Petroleum prices increased for the first week in three and second in six in a holiday shortened week. Prices surged

despite a sizable Crude release from the Strategic Petroleum Reserve as… more

Commentary

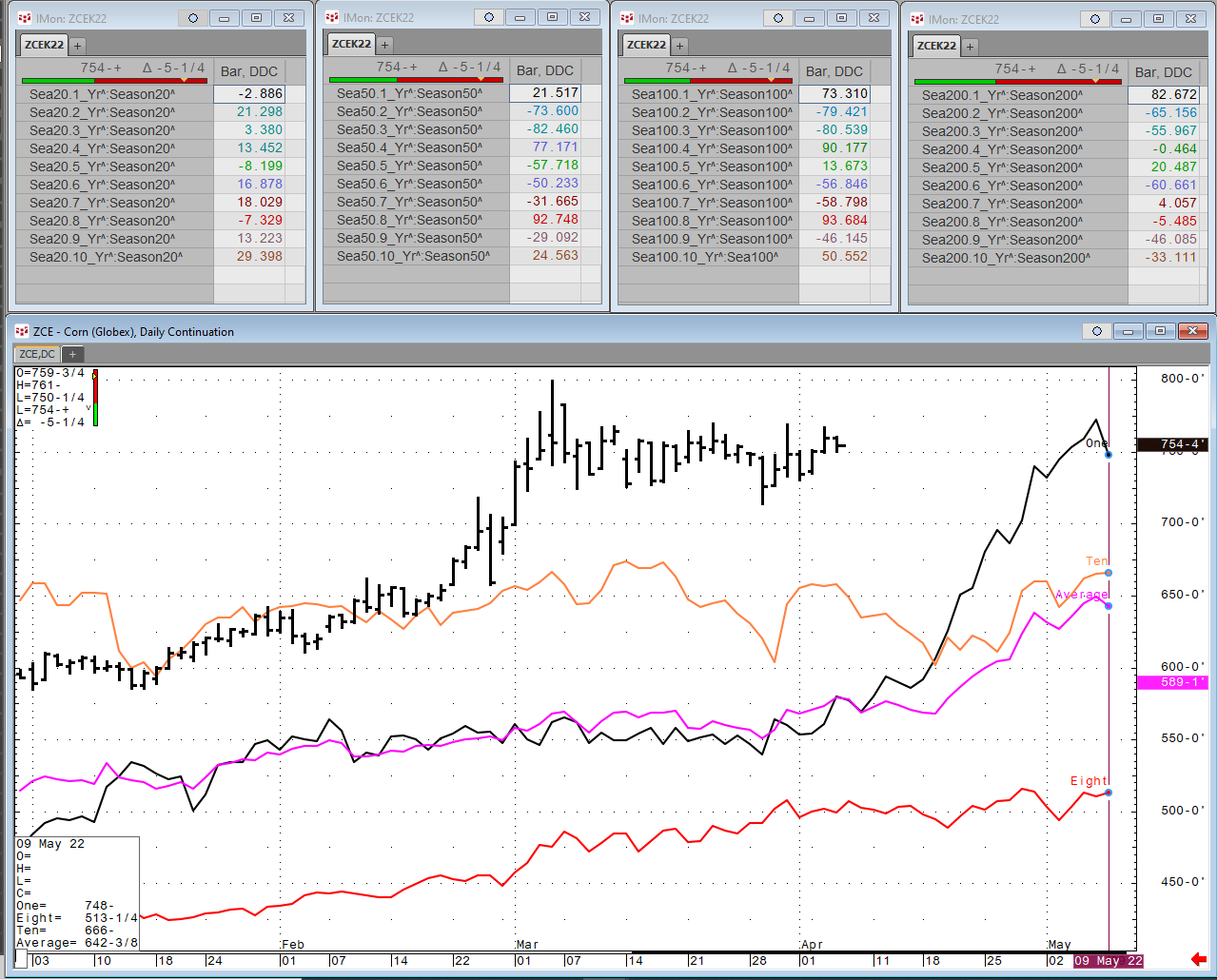

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

There was an article in Foreign Affairs this week by Graham Allison, the dean of American political scientists, titled, “Putin’s Doomsday Threat: How to Prevent a Repeat of the Cuban Missile… more

Petroleum prices fell for a second consecutive week and fourth in five, driven primarily by details of a release of more than 180 MB from the US Strategic Petroleum Reserve that will be done in… more

AT A GLANCE

Crude oil has averaged a 16.06% rise in price in the six months following the start of each of the Fed’s last six rate hike cycles In the first 10 days following the Fed’s March… moreLouis-Vincent Gave - CEO. Louis-Vincent Gave co-founded GaveKal in 1999 with his father Charles and Anatole Kaletsky. GaveKal started as an independent research firm and evolved in 2005 to… more

Author Kushal Thaker’s new book “Be Rich with Specunomics” is an insightful guide for readers looking to intelligently build financial growth

Kushal Thaker, who has been a… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

This week I had the extreme pleasure of recording a Financial Repression Authority podcast with Zoltan Poszar (moderated by Richard Bonugli, of course). We covered the entire global scene from… more

The raw material markets asset class moved higher in the first quarter of 2022 after posting gains throughout 2021. The commodity asset class consisting of 29 of the primary commodities that trade… more