- The bearish trend since the 2022 peak continues

- Seasonality favors lower oil prices

- U.S. energy policy is bearish- OPEC+ production weighs on prices

- Geopolitics remains bullish

- A break of critical support could entice a herd of technical sellers

Crude oil is a highly political commodity because it powers the world, and the turbulent Middle East is a leading producer. The International Oil Cartel, OPEC, cooperates with Russia on production policy, adding to the energy commodity's political nature.

OPEC+'s pricing influence grew under the previous U.S. administration, which supported alternative and renewable energy policies and inhibited fossil fuel production and consumption. When Russia invaded Ukraine in March 2020, crude oil futures prices soared to over $130 per barrel, where they ran out of upside steam.

Since early 2025, the Trump administration has reversed U.S. energy policy and supports a "drill-baby-drill" and "frack-baby-frack" approach to oil and gas production and consumption. The policy reversal has decreased OPEC+'s influence and increased the United States's pricing influence.

Crude oil prices were heading toward a test of the April 2025 low and a critical technical support level at $55.12 per barrel when the U.S. decided to increase pressure on Russia to end the ongoing war in Ukraine. Sanctioning Russian oil and pressuring countries that import it increased supply concerns and sent prices higher, from below $56.50 to over $62.50 per barrel on the nearby NYMEX crude oil futures contract.

The bearish trend since the 2022 peak continues

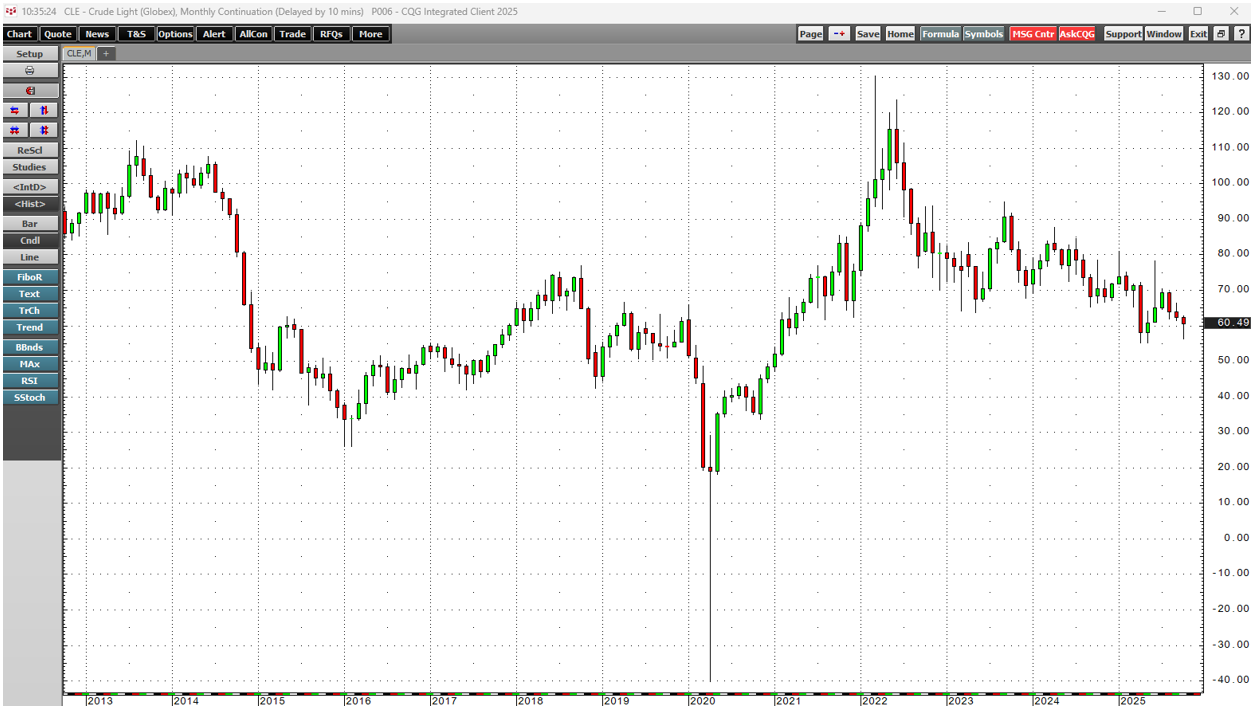

The monthly chart highlights the bearish pattern of lower highs and lower lows in NYMEX WTI crude oil futures since 2022.

After reaching a high of $130.50 per barrel in March 2022, following Russia's invasion of Ukraine, crude oil futures have trended lower, reaching a continuous contract low of $55.12 per barrel in April 2025. While the energy commodity futures reached $56.35 per barrel in September, the U.S. administration's frustrations with Moscow that led to new sanctions on Russian oil exports caused supply concerns that led to a bounce to nearly $63 per barrel.

Even the most aggressive bear markets rarely move in a straight line, and while crude oil futures did not eclipse the $55.12 April 2025 low, the monthly chart shows the energy commodity remains in a long-term bearish trend as of late October 2025.

Seasonality favors lower oil prices

Gasoline is the most ubiquitous oil product, and its demand tends to reach seasonal lows during winter when drivers put less mileage on their automobiles.

