It has been quite an extended period since my last post, but now I’m trying to catch up on some reading and relevant research on all things pertinent to GLOBAL MACRO. Following the FEDERAL RESERVE… more

Commentary

Darius Dale is the Founder… more

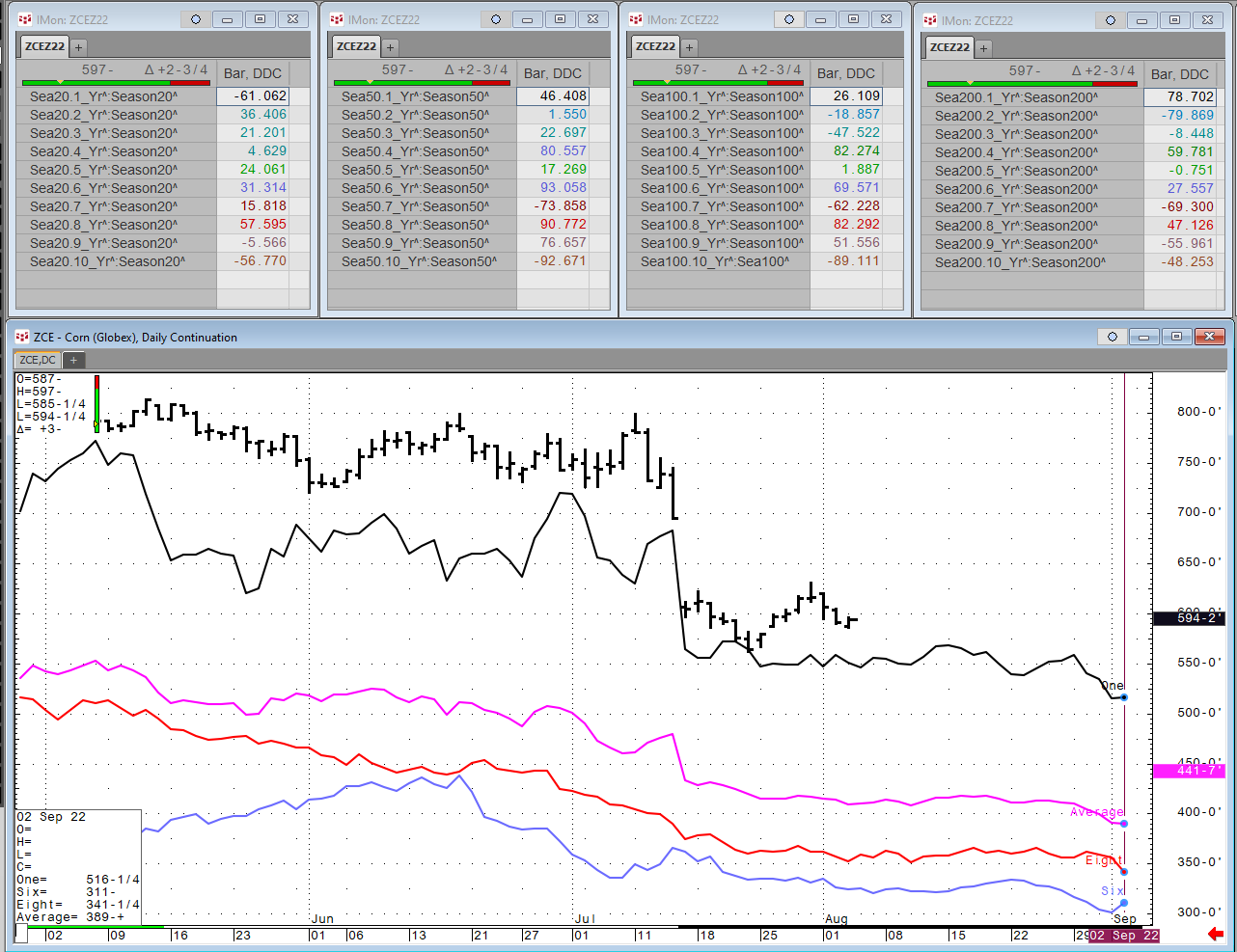

