- A bullish trend in natural gas at the beginning of the peak demand season

- The withdrawal season began in mid-November

- Geopolitics and LNG could support prices

- The winter temperatures are critical for the price path

- Natural gas is a highly volatile commodity- Volatility creates trading opportunities

Seasonality is a crucial factor for the path of least resistance of many commodity prices. Cattle and hog prices tend to reach annual highs during late spring and summer as the grilling season increases beef and pork demand. The protein futures tend to experience price weakness during fall and winter, the offseason for demand.

Gasoline prices often reach annual peaks during spring and summer, the driving season, and lows during winter when the weather conditions cause drivers to put less mileage on their vehicles.

Natural gas is a seasonal commodity, as it is the primary input for power generation and provides heating during the year's coldest months. As the natural gas market moves into winter, the weather over the coming weeks and months will determine the direction of natural gas prices.

A bullish trend in natural gas at the beginning of the peak demand season

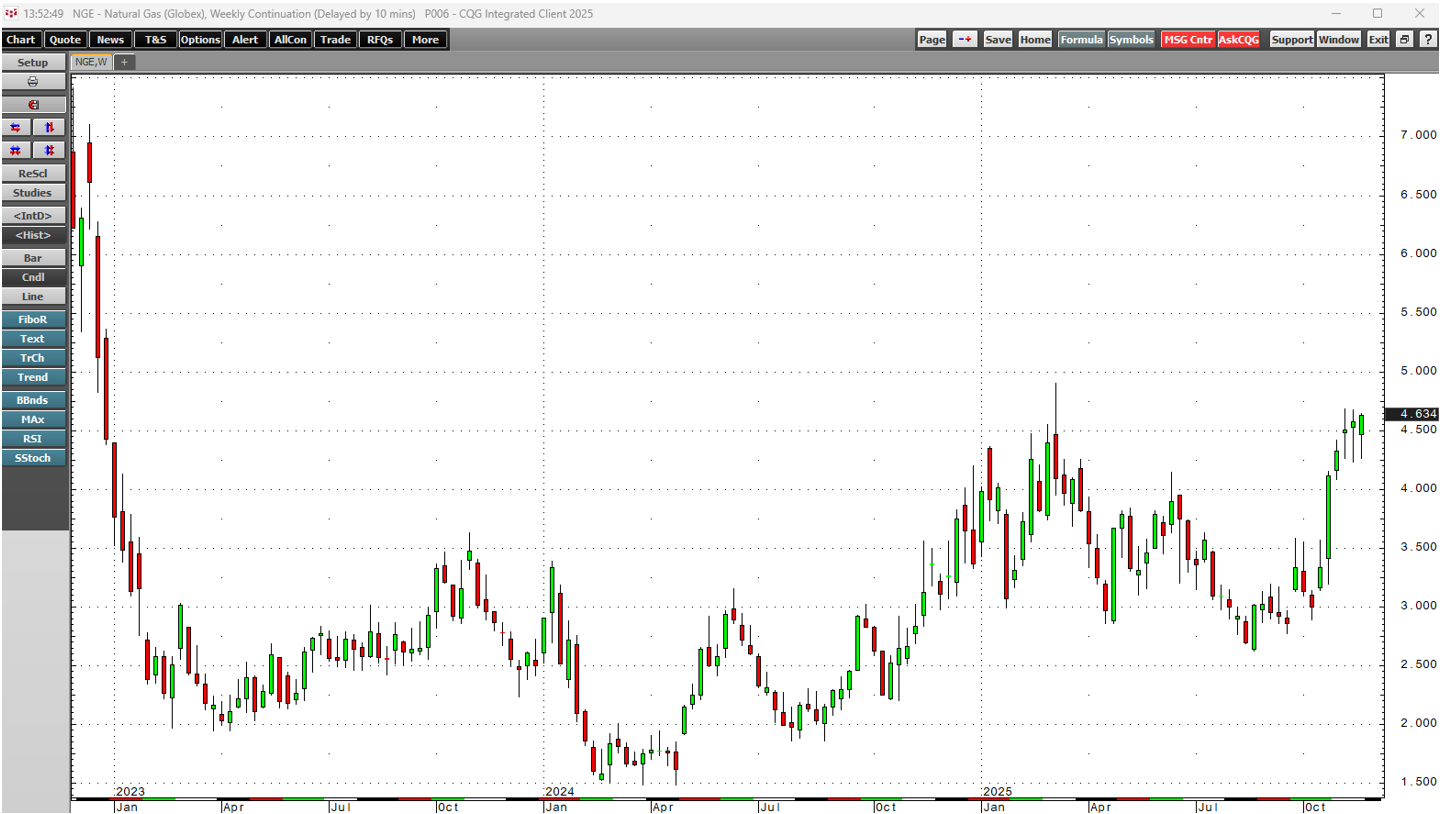

The weekly chart of NYMEX U.S. natural gas futures shows a bullish trend since the March 2024 lows.

The weekly continuous NYMEX natural gas futures for delivery at the Henry Hub in Erath, Louisiana, reached a low of $1.481 in late March 2024 and rose to a high of $4.901 per MMBtu in mid-March 2025. As the natural gas futures market moves into the winter of 2025/2026, the price recently rose to a lower high of $4.688 and was near that level on November 26.

Natural gas has mainly formed higher lows since hitting its low in March 2024.

The withdrawal season began in mid-November

