A recent YouTube post from the All-In Podcast interviewed NVDIA's Jensen Huang, Advanced Micro Devices' Lisa Su, MP Materials' Jim Litinsky, and Crusoe's Chase Lochmiller.

… moreWorkspaces

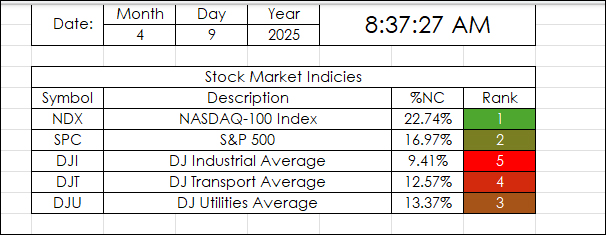

This Excel Dashboard uses RTD Calls to pull in the Net Percent Change of a collection of markets by a particular date.

For example, April 9, 2025:

"Markets News, April 9, 2025: Dow… more

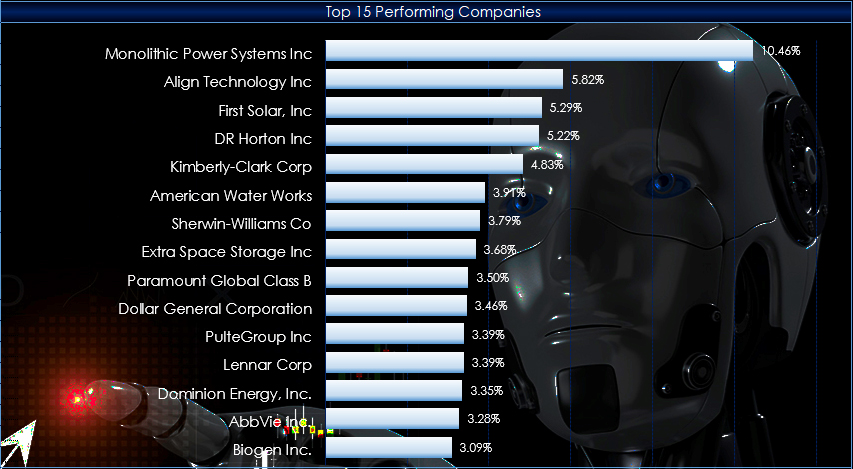

This post presents an Excel dashboard for tracking the constituents of the S&P 500 SPYDR ETF.

The S&P 500 is one of the most cited U.S. stock market indices by the medial and… more

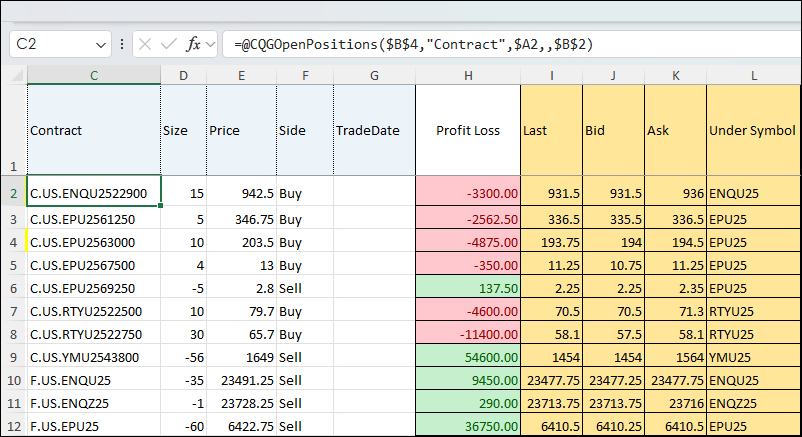

This spreadsheet built by CQG Product Specialist Jim Stavro uses RTD calls to pull in open futures and options positions as well as "Greeks" using RTD formulas.

