AT A GLANCE

The maturation of cryptocurrencies has led to increased adoption of crypto products, including regulated and centrally cleared crypto derivatives With sustainable investments set… moreCommentary

Petroleum prices increased for an eighth consecutive week, touching eight year highs as reports released on Friday

afternoon from numerous mainstream media outlets stated that Russia had… more

This article discusses the evolution of peer-to-peer trading – and if the market is now embracing this model as a mechanism to achieve lower spreads, reduce information leakage and minimize market… more

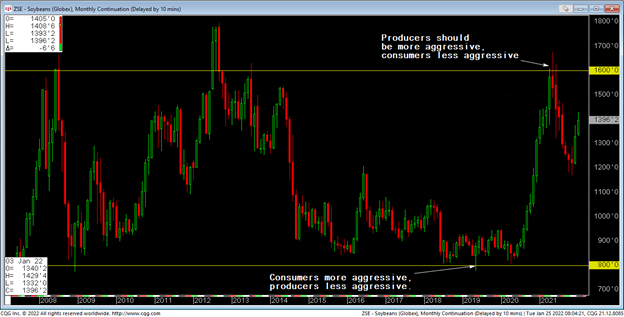

Moving averages, oscillators, forward curves, spreads, basis graphs... charting can seem overwhelming to commercial hedgers who are simply seeking to dampen volatility and lock in profits on their… more

Petroleum prices rose for a seventh consecutive week,reaching seven year highs as the price of WTI breached $93. There were a number of influences, virtually all positive, that drove petroleum… more

Tomorrow is the first Friday of the month so it is known on trading desks as UNEMPLOYMENT Friday — or Unenjoyment Day for some — as volatility will reign in the early part of the trading day. As… more

At the most recent Fed meeting, the US central bank set the stage for ending quantitative easing in early March and liftoff from a zero percent short-term Fed Funds Rate at the March FOMC meeting… more

Petroleum prices increased for a fifth consecutive week, touching seven-year highs midweek as

dated Brent briefly touched $90 before easing at week’s end on profit-taking as well as a sharp… more

Bernard Connolly is a British economist noted for his dislike of the euro. He is know for writing The Rotten Heart of Europe: The Dirty War for Europe's Money.

with thanks to … more

Energy prices increased for a fourth consecutive week, the longest such streak of gains since October. Reductions in Crude inventories rendering stocks to their lowest levels since October 2018,… more