The annual injection season, when natural gas inventories across the U.S. rise, runs from March through November. From November through March, stockpiles decline as demand for the energy commodity increases.

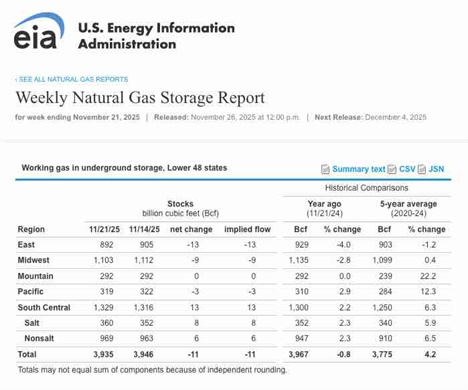

Source: EIA

The chart shows that U.S. natural gas inventories experienced their first decline ahead of the upcoming peak season during the week of November 14 and edged lower as of November 21. At 3.935 trillion cubic feet (tcf), stockpiles were 0.8% below last year's level and 4.2% above the five-year average for mid-November. Stocks appear to have peaked at 3.96 tcf during the week of November 7, just below the level at the beginning of last year's season at 3.972 tcf.

Geopolitics and LNG could support prices

Natural gas prices began trading on the CME's NYMEX division in 1990, when the energy commodity was limited to the North American pipeline network. Over the past years, technological advances have liquefied natural gas (LNG). LNG now travels on ocean vessels, like crude oil, to regions where prices are higher than in the U.S., expanding the energy commodity's addressable market.

Western Europe has traditionally purchased natural gas from Russia via its extensive pipeline network. However, sanctions on Moscow due to the ongoing war in Ukraine have caused Europe to shun Russian gas.

The winter temperatures are critical for the price path

A cold European winter in 2025/2026 could lead to increased LNG flows into the region from the United States, putting downward pressure on stockpiles. Moreover, a cold winter in the U.S., which would increase heating demand, could further depress stocks and create supply concerns that push prices higher.

Therefore, natural gas prices are likely to be as volatile as the winter temperatures over the coming weeks and months.

Natural gas is a highly volatile commodity - Volatility creates trading opportunities

