First quarter of 2016 is now in the books. It was a quarter of fear, of uncertainty, of losses, and redemption. Overall, a composite of the twenty-nine major commodities traded on futures markets moved only 1.63% higher. When I include iron ore, lumber, and the Baltic index, the gain for Q1 amounts to 2.32%. It was a tale of two markets during the first three months of 2016.

During the first six weeks, some major commodities made new multi-year lows. In February, crude oil traded to the lowest price since 2003. In January, copper traded to the lowest level since 2009. However, both wound up posting gains on the quarter. Gold and high-quality government bonds moved higher out of the gate. The best performing commodities were two industrial raw materials: iron ore gained 24.16% and lumber was up over 21% for the quarter. Equity prices were little changed, but the S&P 500 plunged 11.5% and then recovered to finish up just under 1%.

The Dollar and Commodities - Commodities Lag

The US dollar corrected lower in Q1, falling 4.22% on the dollar index futures contract. Central bank policy in the US and Europe caused the slide in the dollar. Given the inverse historical relationship between the dollar and raw material prices, commodities under performed the dollar, registering gains of only half the dollars correction. In 2015, commodities fell around twice the amount, on a percentage basis, that the dollar gained. Last year the dollar index rose 8.94% and commodities fell 17.54%.

The under performance of commodities relative to the dollar could be the result of the bear market conditions that began in 2011/2012. It has been difficult to attract investors, traders, and speculators back to these markets.

China Continues to be a Question Mark

One of the reasons for the tepid performance by commodity prices in light of the dollar could be China. China has been the demand side of the equation when it comes to raw material prices over recent years. The economy in China continues to slow as the nation shifts from a heavy manufacturing to a consumer-based economy. During the heyday of the bull market in commodities, China could not buy and stockpile enough raw material assets. That has changed over recent years as double-digit growth has become a thing of the past for the Chinese.

In a sign of the economic woes facing China, the domestic stock market plunged on the year's first trading day, sending fears of contagion around the world. The already weak European economy saw its stock market cascade lower in response to action in Chinese markets, and the US markets followed suit. Fear and uncertainty gripped all asset markets and many traders and investors turned to safe haven assets.

