Volatility exacerbated by a liquidity crunch that intensified price swings was a key characteristic of petroleum markets which fell for a second consecutive week after having reached 14 month… more

Commentary

AT A GLANCE

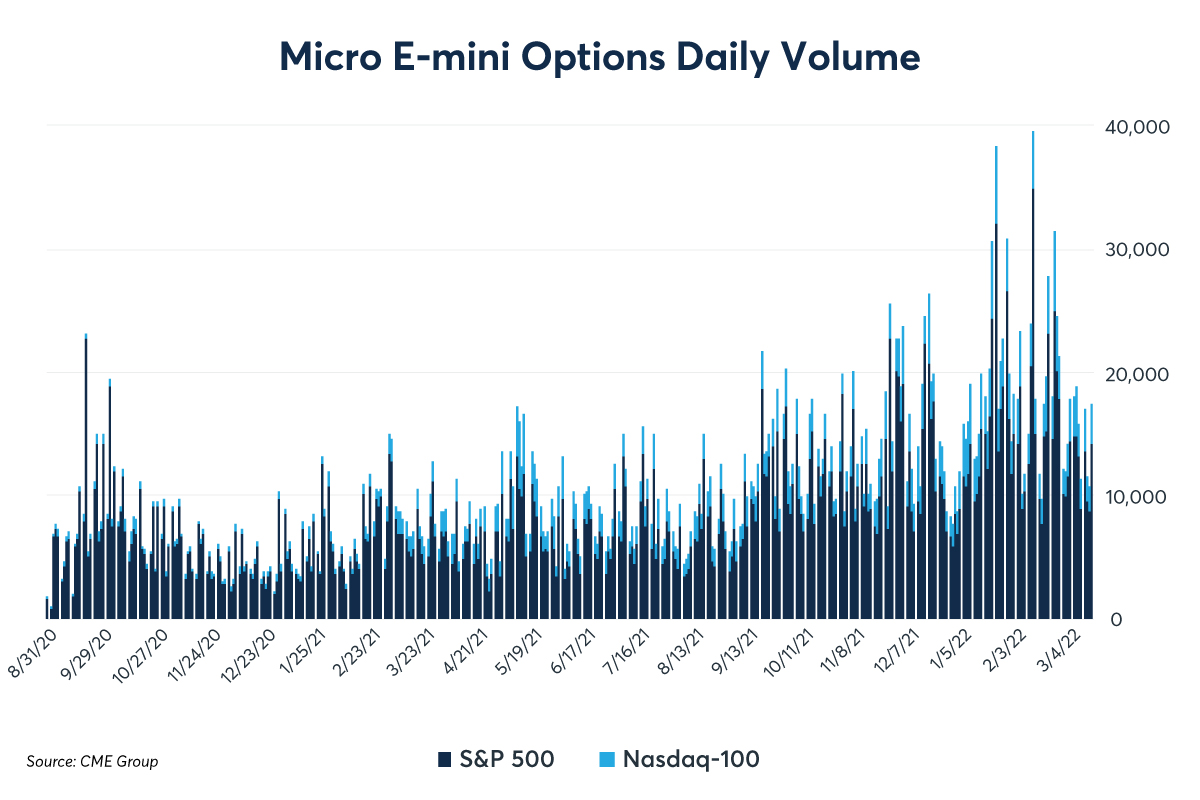

Micro E-mini equity options are tapping into industry demand for equity index products for a wider range of investors More options trading in 2021 coincided with a rise in… moreProfound volatility was the primary feature of petroleum markets which had their first weekly loss since Russia’s invasion of Ukraine. Prices fell sharply after reaching historic highs on Monday.… more

There are so many things to consider when trading in the current climate. First and foremost, CAUTION is the key word, not FEAR. As Billy Joel would say, “We didn’t start the fire,” but as traders… more

Russia’s invasion of Ukraine caused a historic spike in petroleum prices which registered their largest weekly gains in terms of dollars on record. Accentuating the week was the dangerous seizure… more

The first major war in Europe since WW II broke out in February with Russia’s invasion of Ukraine. At the beginning of March, the Ukrainian military and citizens continued to hold off the Russian… more

