $2,308.80 per ounce.

Meanwhile, palladium was the third precious metal to form a bullish key reversal pattern in Q2 2025. The continuous quarterly NYMEX palladium chart highlights the 2025 118.15% rally from $909.80 at the end of 2024 to the $1,984.70 high in December 2025.

Gold was the precious metal laggard in 2025, with an incredible 72.5% gain at the 2025 high in a year where precious metals experienced massive percentage gains and continued to reach new all-time highs. Silver reached a new high after surpassing the record made four and a half decades ago. Platinum broke out of a decade-long consolidation around the $1,000 per ounce pivot point and eclipsed the 2008 peak. Palladium rose to its highest price since late 2022 and reached a pre-2019 record high in late 2025.

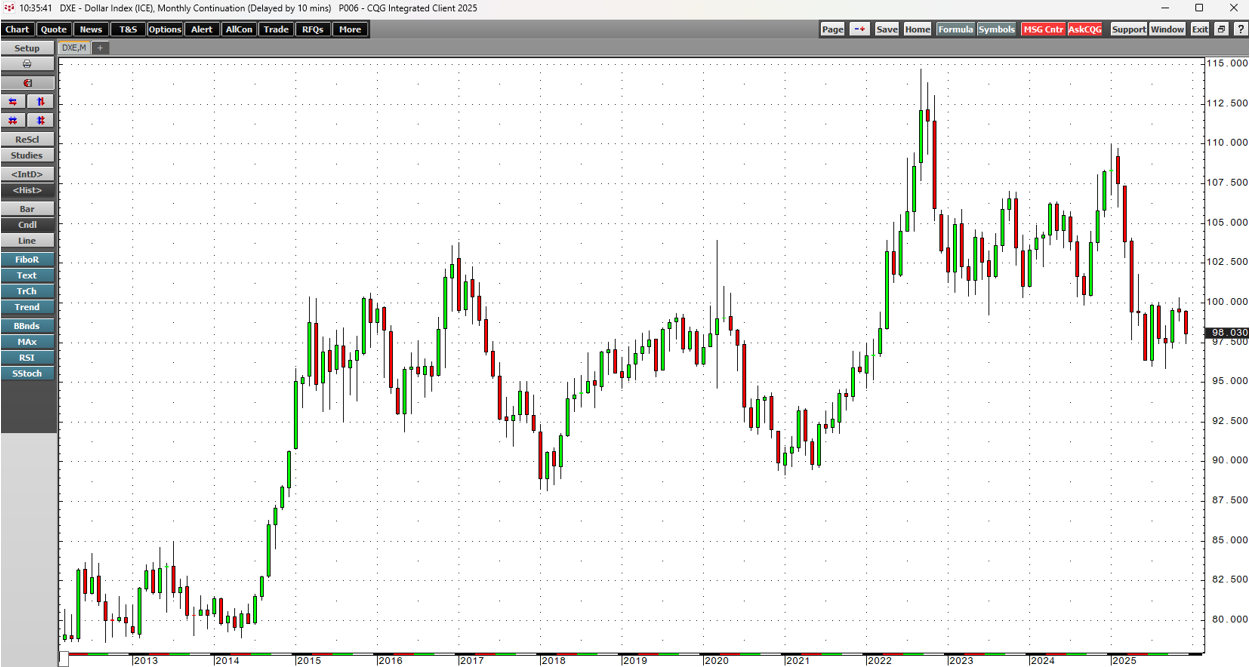

A commentary on fiat currency values

Precious metals have industrial and ornamental applications, but they are also financial assets. Gold and silver have long histories as hard currencies and stores of value dating back thousands of years.

Gold, silver, platinum, and palladium have rallied across all fiat currencies. The U.S. dollar is the world's leading reserve currency. The U.S. dollar index measures the dollar against other leading freely exchangeable reserve currencies, with the euro accounting for the most significant exposure (57.6%).

The monthly continuous chart of the U.S. dollar index futures contract shows the 9.5% decline from 108.28 at the end of 2024 to 98.030 in late December 2025. The 9.5% decline is only part of the story, as the dollar and other currencies' values have plunged against gold and silver, the world's oldest means of exchange.

Central banks, monetary authorities, governments, and even supranational institutions hold gold as an integral component of their foreign currency reserves. Over the past years, central banks have consistently added to their gold reserves.

The world's two leading gold-producing countries are China and Russia. Since the Chinese and Russians consider strategic reserves national security matters, the central bank and government buying statistics are likely understated, as domestic production likely moved into these countries' reserves. The bottom line is that governments have validated gold's role in the worldwide financial system, and the price increases over the past years have not only raised gold's profile but also made it a critical asset for institutional and retail portfolios.

The price action in gold, silver, platinum, and palladium signals that fiat currencies have lost considerable purchasing power.

The prospects for 2026 - Cyclicality versus fundamental trends

When thinking about the prospects for the precious metals in 2026 after such an explosive year, commodity cyclicality increases the odds of corrections, as even the most aggressive bull markets rarely move in straight lines.

Bull markets tend to rise to unsustainable prices where production increases, inventories grow, demand declines, and prices reach tops and reverse. While gold, silver, platinum, and palladium have idiosyncratic fundamental characteristics, they have all rallied as fiat currency's purchasing power has declined. If the currency trend continues, higher highs are likely. Increasing debt, the bifurcation of the world's nuclear powers, wars, tariffs, sanctions, and uncertainty are bullish factors for the precious metals as the markets head into 2026.

Meanwhile, higher prices increase the odds of periodic selloffs. In gold and silver, buying during corrections has been optimal since the turn of this century, and I expect that trend to continue. Platinum has broken out of a long-term consolidation, and new record highs above the 2008 peak are likely. Palladium is the least liquid precious metal traded on the futures exchange, so extremely volatile conditions could develop over the coming months.

After a precious 2025, the four metals enter 2026 in explosive bull markets. The odds favor a continuation of higher highs, but the bullish road could be extremely bumpy as the cure for high commodity prices is always those high prices. Precious metals are unique raw materials, as they are part commodity and part financial asset, which has led to explosive rallies, but also makes forecasting future prices more challenging.