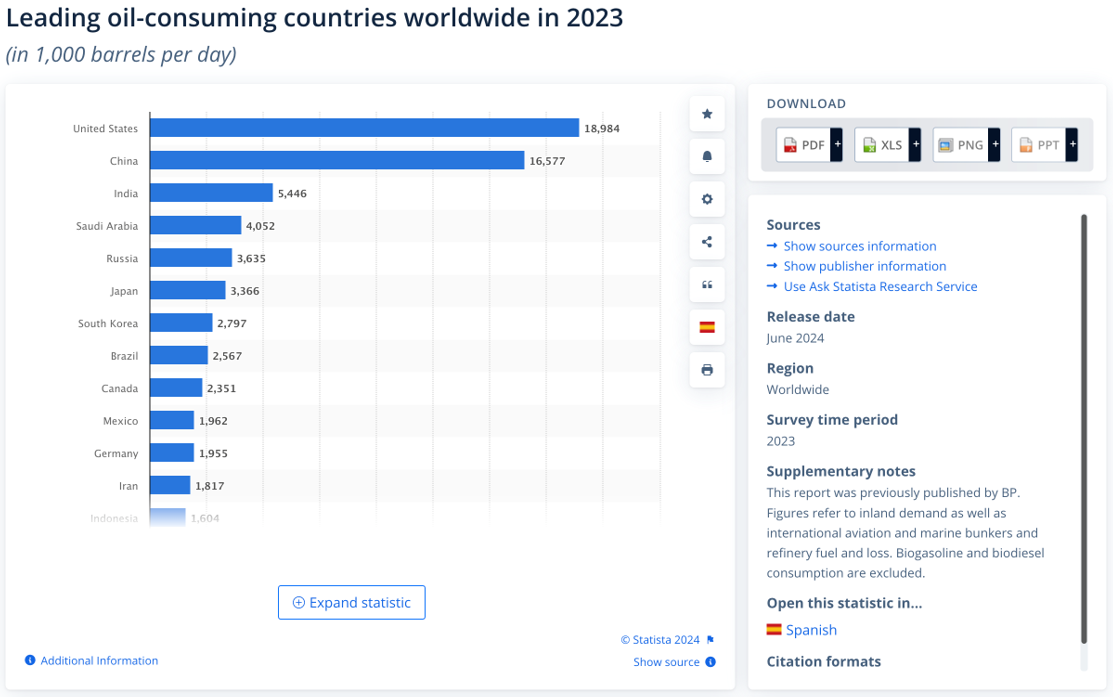

Crude oil is a highly political energy commodity that powers the world. The U.S. is the world's leading oil-consuming country.

Source: Statista

The chart shows the U.S. was the top oil consumer in 2023, with China second. As of late November, the U.S. produced 13.493 million barrels of petroleum per day, making it a net importer of the energy commodity.

In last month's CQG article on the upcoming election, I concluded:

The bottom line is that crude oil is on the ballot in the November 5 U.S. Presidential election. Time will tell if the recent decline in prices predicted a second term for former President Trump as the polls remain a virtual dead heat.

The polls were wrong, and President-elect Trump swept the swing states, collecting 312 electoral college votes, a majority in the popular vote, with Republican majorities in the U.S. Senate and the House of Representatives.

Elections have consequences

The President-elect promised to return to a "drill-baby-drill" and "frack-baby-frack" traditional energy policy to establish energy independence, reduce inflationary pressures, and increase revenues by making the U.S. the world's leading oil and gas exporter.

On November 5, 2024, U.S. voters chose lower energy prices over addressing climate change through the current energy policy path. The odds favor lower oil prices over the coming months and years.

The new administration takes over on January 20, 2025

In early November, the U.S. elected former President Donald Trump to a second nonconsecutive term. Energy policy was on the ballot. Vice President Harris had pledged to continue the Biden administration's energy path of addressing climate change by supporting alternative and renewable energy and inhibiting fossil fuel production and consumption. The President-elect promised to return to a "drill-baby-drill" and "frack-baby-frack" traditional energy policy to establish energy independence, reduce inflationary pressures, and increase revenues by making the U.S. the world's leading oil and gas exporter.

The new administration will take over on January 20, and President-elect Trump has pledged that promises made will be promises kept. As of the week ending on November 15, the U.S. was producing 13.201 million barrels of crude oil per week. The pivot in U.S. energy policy will likely increase petroleum output, perhaps significantly, in 2025 and the coming years.

A look back at oil prices during the first Trump and Biden Administrations

President-elect Trump has pledged to return consumer gasoline prices to levels seen during his first administration.

During his first term, nearby NYMEX gasoline prices traded from a pandemic-inspired low of 37.60 cents in March 2020 to a high of $2.2844 per gallon wholesale in May 2018. Wholesale gasoline futures under the Biden administration have traded as low as $1.8545 in September 2024 and as high as $4.3260 per gallon wholesale in June 2022.