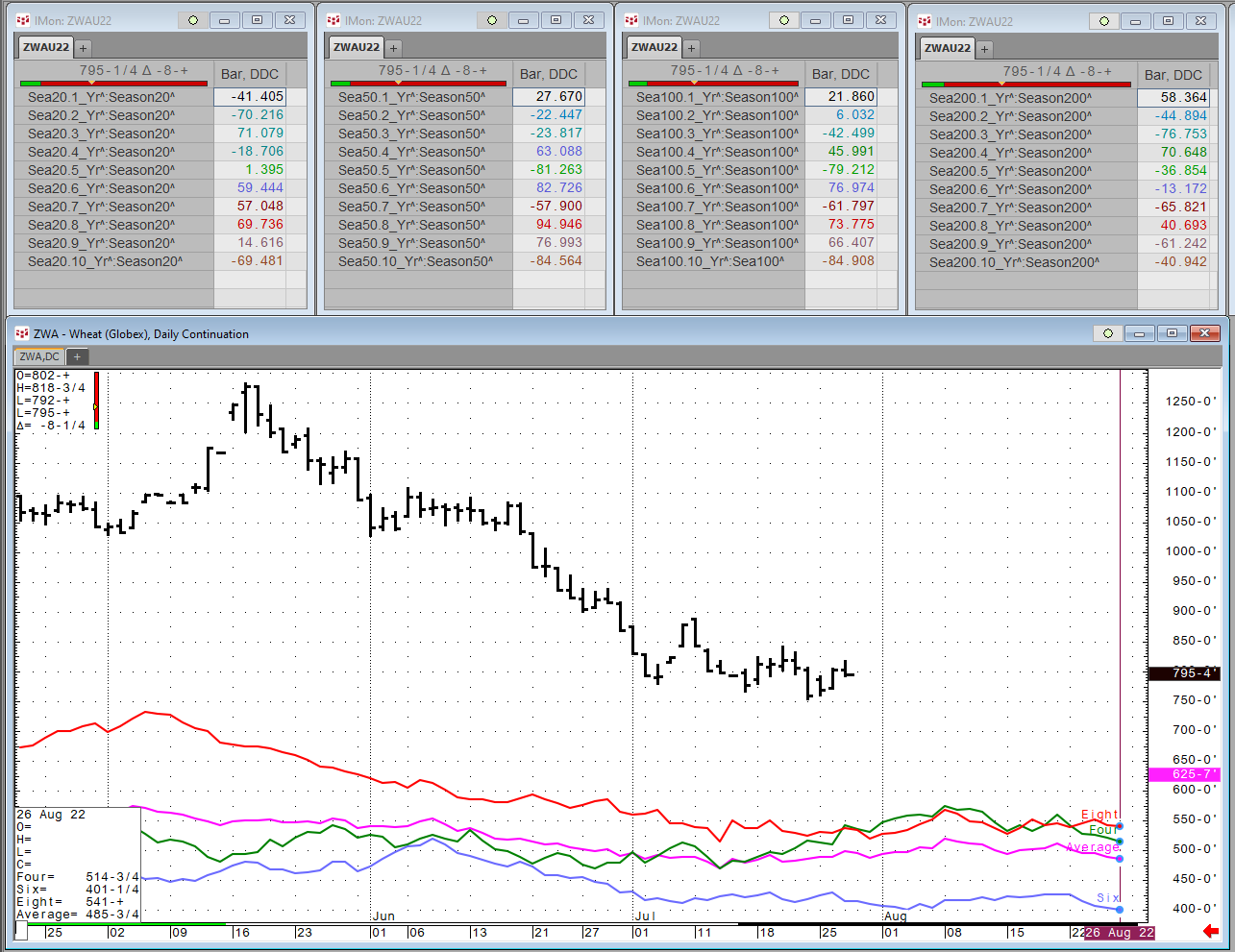

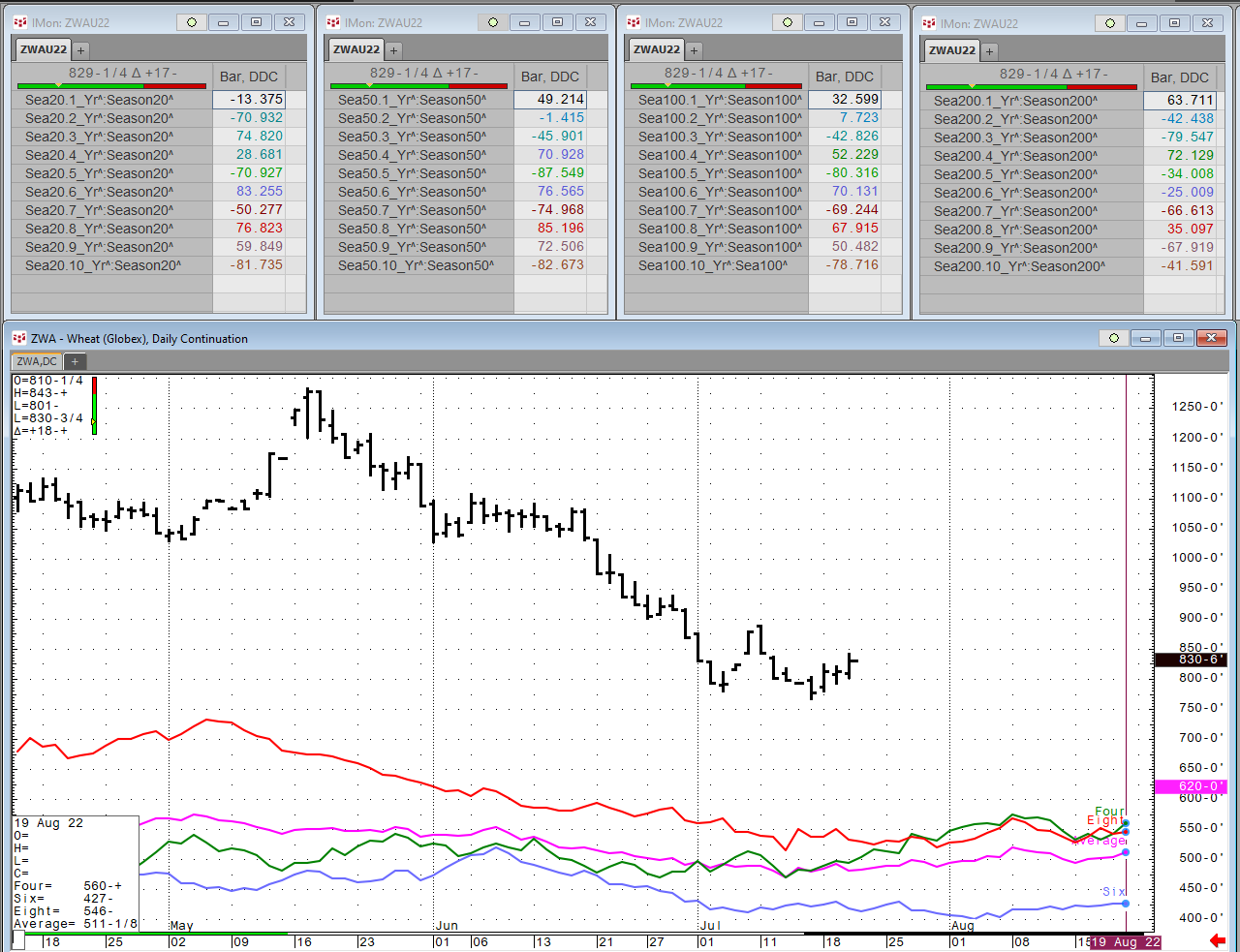

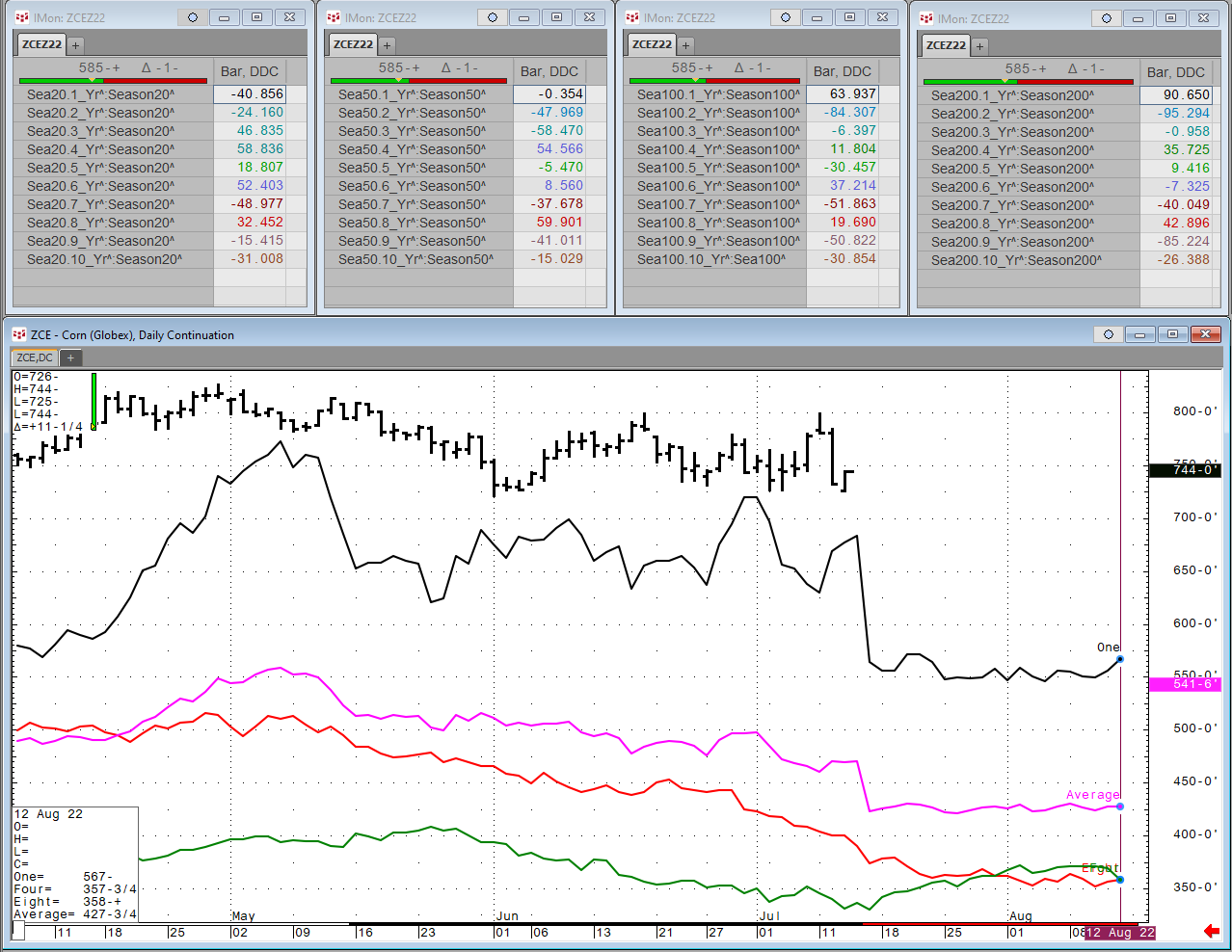

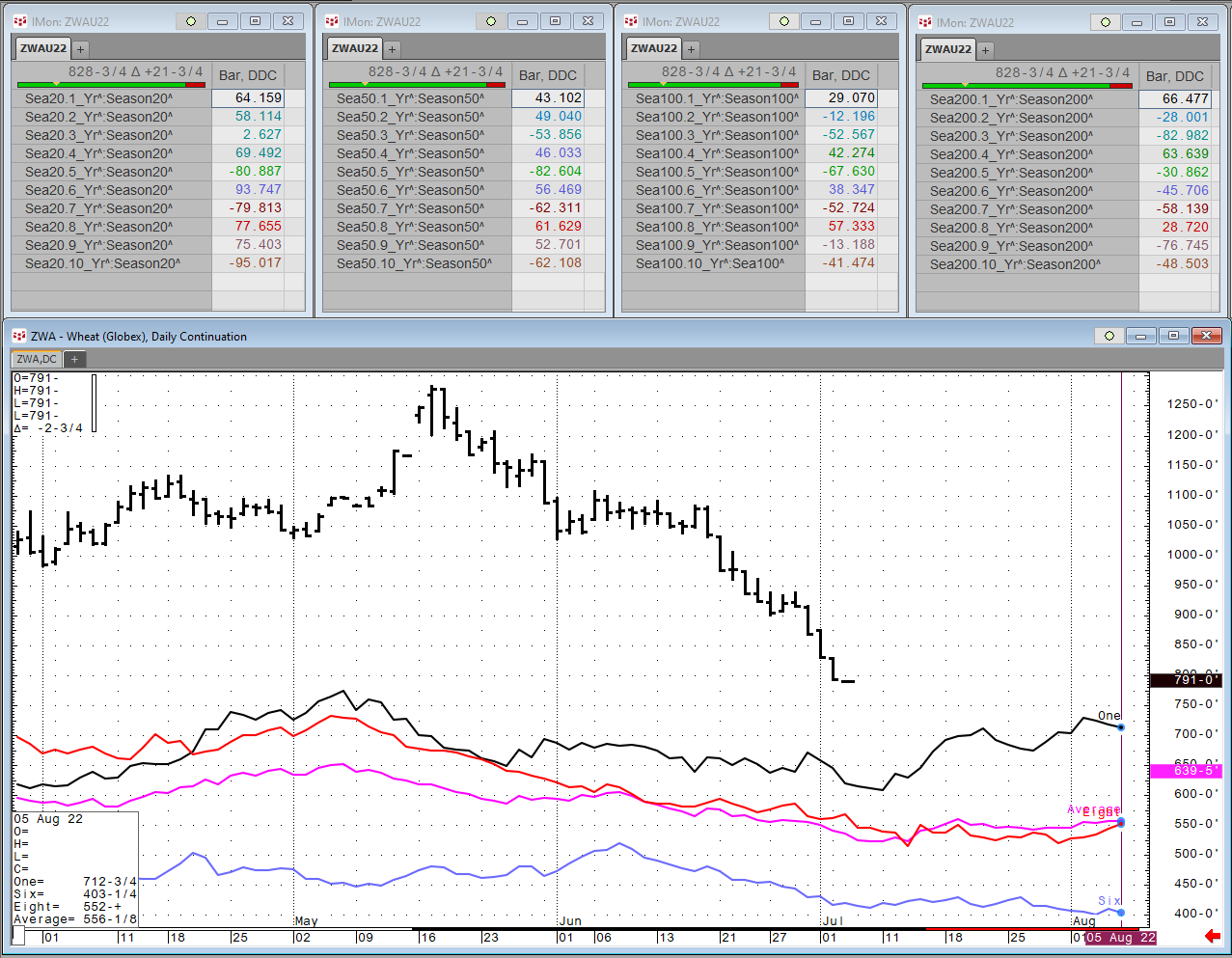

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

COMEX gold futures reached a record high in 2011 at $1,911.60. After a four-year correction, the price reached a bottom at $1046.20 in late 2015. In August 2020, the price eclipsed the 2011 high,… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Frank Shostak is an Associated Scholar of the Mises Institute. His consulting firm, Applied Austrian School Economics, provides in-depth assessments and reports of financial… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

Each Wednesday this article will be updated with the current seasonal study using CQG’s Seasonal analysis applied to the Soybean, Wheat and Corn markets. You can download the CQG pac providing the… more

The raw material markets moved lower in Q2 but were still higher than the level at the end of 2021. The commodity asset class consisting of 29 primary commodities that trade on US and UK exchanges… more