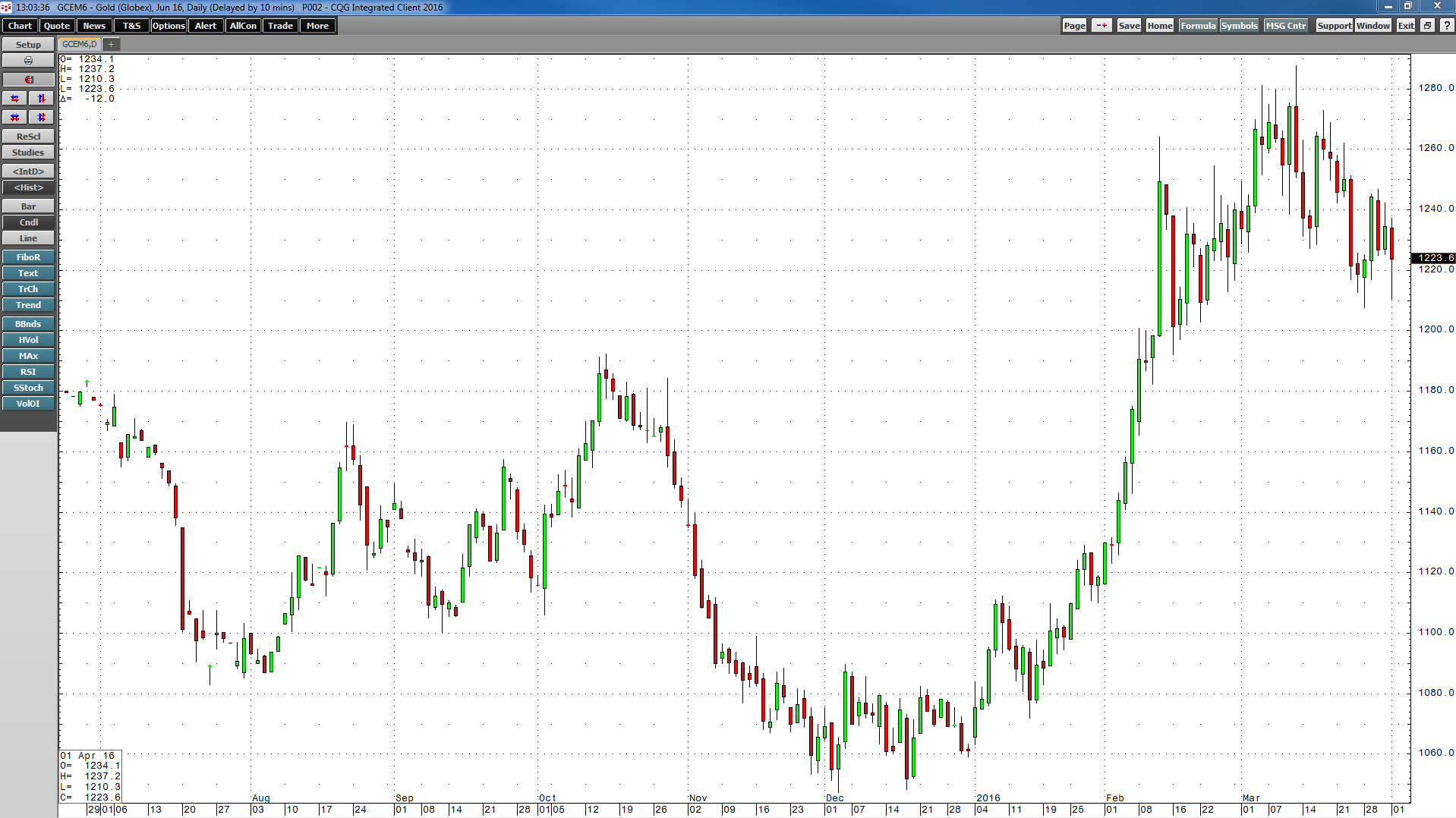

Precious Metals Shine - The Best Performing Sector

Gold came out of the gate like a charging horse in Q1 and it added to gains over the course of the three-month period. Gold was up 16.41%, posting the best quarterly results in thirty years. Silver gained 11.86% and platinum rallied 9.52% while palladium only posted a margin gain of under 1%. The precious metals sector was up 9.54% on the quarter, making it the best performing sector.