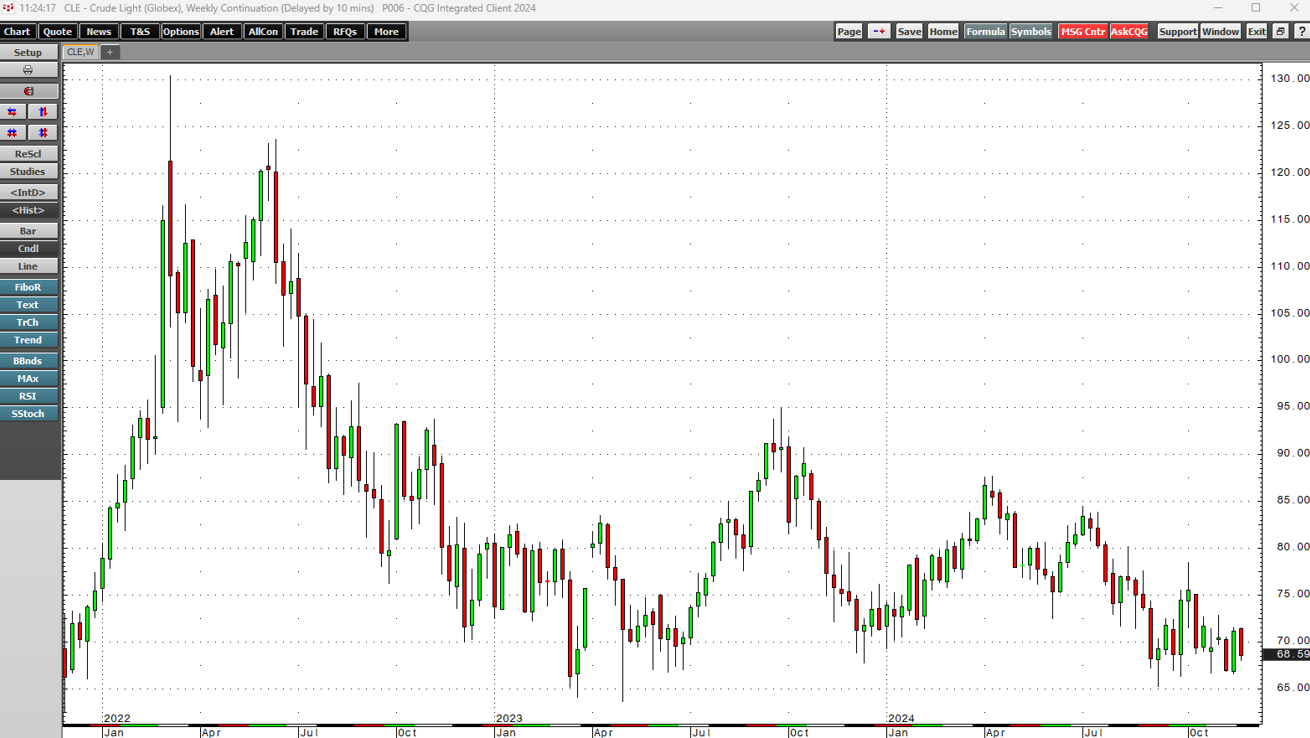

Gasoline prices follow NYMEX crude oil prices, which traded below zero to a $76.90 high during the first Trump administration and a $47.18 to $130.50 per barrel range during the Biden administration. The low during the current administration came in January 2021 when President Biden took office.

On November 5, U.S. voters chose lower energy prices over addressing climate change through the current energy policy path. The odds favor lower oil prices over the coming months and years.

Some bullish factors underpin prices

Meanwhile, several factors underpin crude oil prices in late November 2024. The following issues support higher petroleum prices:

- Hostilities in the Middle East threaten Iranian crude oil output and crucial logistical routes in the Persian Gulf and the Straits of Hormuz. Conflicts in the region could suddenly lift crude oil prices.

- Chinese economic stimulus could increase the demand for crude oil. China is the world's second-leading economy. In late 2024, the Chinese government cut interest rates and reduced bank reserve requirements to stimulate the economy and achieve 5% GDP growth.

- Russia cooperates with Saudi Arabia and the other OPEC members on production policy. If the international oil cartel reduces production, it could put upside pressure on crude oil prices.

Crude oil could experience upside price pressure if Middle East supplies decline or Chinese demand suddenly increases.

The bearish case for crude oil futures

The bearish case for crude oil includes the following:

- The Trump administration will dramatically increase U.S. crude oil output, causing prices to decline to $50 or even $40 per barrel.

- NYMEX crude oil has been in a bearish trend since March 2022, when it reached $130.50 per barrel, making lower highs.

While the 2024 continuous contract low was $65.27 per barrel, critical technical support is at the May 2023 low of $63.64. A decline below that price could cause further selling to descend on the crude oil futures market.

