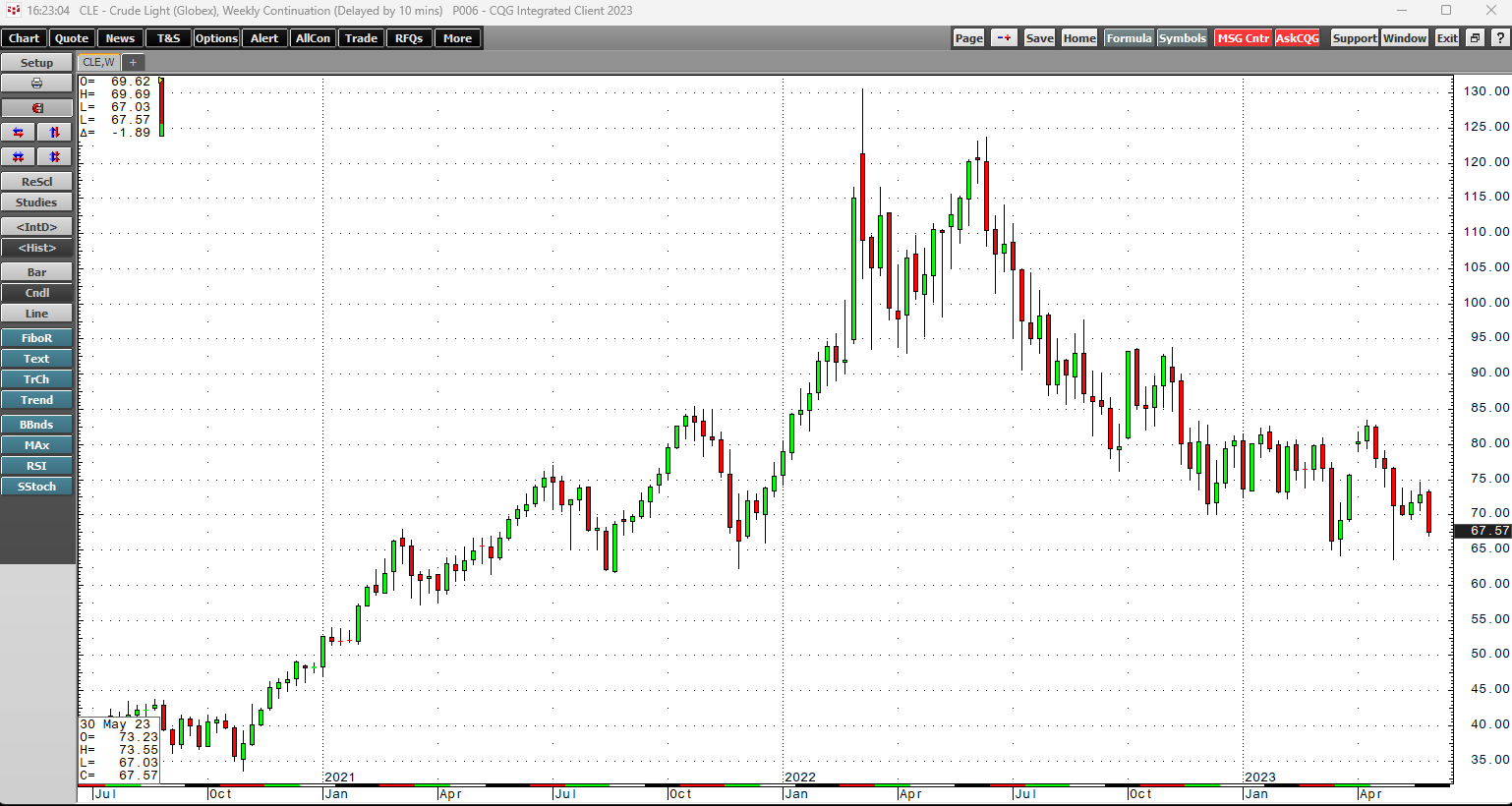

While the U.S. energy policy embraces alternative and renewable fuels and inhibits hydrocarbons, crude oil remains the energy commodity that powers the world. In 2022, the war in Ukraine and U.S.… more