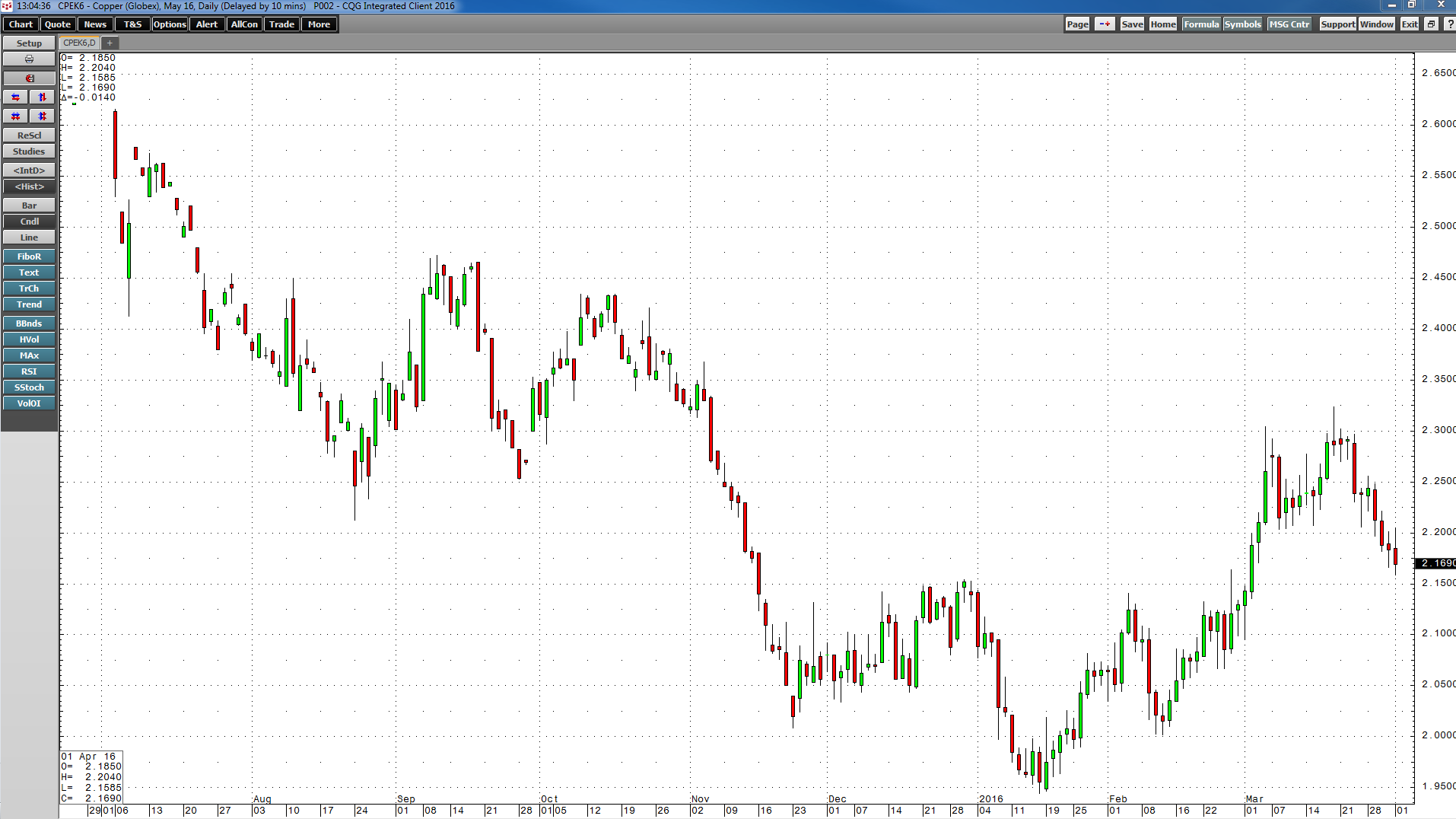

While luster returned to precious metals, nonferrous metals as a sector gained 3.36% over the three-month period. Tin was the leader, up 16.18%, and zinc also posted a double-digit gain of 10.89%. These metals were both down over 25% in 2015. Copper was up 2.7% on COMEX and 2.55% on the LME. Meanwhile, lead sunk 4.74% and nickel shed another 3.9% of its value. Aluminum was down around 0.8%. Nonferrous metals were the second best performing sector in Q1.