Meanwhile, in the past, OPEC had addressed increasing U.S. oil production by flooding the market with petroleum, making U.S. production uneconomic. Another output war in 2025 could cause prices to fall appreciably from the current levels. OPEC+ will be meeting in early December to discuss and establish its production policy for the coming months. We could see lots of volatility in the crude oil and oil product futures markets after the cartel announces its output policy.

Meanwhile, the bottom line is that if promises made by President-elect Trump are promises kept, we could see far lower crude oil prices over the coming months.

/ah202412-2.png">

Source: Statista

The chart shows the U.S. was the top oil consumer in 2023, with China second. As of late November, the U.S. produced 13.493 million barrels of petroleum per day, making it a net importer of the energy commodity.

In last month's CQG article on the upcoming election, I concluded:

The bottom line is that crude oil is on the ballot in the November 5 U.S. Presidential election. Time will tell if the recent decline in prices predicted a second term for former President Trump as the polls remain a virtual dead heat.

The polls were wrong, and President-elect Trump swept the swing states, collecting 312 electoral college votes, a majority in the popular vote, with Republican majorities in the U.S. Senate and the House of Representatives.

Elections have consequences

The President-elect promised to return to a "drill-baby-drill" and "frack-baby-frack" traditional energy policy to establish energy independence, reduce inflationary pressures, and increase revenues by making the U.S. the world's leading oil and gas exporter.

On November 5, 2024, U.S. voters chose lower energy prices over addressing climate change through the current energy policy path. The odds favor lower oil prices over the coming months and years.

The new administration takes over on January 20, 2025

In early November, the U.S. elected former President Donald Trump to a second nonconsecutive term. Energy policy was on the ballot. Vice President Harris had pledged to continue the Biden administration's energy path of addressing climate change by supporting alternative and renewable energy and inhibiting fossil fuel production and consumption. The President-elect promised to return to a "drill-baby-drill" and "frack-baby-frack" traditional energy policy to establish energy independence, reduce inflationary pressures, and increase revenues by making the U.S. the world's leading oil and gas exporter.

The new administration will take over on January 20, and President-elect Trump has pledged that promises made will be promises kept. As of the week ending on November 15, the U.S. was producing 13.201 million barrels of crude oil per week. The pivot in U.S. energy policy will likely increase petroleum output, perhaps significantly, in 2025 and the coming years.

A look back at oil prices during the first Trump and Biden Administrations

President-elect Trump has pledged to return consumer gasoline prices to levels seen during his first administration.

During his first term, nearby NYMEX gasoline prices traded from a pandemic-inspired low of 37.60 cents in March 2020 to a high of $2.2844 per gallon wholesale in May 2018. Wholesale gasoline futures under the Biden administration have traded as low as $1.8545 in September 2024 and as high as $4.3260 per gallon wholesale in June 2022.

Gasoline prices follow NYMEX crude oil prices, which traded below zero to a $76.90 high during the first Trump administration and a $47.18 to $130.50 per barrel range during the Biden administration. The low during the current administration came in January 2021 when President Biden took office.

On November 5, U.S. voters chose lower energy prices over addressing climate change through the current energy policy path. The odds favor lower oil prices over the coming months and years.

Some bullish factors underpin prices

Meanwhile, several factors underpin crude oil prices in late November 2024. The following issues support higher petroleum prices:

- Hostilities in the Middle East threaten Iranian crude oil output and crucial logistical routes in the Persian Gulf and the Straits of Hormuz. Conflicts in the region could suddenly lift crude oil prices.

- Chinese economic stimulus could increase the demand for crude oil. China is the world's second-leading economy. In late 2024, the Chinese government cut interest rates and reduced bank reserve requirements to stimulate the economy and achieve 5% GDP growth.

- Russia cooperates with Saudi Arabia and the other OPEC members on production policy. If the international oil cartel reduces production, it could put upside pressure on crude oil prices.

Crude oil could experience upside price pressure if Middle East supplies decline or Chinese demand suddenly increases.

The bearish case for crude oil futures

The bearish case for crude oil includes the following:

- The Trump administration will dramatically increase U.S. crude oil output, causing prices to decline to $50 or even $40 per barrel.

- NYMEX crude oil has been in a bearish trend since March 2022, when it reached $130.50 per barrel, making lower highs.

While the 2024 continuous contract low was $65.27 per barrel, critical technical support is at the May 2023 low of $63.64. A decline below that price could cause further selling to descend on the crude oil futures market.

Meanwhile, in the past, OPEC had addressed increasing U.S. oil production by flooding the market with petroleum, making U.S. production uneconomic. Another output war in 2025 could cause prices to fall appreciably from the current levels. OPEC+ will be meeting in early December to discuss and establish its production policy for the coming months. We could see lots of volatility in the crude oil and oil product futures markets after the cartel announces its output policy.

Meanwhile, the bottom line is that if promises made by President-elect Trump are promises kept, we could see far lower crude oil prices over the coming months.