Supply and demand fundamentals support the grain markets. According to the US Census Bureau, the global population grows by approximately twenty million each quarter. At the turn of this century,… more

Commentary

Here is a presentation by Yra Harris, presented by WhiteWave Trading Strategies, an independent research firm, about Japan, the Nikkei Index, and how markets align.

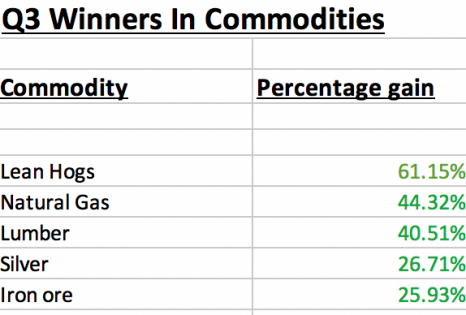

… moreThe raw material markets continued to make a comeback in the third quarter of 2020 after the global pandemic caused a deflationary spiral taking the prices of most assets lower in Q1. The… more

CME Group is launching a water contract based on the NASDAQ Veles Water Indexes in December.

Here is a presentation by Kevin L. Patrick, a preeminent authority on water law and water issues… more

The end of the summer is the start of the harvest season in the grain markets. The United States is the world’s leading producer and exporter of corn and soybeans, and a leading producer of wheat… more

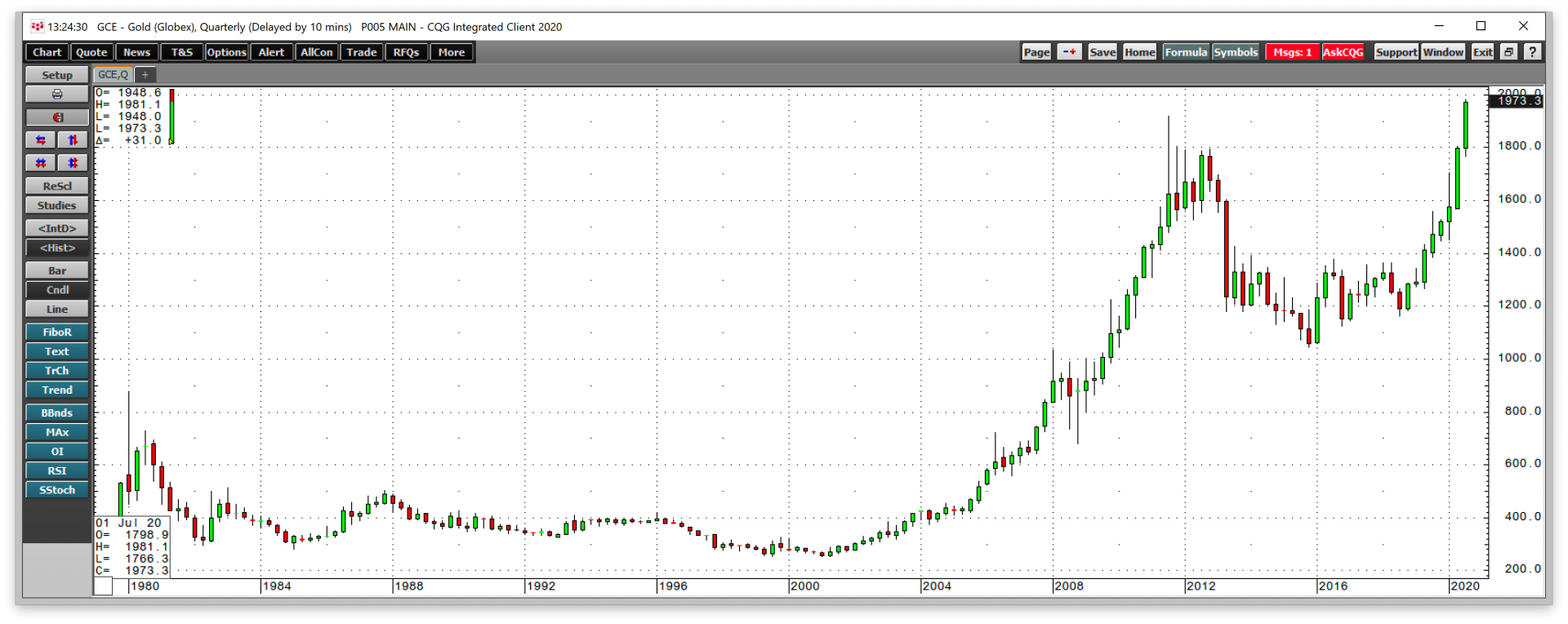

July 2020 was a month where the prices of gold and silver posted significant gains. In what has been almost a perfect bullish storm for the two precious metals, a decline in the value of the US… more