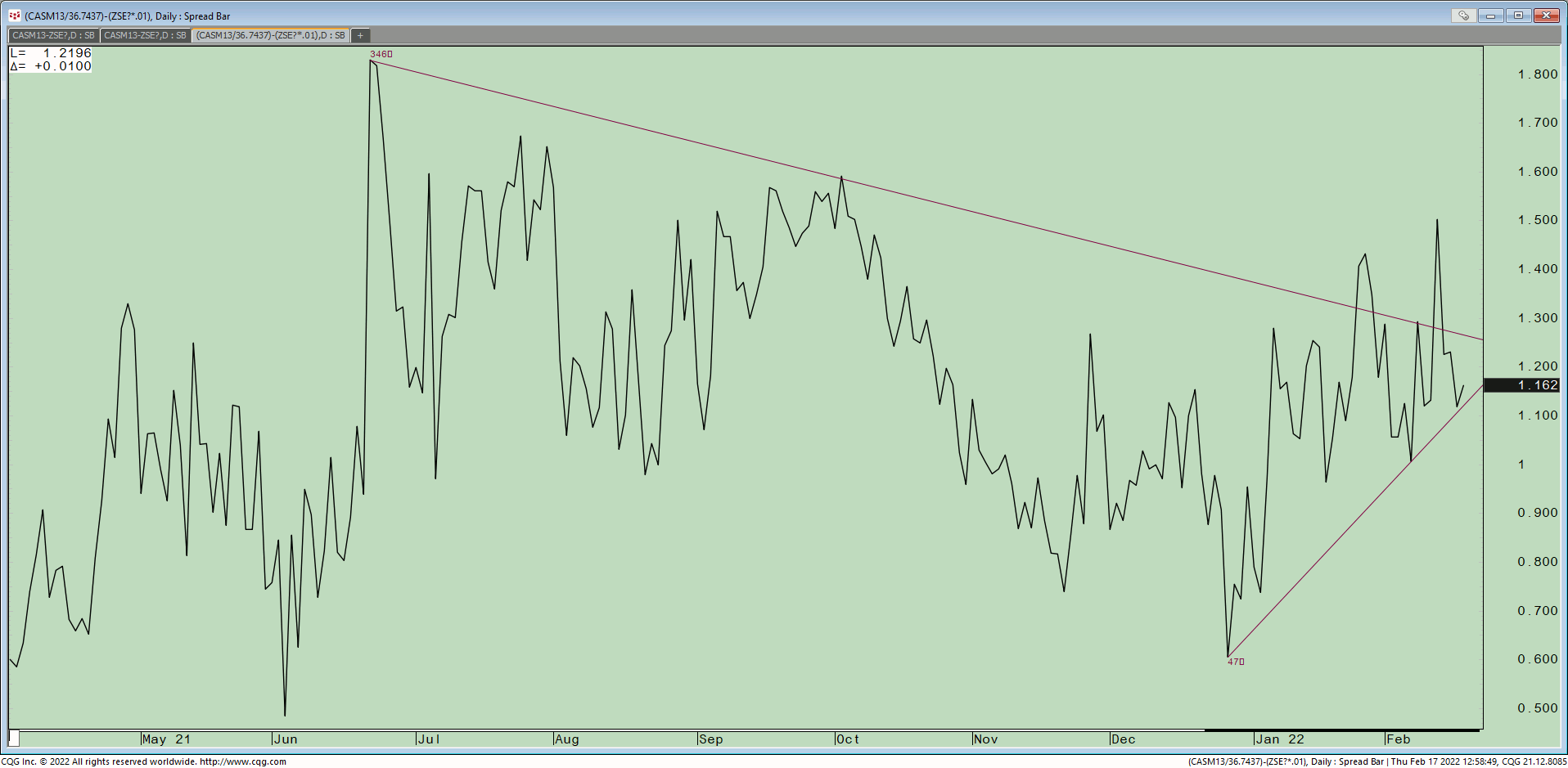

In this second of our series of articles on technical analysis for commercial hedgers we will look at using technical analysis to understand the basis and how it impacts the decision-making… more

Petroleum prices fell for the first week in nine as continued tensions on the Russian Ukrainian border which appear to be poised for rapid escalation to an invasion were offset by apparent… more

Bank of England Governor Andrew Bailey made a ridiculous comment almost two weeks ago and I’d be remiss not to mention it. Bailey issued his own FORWARD GUIDANCE on how to slow the pace of… more