Commentary

What are the most potent candlestick signals? This is the question many investors ask when just learning about candlestick analysis. There are approximately 50 or 60 candlestick signals. But there… more

Larry Hite famously posited the 1% rule in Schwager's, "Market Wizards". This risk management rule suggests risking no more than 100 basis points of total assets under management on any… more

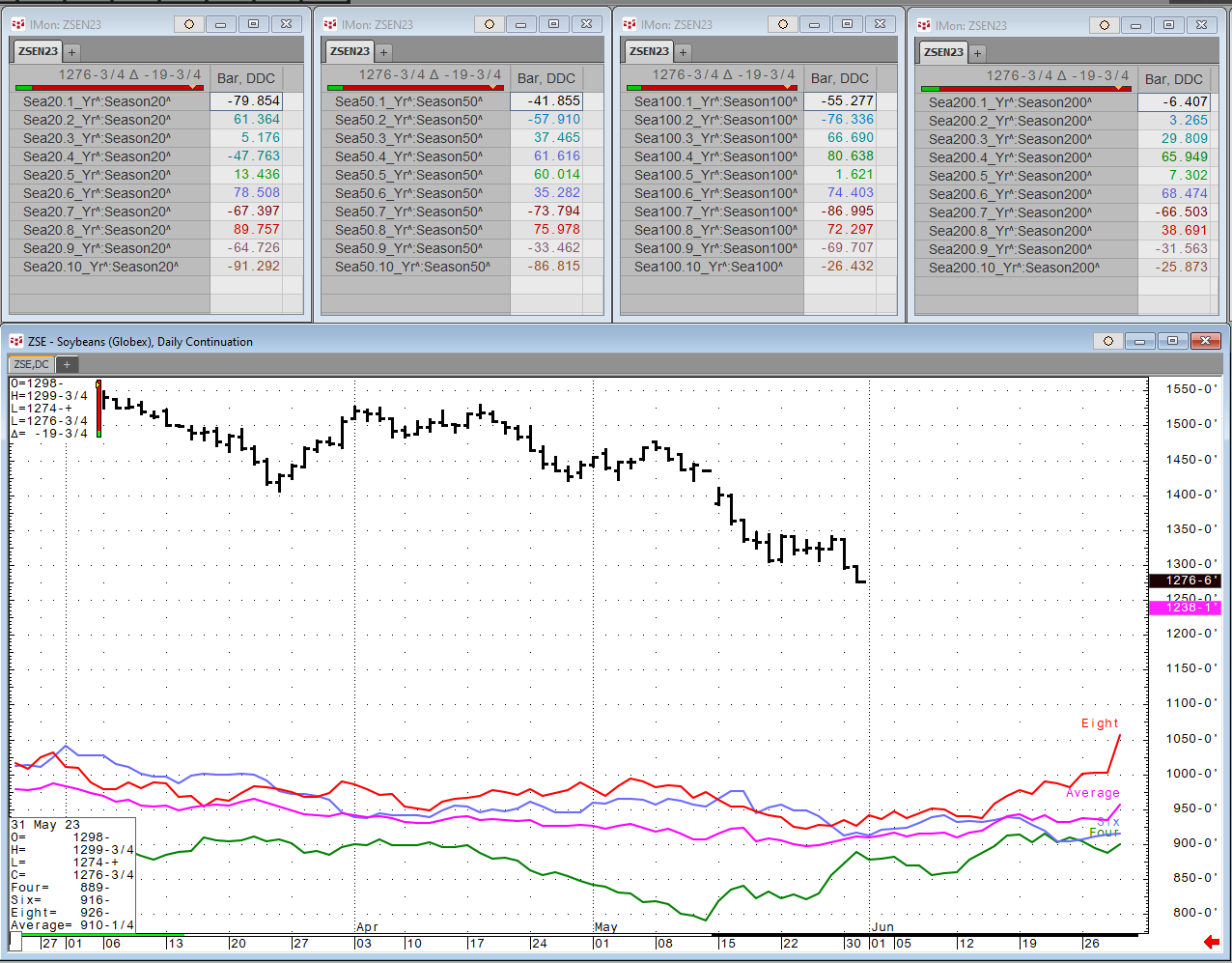

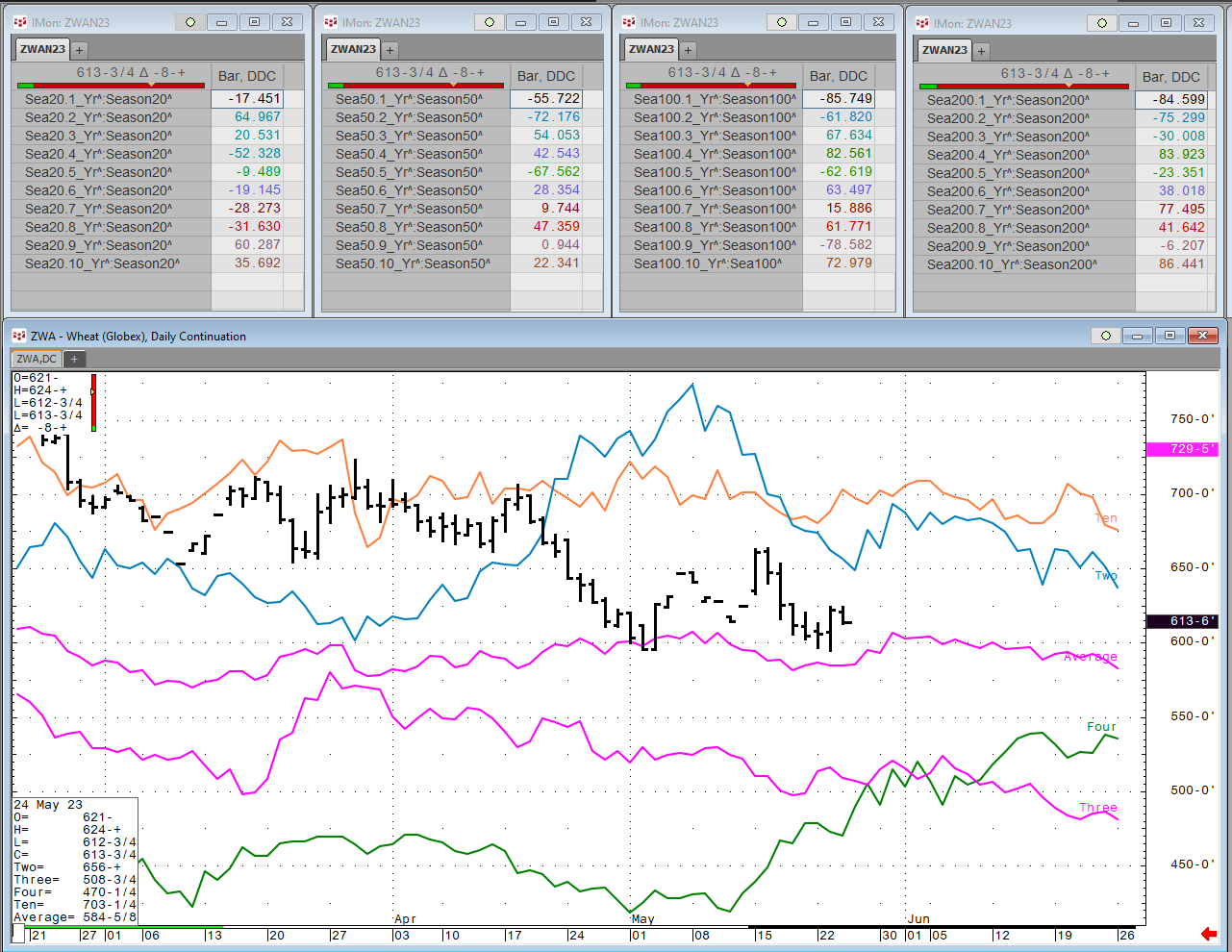

