Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the studies and charts here. In addition, the seasonal data lines can be pulled into Excel using RTD formulas.

Seasonal analysis is about price direction or the trend.

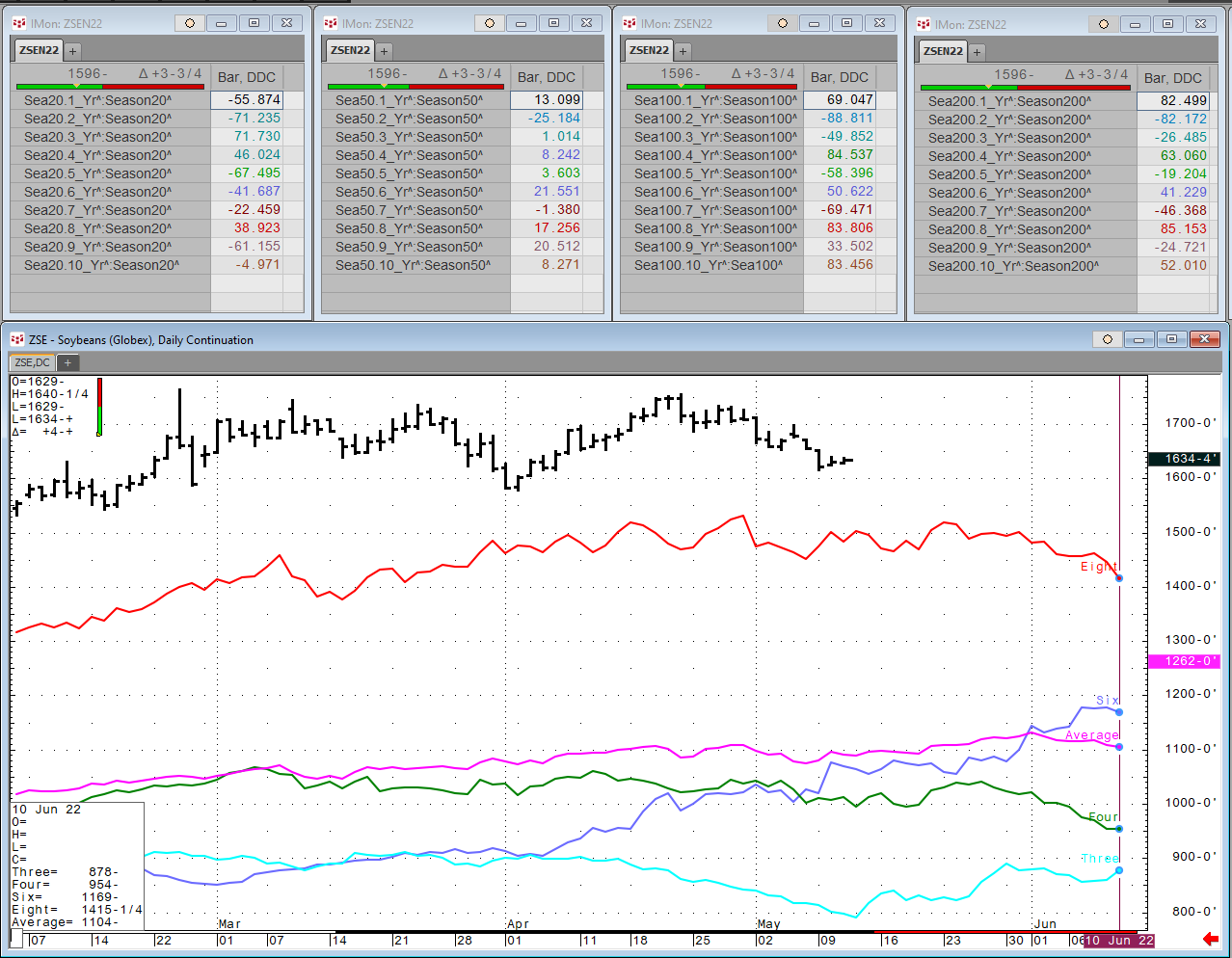

Soybeans

The short term correlation (20-days) is now tracking the 6-year seasonal line. The 50-days correlation is still tracking the 1-year seasonal line. The 100-days correlation is still tracking the 10-year seasonal line. Also, the 200-days correlation is still tracking the 8-year seasonal line.