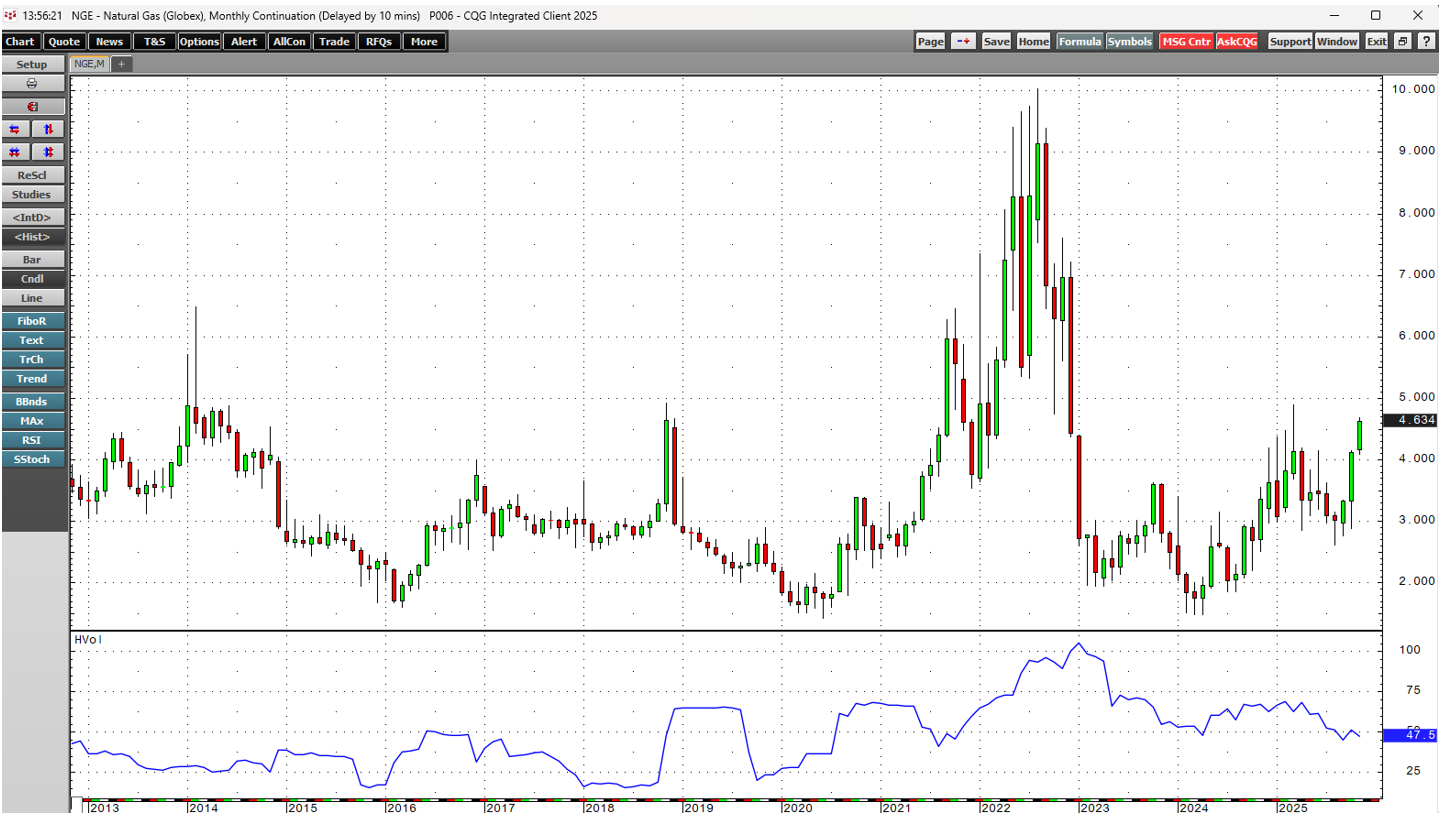

Natural gas is a highly volatile energy commodity.