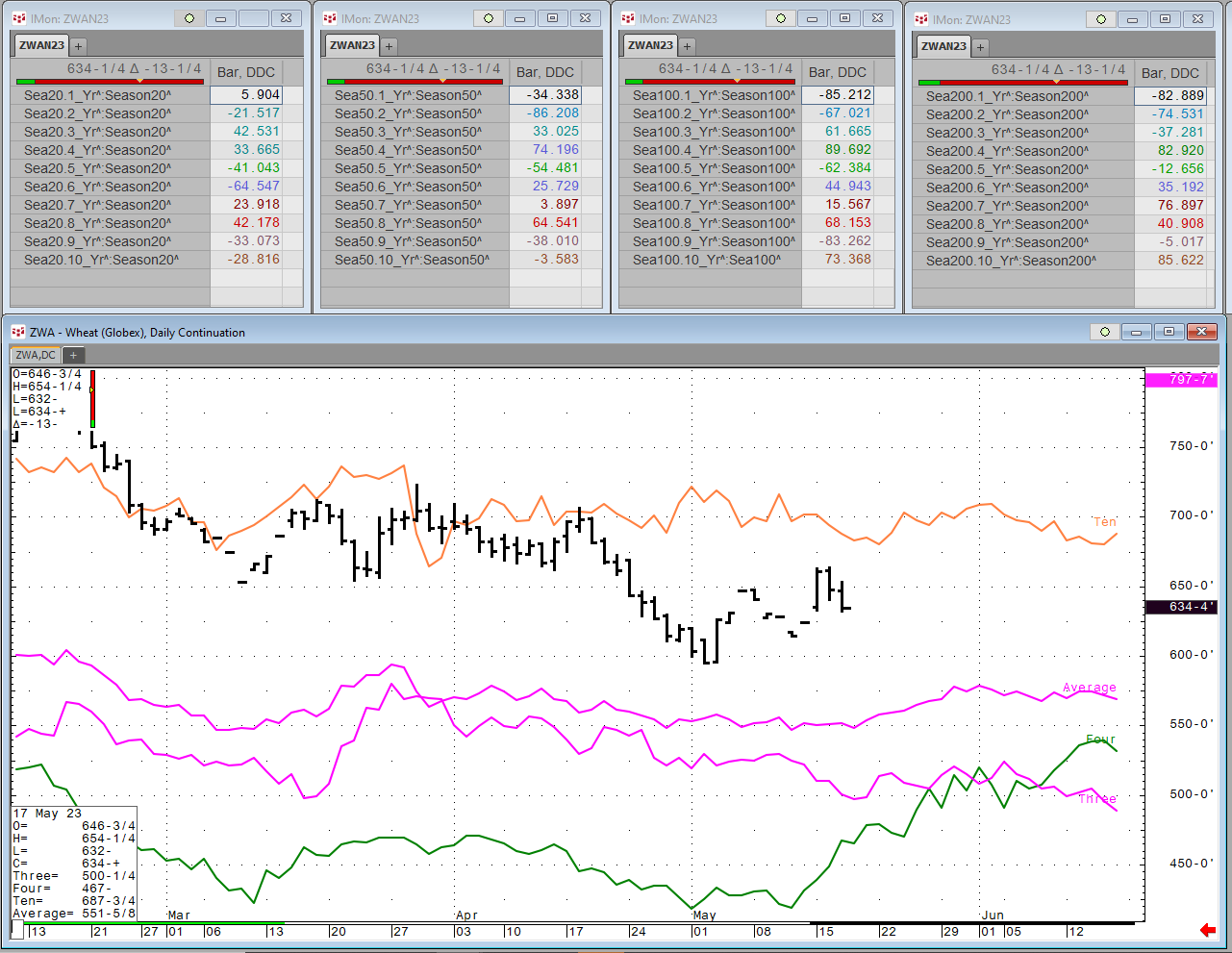

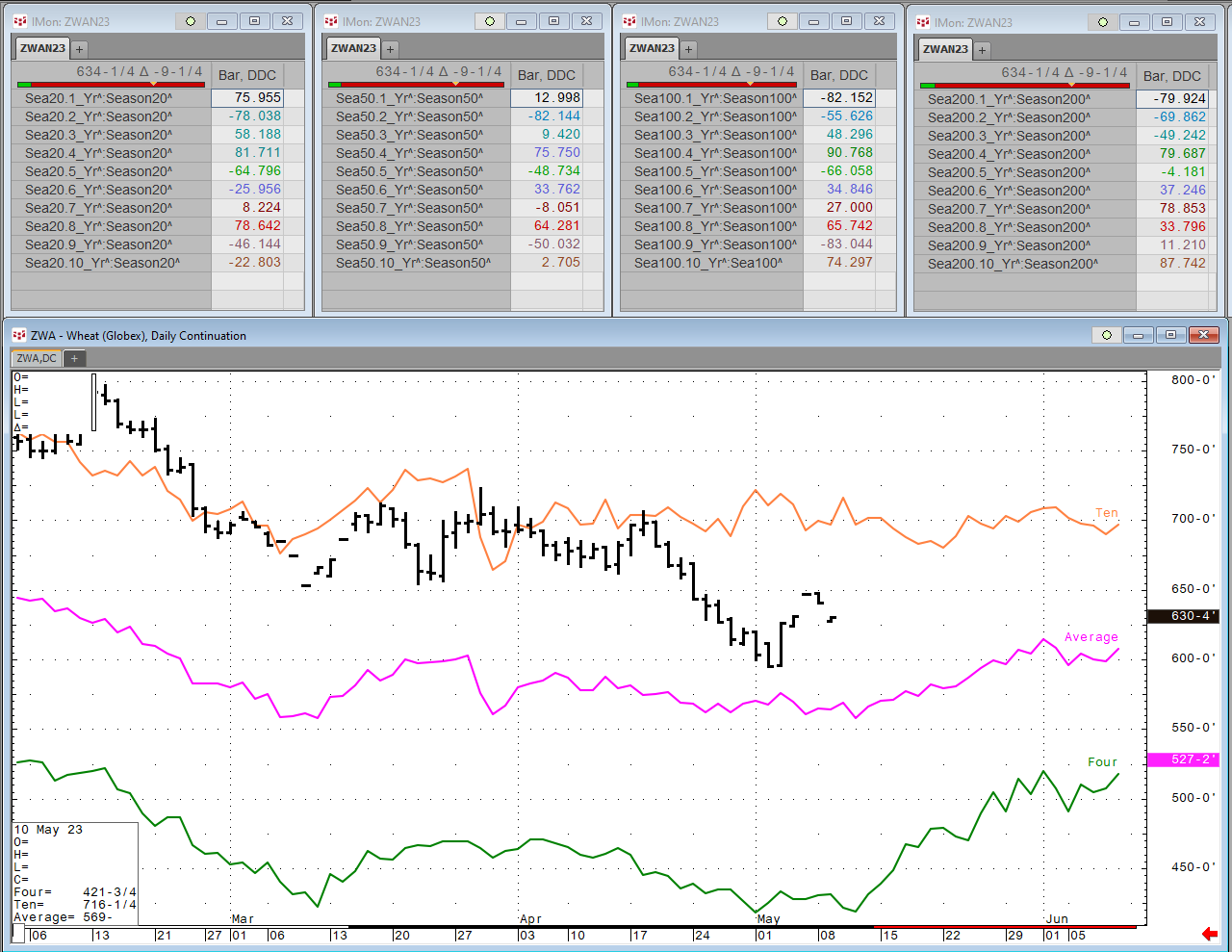

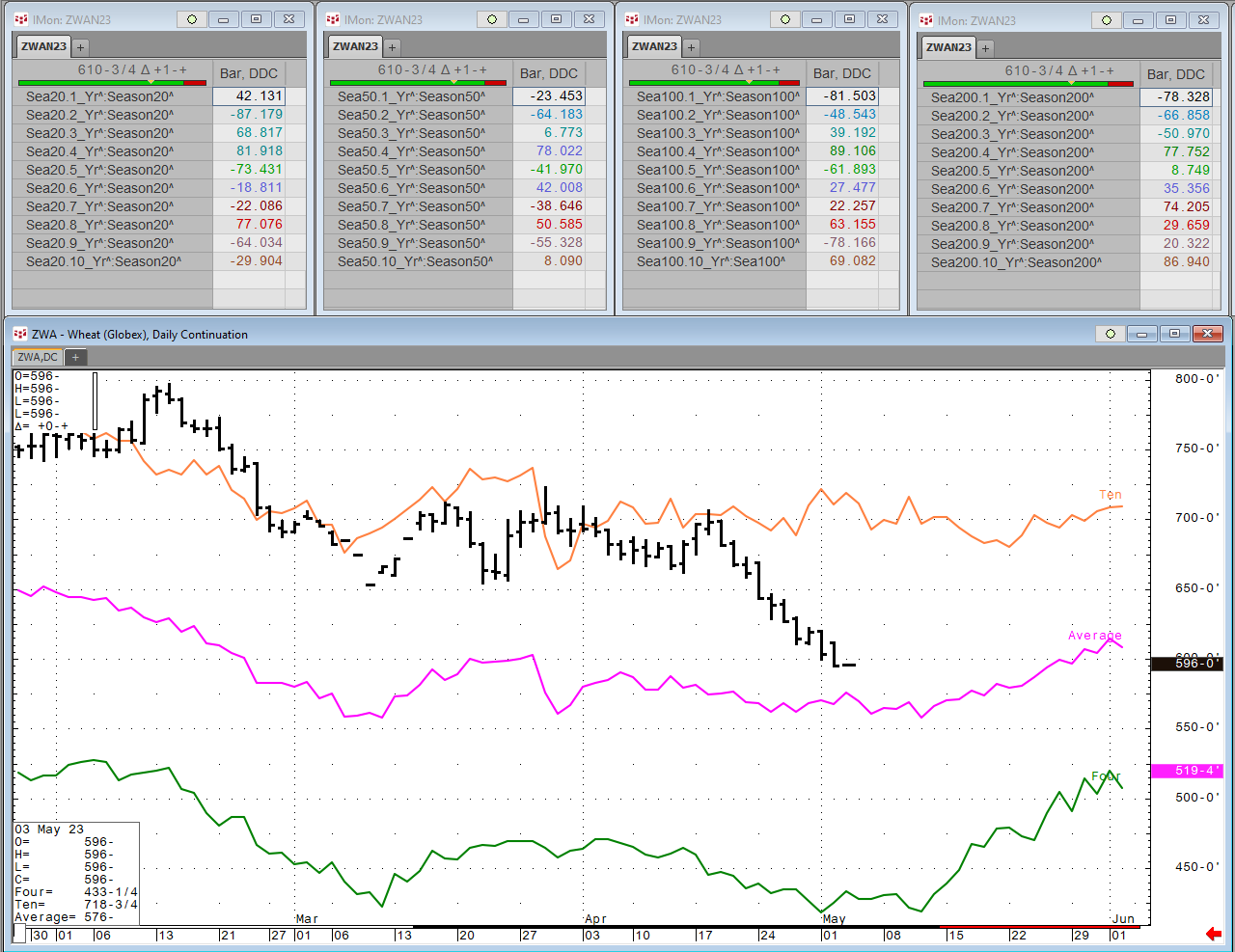

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG's Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

With thanks to Financial Repression Authority .

CQG Integrated Client 2-week free trial