| Correlation Lookback (Days) | 20 | 50 | 100 | 200 |

| Seasonal Year Back with the Highest Correlation | 3_Yr 71.73 |

6_Yr 21.55 |

4_Yr 84.54 |

8_Yr 85.15 |

| Last Week | ||||

| Correlation Lookback (Days) | 20 | 50 | 100 | 200 |

| Seasonal Year Back with the Highest Correlation | 6_Yr 53.75 |

1_Yr 49.30 |

10_Yr 86.65 |

8_Yr 84.63 |

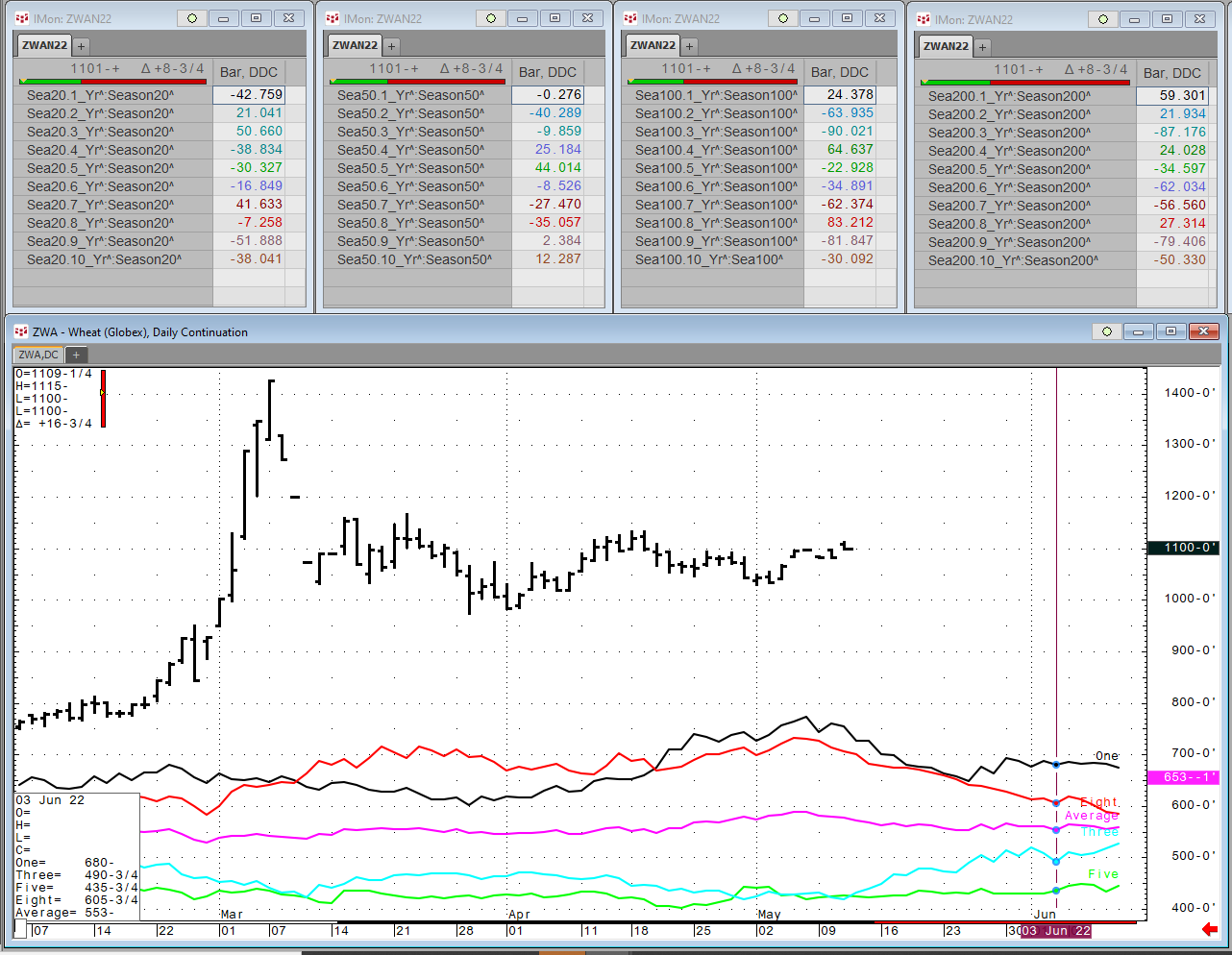

Wheat

The short term correlation (20-days) is still tracking the 1-year’s seasonal line. The 50-days and 100-days correlation are still tracking the 8-year seasonal line. The 200-days correlation is still tracking the 1-year seasonal line.

| Correlation Lookback (Days) | 20 | 50 | 100 | 200 |

| Seasonal Year Back with the Highest Correlation | 3_Yr 50.66 |

5_Yr 44.01 |

8_Yr 83.21 |

1_Yr 59.30 |

| Last Week | ||||

| Correlation Lookback (Days) | 20 | 50 | 100 | 200 |

| Seasonal Year Back with the Highest Correlation | 1_Yr 19.49 |

8_Yr 26.29 |

8_Yr 80.64 |

1_Yr 56.55 |

Corn

The short term correlation (20-days) is still tracking the 1-year seasonal line. The 50-days and 100-days correlation are still tracking the 8-year seasonal line. The 200-days correlation is still tracking the 1-year seasonal line.

| Correlation Lookback (Days) | 20 | 50 | 100 | 200 |

| Seasonal Year Back with the Highest Correlation | 6_Yr 75.85 |

6_Yr 82.76 |

8_Yr 96.43 |

1_Yr 89.17 |

| Last Week | ||||

| Correlation Lookback (Days) | 20 | 50 | 100 | 200 |

| Seasonal Year Back with the Highest Correlation | 1_Yr 90.66 |

8_Yr 78.86 |

8_Yr 96.34 |

1_Yr 88.74 |