To use the spreadsheet, CQG… more

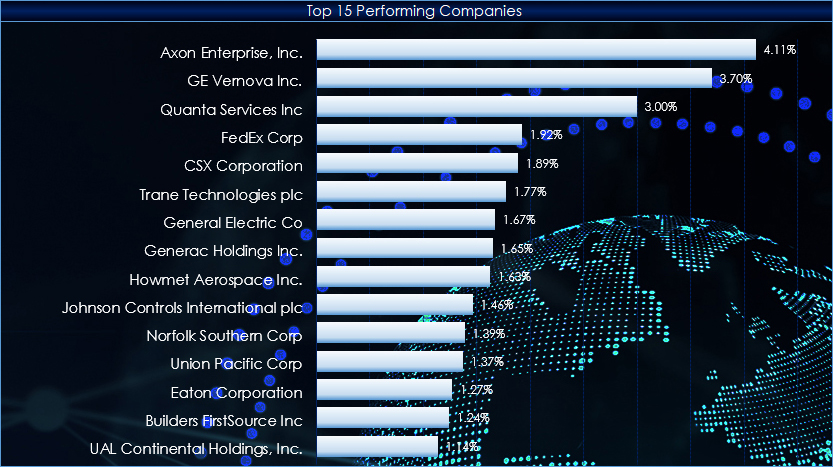

This post presents an Excel dashboard for tracking the constituents of the Industrial Select Sector SPDR® Fund. So far, during 2025 the top performing sector is the Industrials Sector (up 17.63%)… more

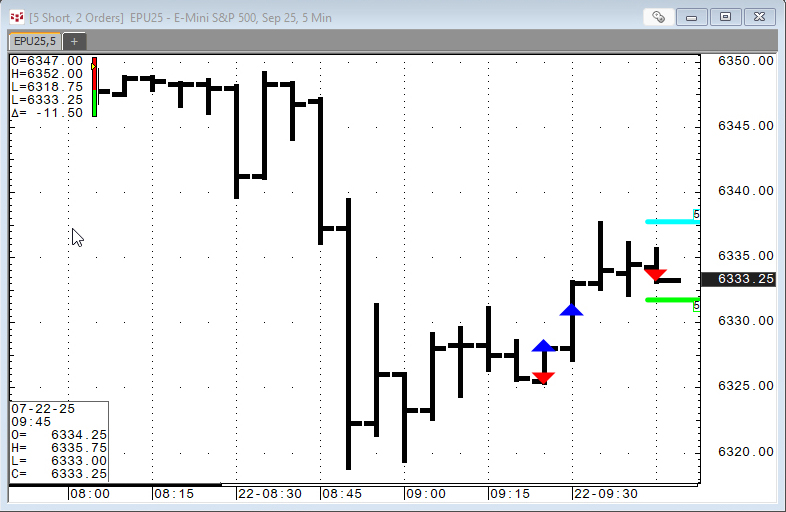

This set of studies provides the Order Display study (indications on a chart for filled and working orders), open trade equity, current position, and profit and loss account… more

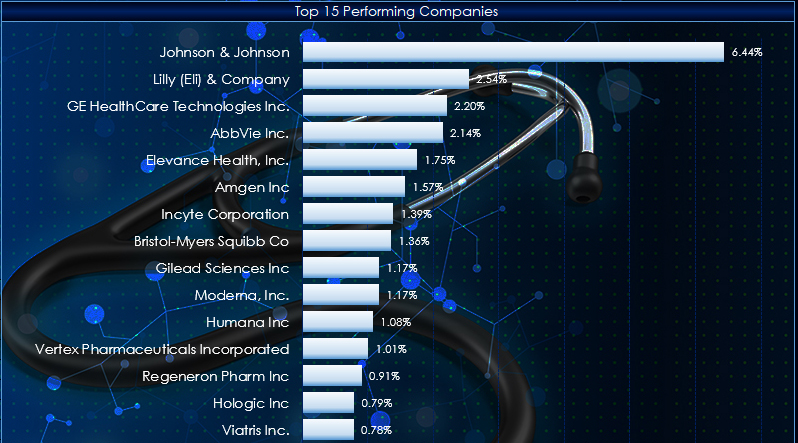

This macro-enabled Microsoft Excel® spreadsheet tracks the holdings of the Health Care Select Sector SPDR® (XLY). The ETF is based on the Health Care Select Sector Index.