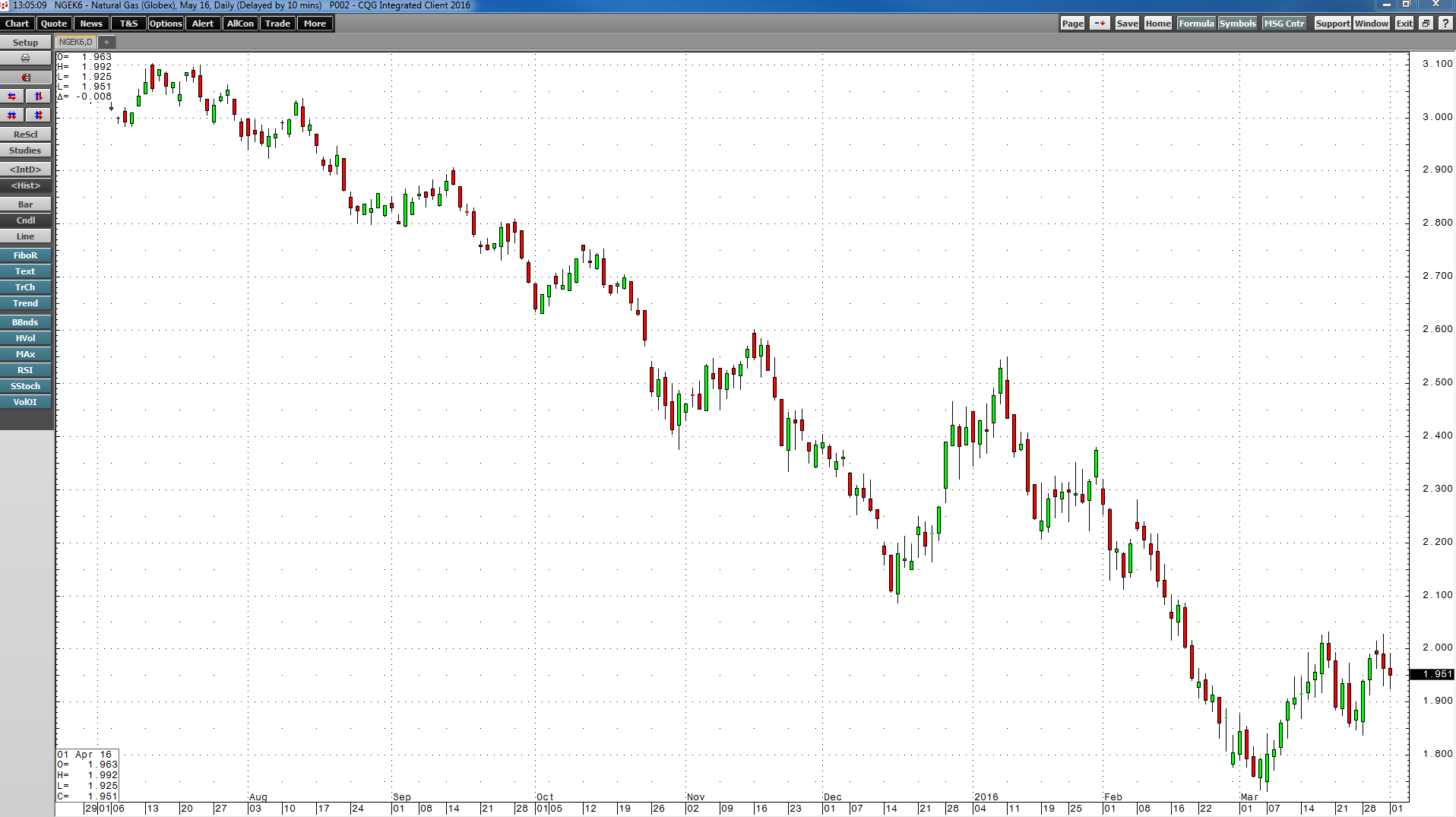

Coming in a close third was energy. The energy composite was up 2.37%. The leader was gasoline, which moved close to 14% higher. Heating oil gained almost 5.5% and WTI and Brent crude oil futures added between 3.5-5% on the quarter. Ethanol gained 2.6% and the only loser was natural gas, which fell over 16% as massive inventories and a warm winter season weighed on price.

While most of these commodities gained on a quarter-to-quarter basis in the nonferrous metal and energy sector, many moved to new lows during January and February, making the comeback dramatic and volatile. Only gold and silver moved higher without making new lows in Q1.

Agricultural Commodities Continue to Sink

The worst performing sectors during the first three months of 2016 were agricultural commodities. The grain sector was down 5.48%. Rough rice was down 16.21% and oats lost 14.61%. Corn fell just over 2%, but all of the losses came on the final trading day of the quarter when it plunged over 4%. CBOT wheat gained just under 1% but KCBT and MGE wheat rose 1.65% and 7.35% respectively. Soybeans rose 4.68% as it was supported by product prices. Soybean meal was up 2.27% and soybean oil was the best performer in the grain sector, adding just over 12% on shortages of palm oil in Asia and increased demand from China.