The monthly chart shows that, barring any geopolitical surprises, crude oil prices tend to reach seasonal lows during winter. Therefore, while oil prices have recovered since the most recent October low of $56.35, weaker prices could be on the horizon in November and December 2025, and January and February 2026.

U.S. energy policy is bearish- OPEC+ production weighs on prices

The 180-degree shift in U.S. energy policy under the Trump administration supports increased oil and gas production. According to the EIA, as of the week ending on October 24, the United States was producing 13.644 million crude oil barrels per day. The administration's policies support increasing daily output over the coming months and years. Moreover, lower oil prices which are leading to falling inflationary pressures, support the administration's desire for lower short, medium, and long-term interest rates.

Meanwhile, OPEC+, the international oil cartel and Russia, have reversed their multi-year strategy of production cuts, gradually increasing output since April 2025. OPEC+ is attempting to regain market share lost to other producing countries and has been under pressure from Washington, DC, to keep prices low to combat inflation.

The bottom line is that increasing U.S. and OPEC+ output weighs on crude oil prices in late 2025.

Geopolitics remain bullish

Since the Middle East is a critical crude oil-producing region, regional geopolitics remains a crucial factor shaping the path of least resistance of the energy commodity's price path of least resistance. NYMEX crude oil futures prices spiked higher in June 2025, with the continuous contract reaching $78.40 per barrel when the U.S. attacked Iranian nuclear sites. However, the rally was short-lived as it ran out of upside steam after the attack.

While geopolitical turbulence in the Middle East has calmed, the potential for further hostilities is always a clear and present danger. Any surprises in the region could cause sudden price spikes. However, the U.S.-sponsored peace deal could lead to lower oil prices as the geopolitical risks decline.

A break of critical support could entice a herd of technical sellers

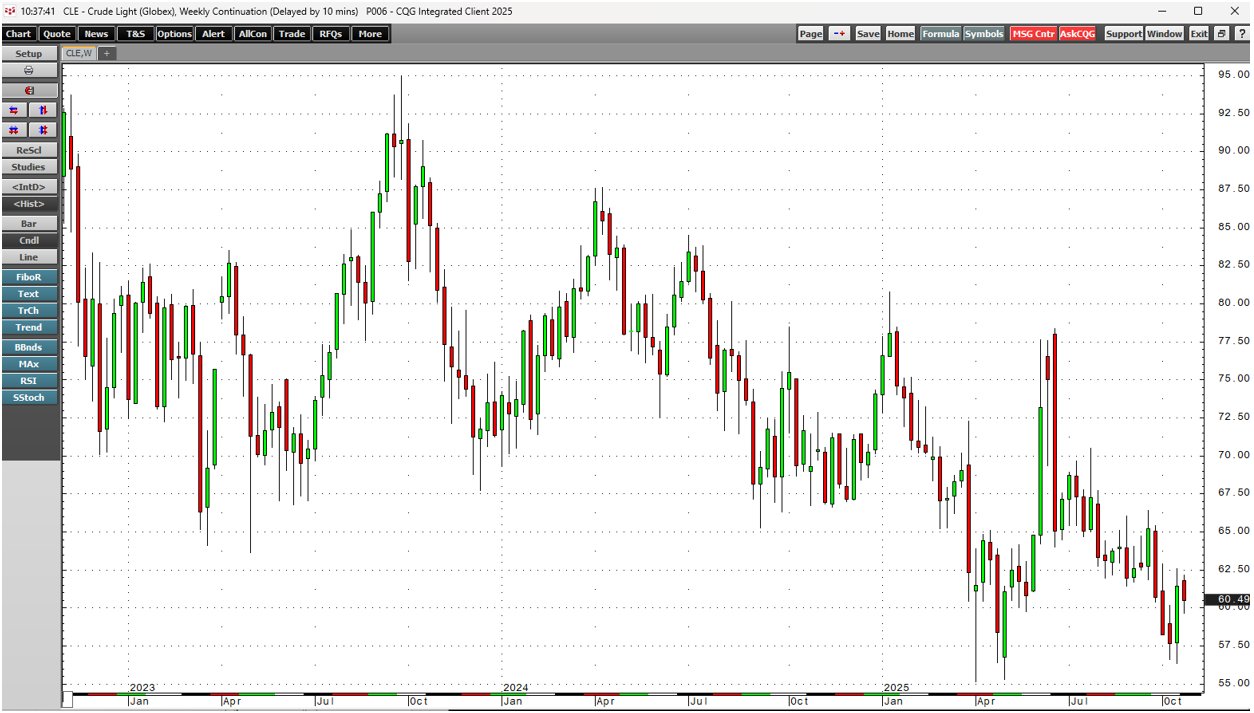

The weekly continuous crude oil chart highlights the bearish trend, despite the recent bounce.

As the weekly chart illustrates, a break below $55.12 per barrel over the coming weeks could unleash a herd of technical sellers, pushing crude oil futures toward a challenge of the $50 per barrel level or lower. Increasing U.S. and OPEC production, seasonality, and the U.S. administration's desire for lower inflation and falling interest rates are bearish factors that could weigh on crude oil prices. The risk-reward dynamics favor the downside for crude oil prices in the current environment.