There are 60 stocks… more

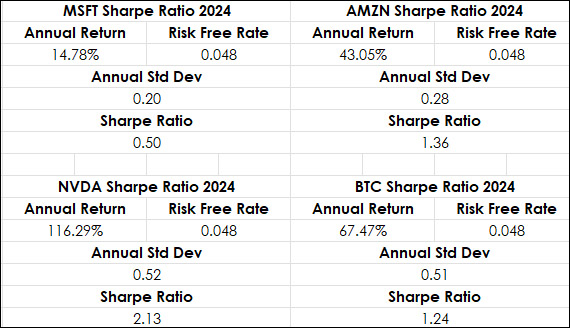

The Sharpe ratio measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk. It is the difference between the returns of… more

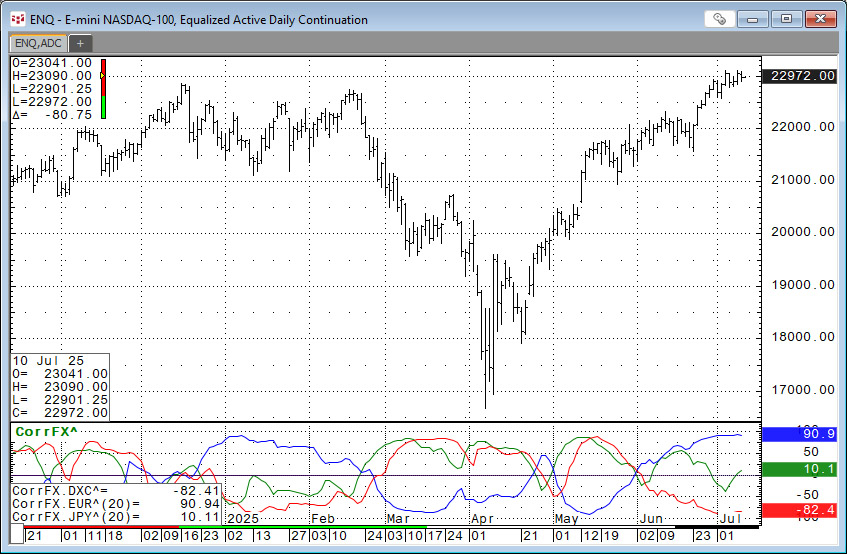

This function is available in the Add Study window and in the Formula Toolbox.

The function measures the strength and direction of the price movement of two symbols over a defined number of… more

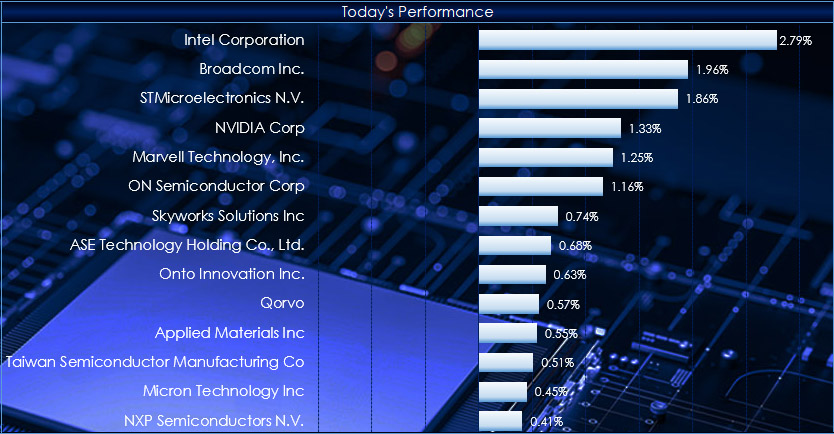

This macro-enabled Microsoft Excel® spreadsheet tracks the holdings of the iShares Semiconductor ETF (SOXX). The ETF tracks the investment results of an index composed of listed US equities in the… more