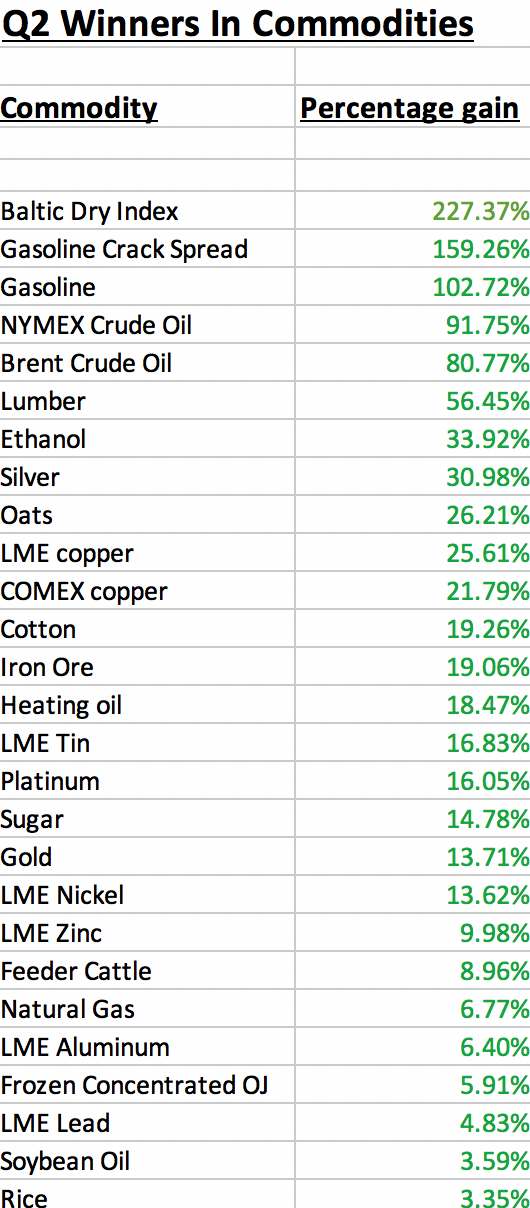

The raw material markets made a comeback in the second quarter of 2020 after the global pandemic caused a deflationary spiral taking the prices of most assets lower in Q1. The commodity asset… more

The silver-gold ratio measures the price relationship between the two precious metals. Silver and gold are hybrid commodities as both have long histories as both metals with a myriad of… more

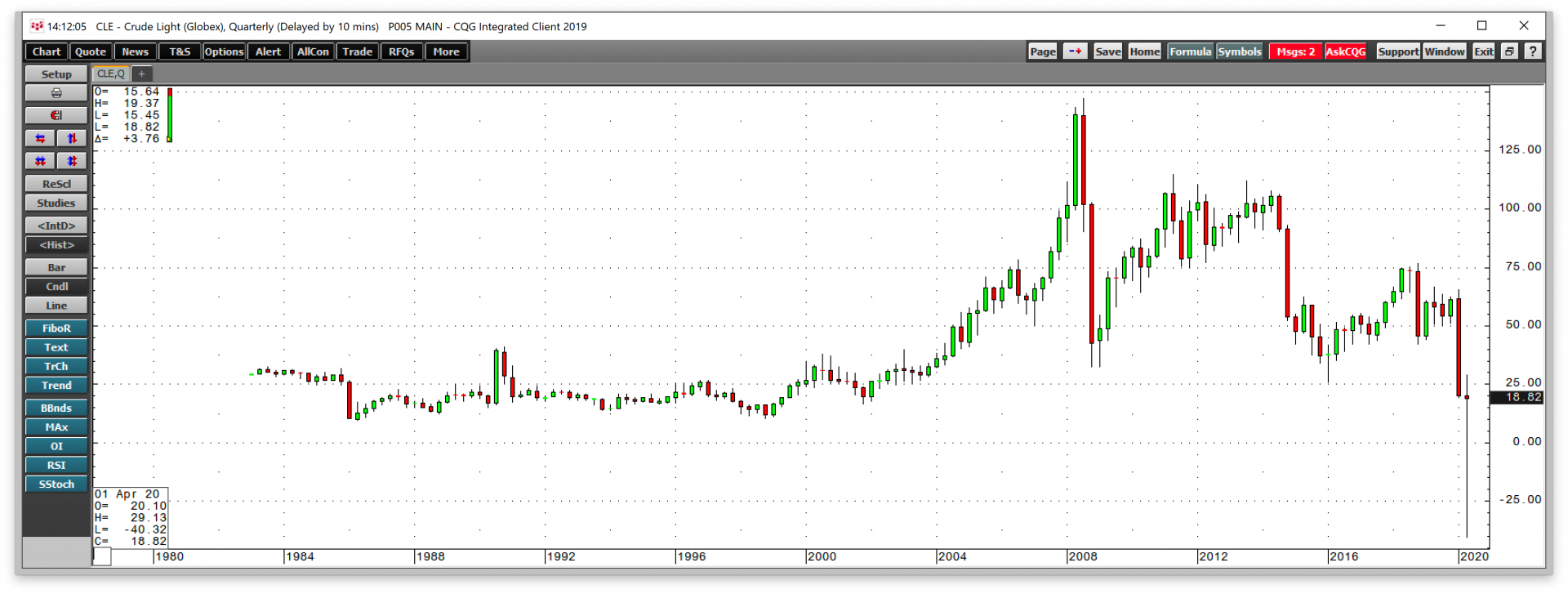

April 2020 will go down in history as the month that the price of crude oil fell to a low that most market participants did not believe possible. West Texas Intermediate crude oil began trading on… more

Optimism ran high at the start of 2020. The United States and China were about to sign the “phase one” trade deal that de-escalated the trade war that hung over markets in 2018 and 2019. The… more