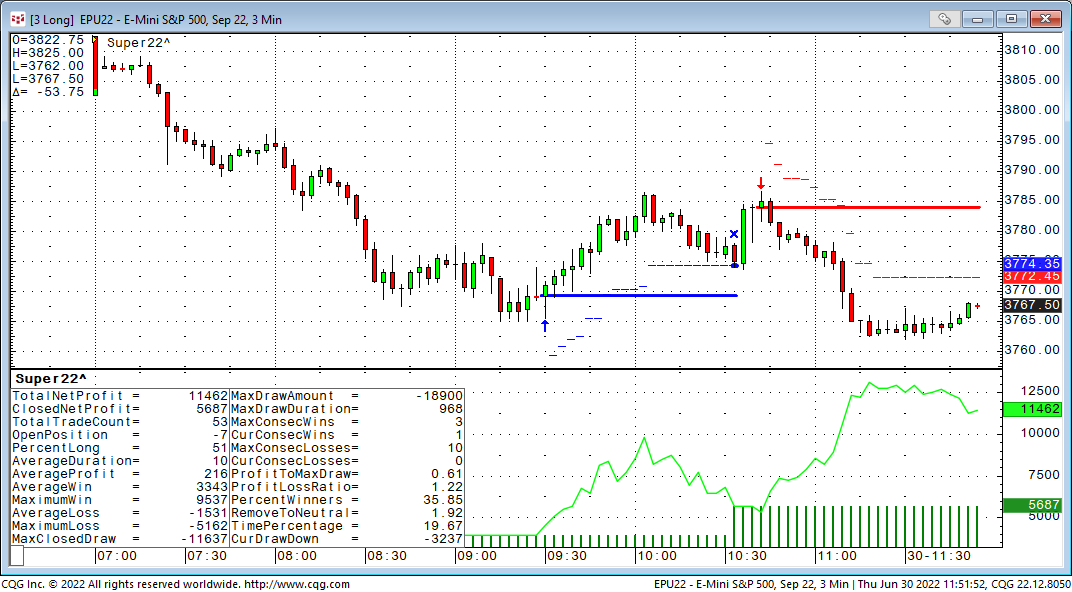

It has been a while since I introduced the Super Template as a shortcut to build trading system inside CQG. In a nutshell, the Super Template is a trading system ready to run, that has a long and short entry, and many different exits that do not need to be “programmed” anymore. They just need to be turned on or off in the settings, and maybe preset with a useful value like a stop loss.

There are a few requests we see frequently, so I decided to add these into the 2022 version of the Super Template.

- Start and end trading based on local time

- Exit trading based on local time (on/off)

- Limit the number of trades per day (long and short)

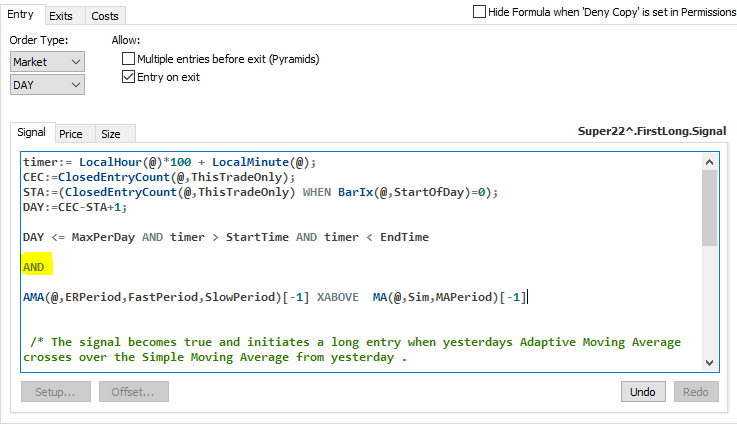

The new Entry looks like this:

The first four lines set various variables to be used for the entry. Line 5 is checking that we have not exceeded max trades and we are above start time and below end time. Line 6 is the AND marked yellow for reference and line 7 is the actual signal to go long in this case.

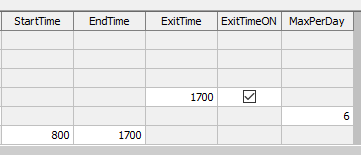

If you right click on the P&L and select modify trading system you will see the parameters. The new pieces are all the way to the right.

StartTime 800 means the first trade can occur on a bar that has a time greater 8:00 so 8:01 on a one-minute chart or 8:05 on five-minute bars.

EndTime means a new trade can only be initiated if the bar time is below 1700 i.e. 16:59 on a one-minute chart.

ExitTime is the open of the bar that crosses above the selected time. For example, 1700 means that the exit would occur on the open of the 17:01 bar in a one-minute chart. If you want to exit when the clock exactly jumps to 17:00 you need to fill in 1659 as a parameter.

ExitTimeON needs to be checked to use that exit.

MaxPerDay is the number of trades that can happen per trade (!) i.e. if you set it to 6 means it can create 6 long and 6 short trades within the day.

Important:

Intraday if you want to use the start/end time function the box Intraday need to be checked! For daily, weekly charts e.t.c. it should remain unchecked.

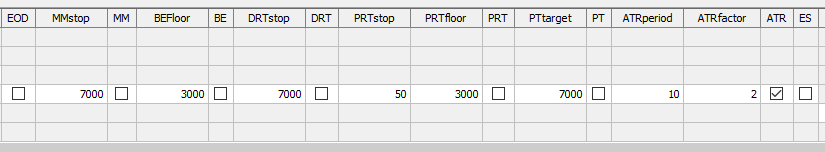

The other pre-defined exits are:

- EOD - End Of Day will exit any position at the last bar of the day when checked.

- MMstop - Money Management is a simple stop loss. You just need to specify the amount.

- MM - Money Management Stop is on if checked.

- BEFloor - Break Even Exit will close the position when it returns to its entry price. It needs to reach a certain amount of profit (Floor) before it is activated.

- BE - Break Even Exit is on if checked.

- DRTstop - Dollar Risk Trailing is a classic trailing stop that is based on maximum profit during the trade (calculated by each close).

- DRT - Dollar Risk Trailing is on if checked.

- PRTstop - Percent Risk Trailing puts a stop below the maximum profit close to risk x% of the money already gained in the trade. The value is in percent.

- PRTfloor - Percent Risk Trailing needs to reach a certain amount of profit (Floor) before it is activated.

- PRT - Percent Risk Trailing is on if checked.

- PTtarget - Profit Target exits a position if a certain amount of money is gained.

- PT - Profit Target is on if checked.

- ATRperiod - Average True Range trailing stop uses the value of the Average True Range study when a trade is initiated. ATRperiod is the length of the ATR measurement.

- ATRfactor - ATRfactor is the parameter that determines how many ATRs the stop is placed away from the market.

- ATR - Average True Range trailing stop is on when checked.

- ES - Entry Stop places an initial stop on the low (for long trades), or on the high (for short trades) of the entry bar. Entry Stop is on if checked.quantity - quantity is the trading size, in contracts, for a stock or future trade.

- FX - If FX markets are traded, the quantity gets multiplied by 100,000. If you want a clip size of 1,000,000 per trade, that is a quantity of ten with FX multiplier checked.

A little note at the end: Super Template is not a trading system ready to use and this is not trading advice. This is simply a template to utilize the full suite of CQG's predefined exits with a sample entry and a sample exit.