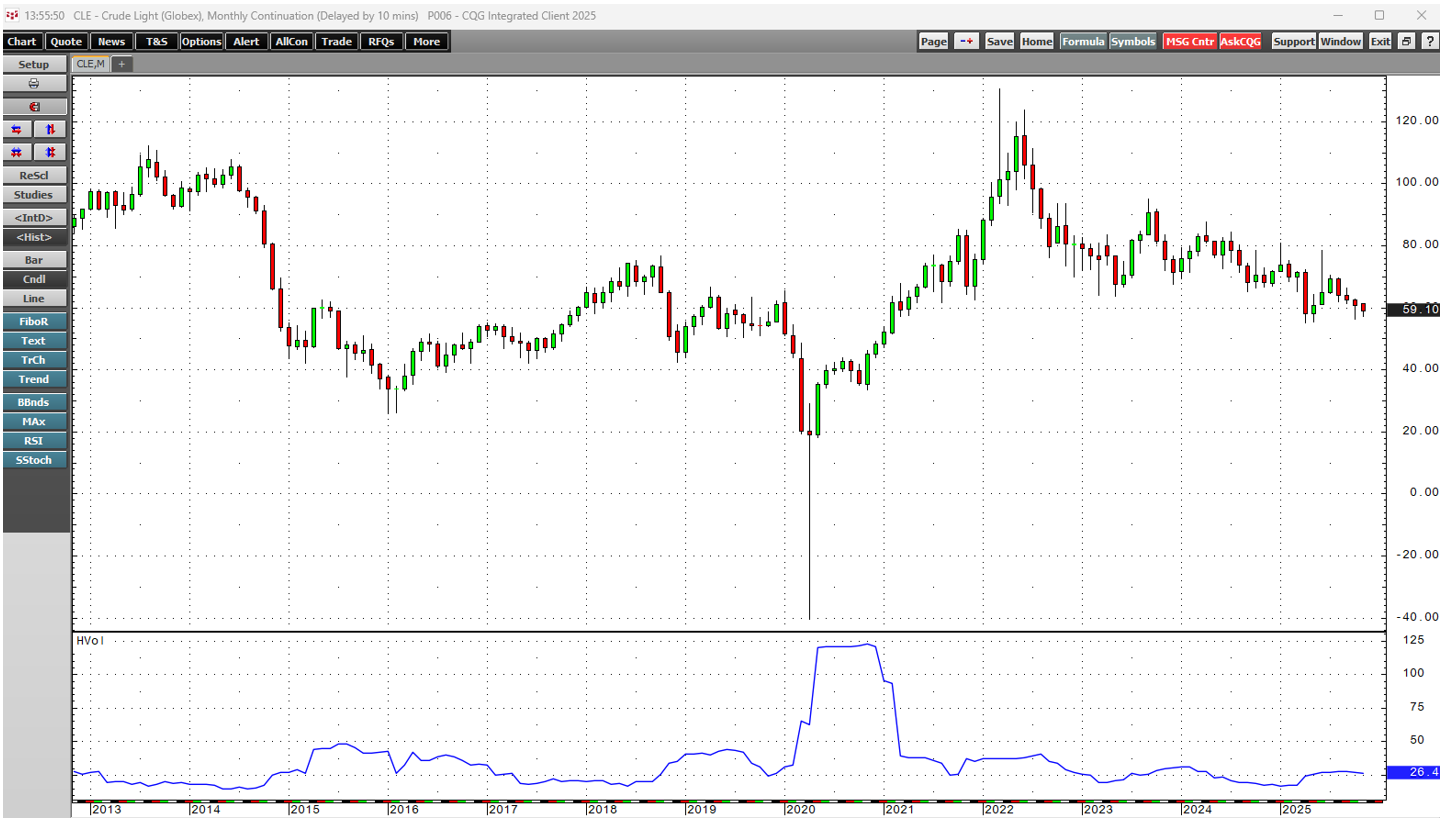

As the chart illustrates, the monthly historical volatility in the NYMEX crude oil futures market is 26.4%.

The monthly natural gas metric is substantially higher at 47.5%. Natural gas futures' high price volatility attracts significant speculative activity, which can only amplify the price volatility when substantial price trends develop. A freezing winter in the U.S. and Western Europe could push prices higher, which are already above last year's levels. In November 2024, nearby U.S. NYMEX natural gas prices traded between $2.514 and $3.564 per MMBtu. In November 2025, the range has been $4.087 to $4.688 per MMBtu, with this year's low over 50 cents above the high from November 2024.

Expect lots of volatility in the natural gas futures market over the coming weeks and through at least February. A warmer-than-expected winter could cause a substantial downside correction, while frigid conditions could push prices above the critical technical resistance level at the March 2025 high of $4.901 per MMBtu. Prices above the $5 level are possible because natural gas attracts a herd of speculative buyers.

Volatility creates a paradise of trading opportunities, but risk is always a function of potential rewards. Therefore, trade natural gas with a clear risk-reward plan that defines stops that protect capital and logical profit horizons. If the price moves contrary to expectations, do not deviate from stop levels. However, when prices move in the expected direction, it is appropriate to increase profit horizons while adjusting stops to protect profits and capital.

The peak season for natural gas demand is also the most volatile time of year, creating many trading opportunities.