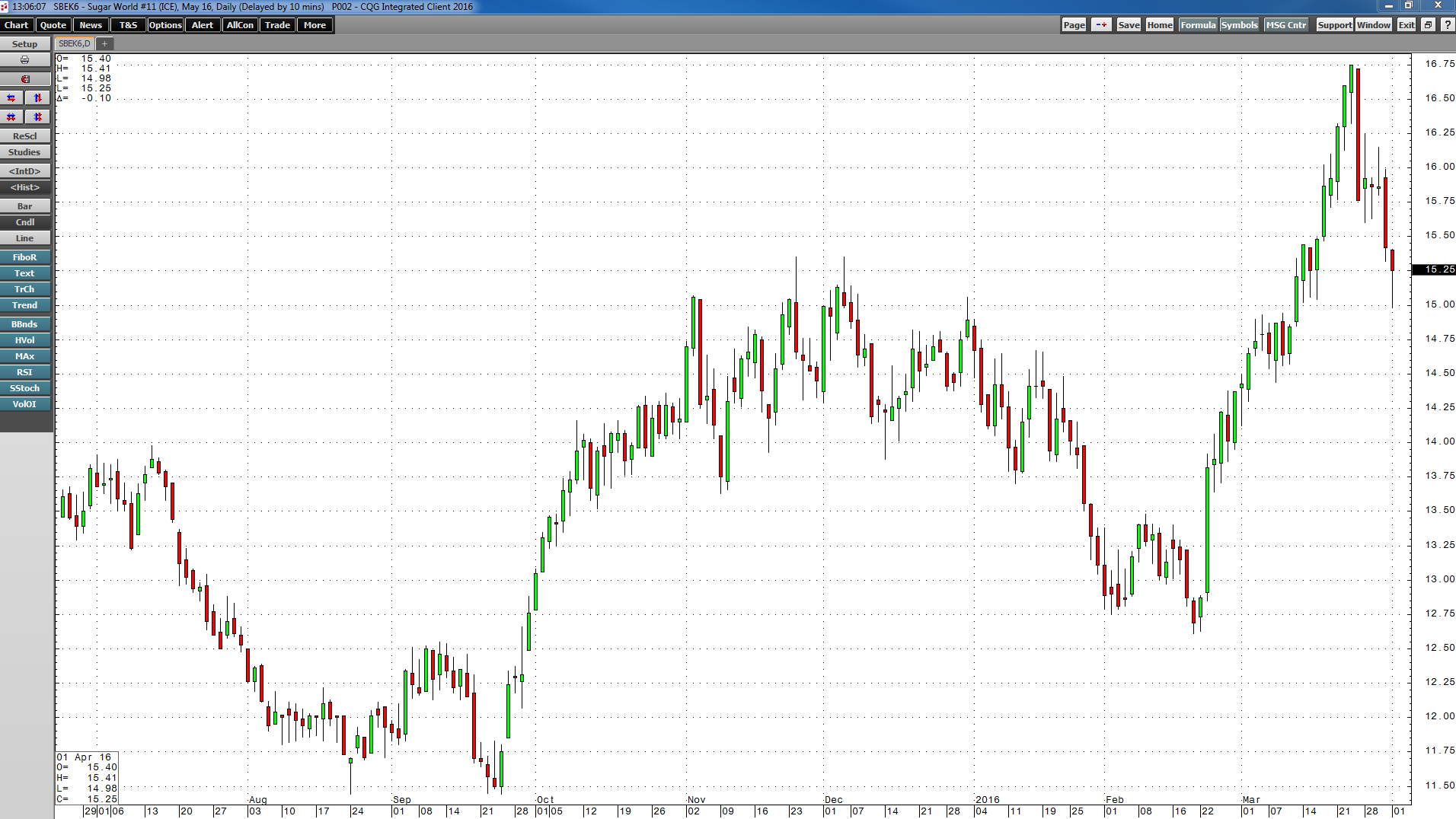

The soft commodities were down 1.86% on losses in cocoa, which shed over 8% of value and cotton, which was down over 7.6%. FCOJ gained over 5% and sugar and coffee posted gains of less than 1%.

Animal proteins posted a small gain on a strong performance in the lean hog market, which rose over 14% on the quarter while live cattle and feeder cattle fell 2.8% and 5.9% respectively.

Basing Action Could Increase Volatility in Q2

The numbers do not do justice to some of the volatility we saw in commodity futures markets during the first three months of 2016.

Copper fell to lows of $1.9355 per pound in January and then rallied to highs of $2.3235 in March, an increase of over 20%.

Natural gas traded to highs of $2.495 in early January and then fell to $1.6110 in early March, a decline of over 35%.

NYMEX crude oil traded to lows of $26.05 on February 11 and then traded to $42.54 on March 18 – an increase of over 63% in five weeks.

Sugar was up 0.72% during the quarter but it moved from 12.45 cents per pound in late February to highs of 16.75 cents on March 23 – an increase of almost 35% in less than one month.

Many commodities traded to levels that could become important bottoms and levels of support as the commodity bear is now in year five. The correction in the dollar provides support to this sector as we head into Q2. Volatility could continue in the commodity asset class. Some of the basing action seen over recent weeks may add to volatility and create frenetic trading conditions at times in the three months ahead. These conditions can create great trading opportunities.