Petroleum prices rose for a sixth consecutive week and sixth consecutive quarter. This was the largest monthly increase since June as Crude prices touched three year highs earlier in the week.… more

Commentary

Petroleum prices rose for a fifth consecutive week as worse than expected long-term damage to both refining and production assets in the US Gulf coupled with the inability of OPEC+ to increase… more

Energy prices increased for a fourth consecutive week, touching their highest levels since July.

A slow return of production from Hurricane Ida, smaller than expected increases from OPEC+… more

In the week following the worst hurricane in the US Gulf Coast in the last 16 years, Crude and product market prices are conspicuously void of trends. The bullish effect of the loss of… more

After FEDERAL RESERVE Chairman Jerome Powell’s Jackson Hole speech, the jobs data may have taken on added significance. Inflation was not a concern for Powell as that is considered transitory… more

Hurricane Ida, a category four storm with winds exceeding 145 MPH, made landfall last Sunday in eastern Louisiana. Most US Gulf oil production, Natural Gas production and more than 2.3 MBPD of… more

Harley Bassman, Brian Pellegrini and Yra Harris on the Economy and the Financial Markets

Mr. Bassman is a Managing Partner at Simplify Asset Management, a designer and manager of ETFs… more

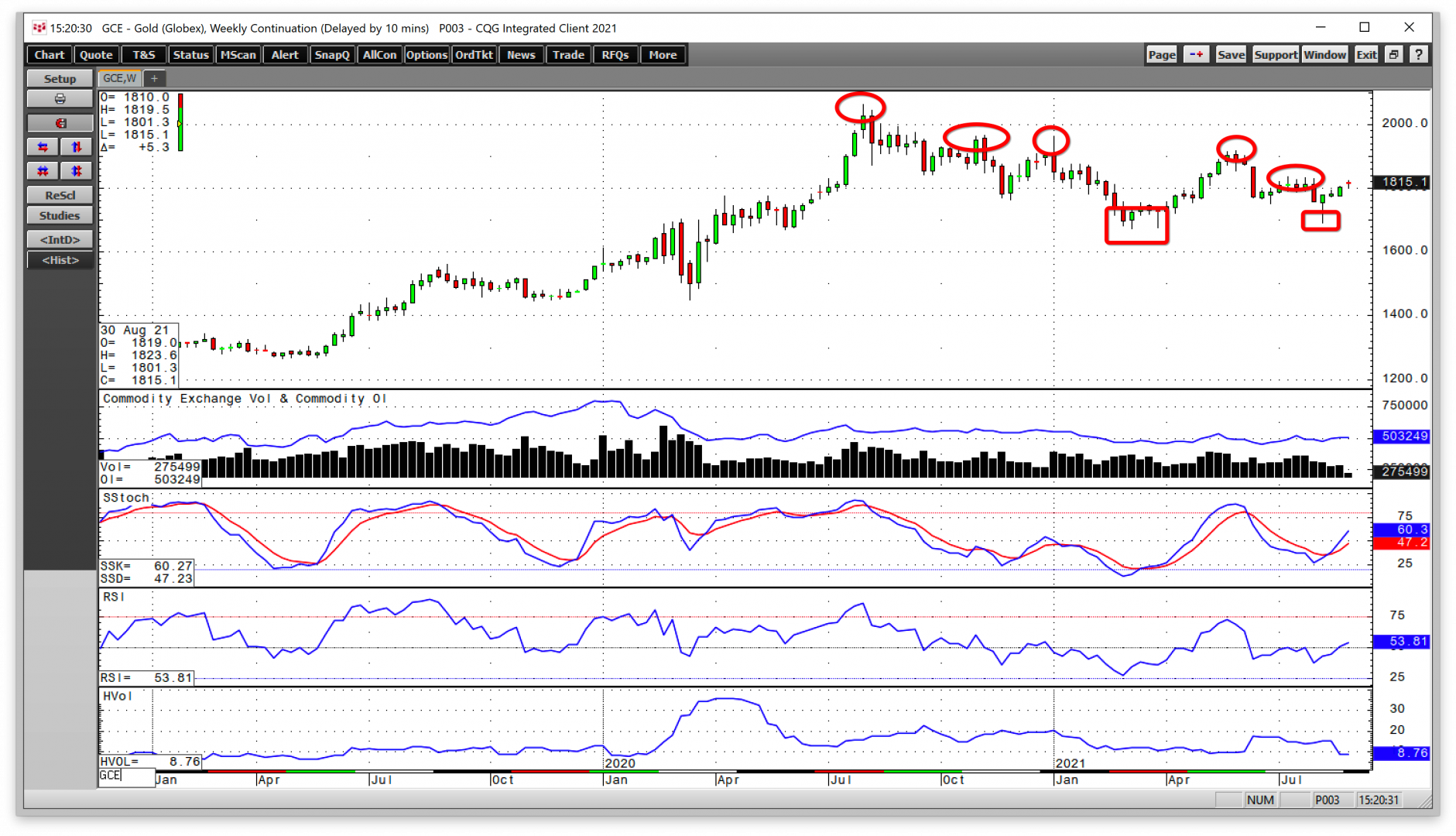

After soaring to an all-time peak in August 2020 in US dollar terms, gold has traded on either side of $1800 per ounce throughout 2021. The yellow precious metal reached a record level in nearly… more

First of all, my offer of any part of a $10,000 bet with 10-1 odds against Jerome Powell being renominated as FED CHAIR is OFFICIALLY RESCINDED. The Fed Chair’s speech was so pathetic that it can… more

In a stunning reversal, petroleum prices recovered all of last week's price plunge plus an additional 2 to 3%. Diminishing COVID-19 concerns and clear signs of recovering demand from the US, China… more