Moving averages, oscillators, forward curves, spreads, basis graphs... charting can seem overwhelming to commercial hedgers who are simply seeking to dampen volatility and lock in profits on their… more

Richard Weissman

I love creating sayings that drive home truths in technical analysis. One of my favorites has always been:

“First test good,

second okay,

third go the other way.”

So,… more

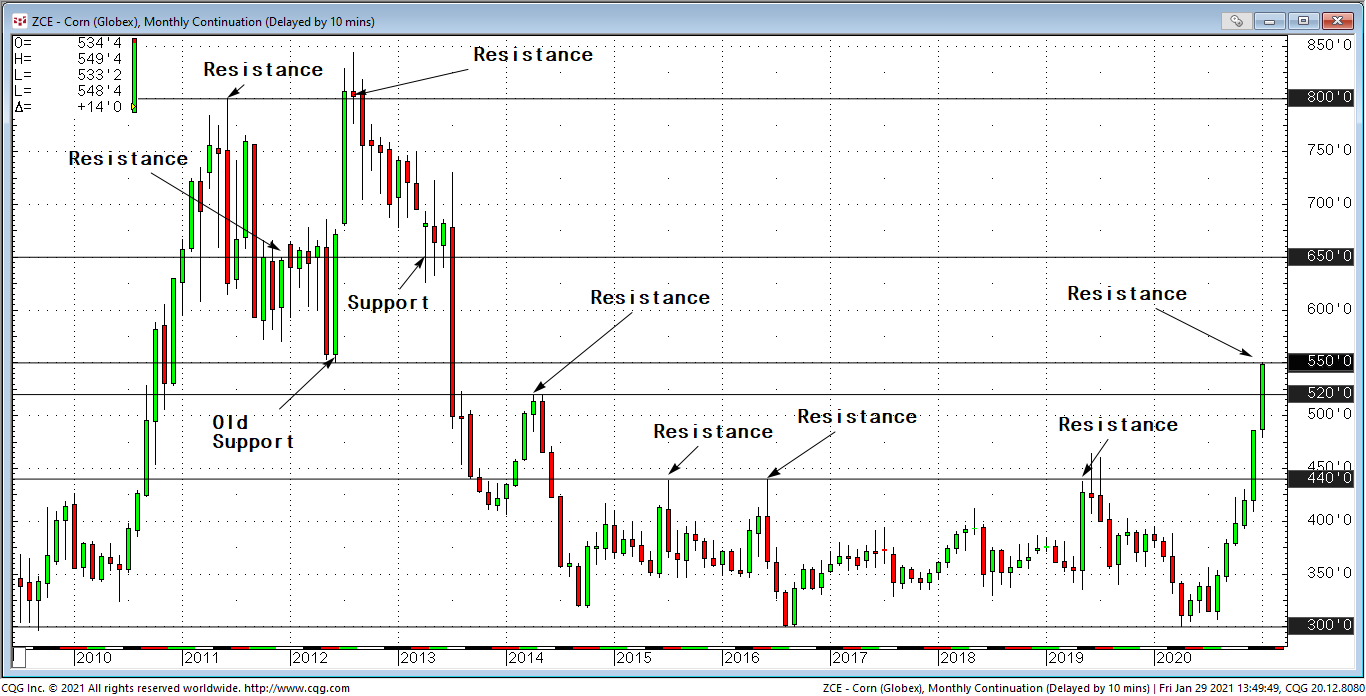

Since the May 7th high at $6.38/bu., CME Group December 2021 Corn futures have been trading in a sideways albeit large trading range with the $6.10-$6.38 area as resistance and $5.00-$5.15 area as… more

Prices for the actively traded July 2021 CME Group soybean oil futures reached all-time new highs in recent trading sessions (see Figure 1), spurred by increasing demand from the biofuels industry… more

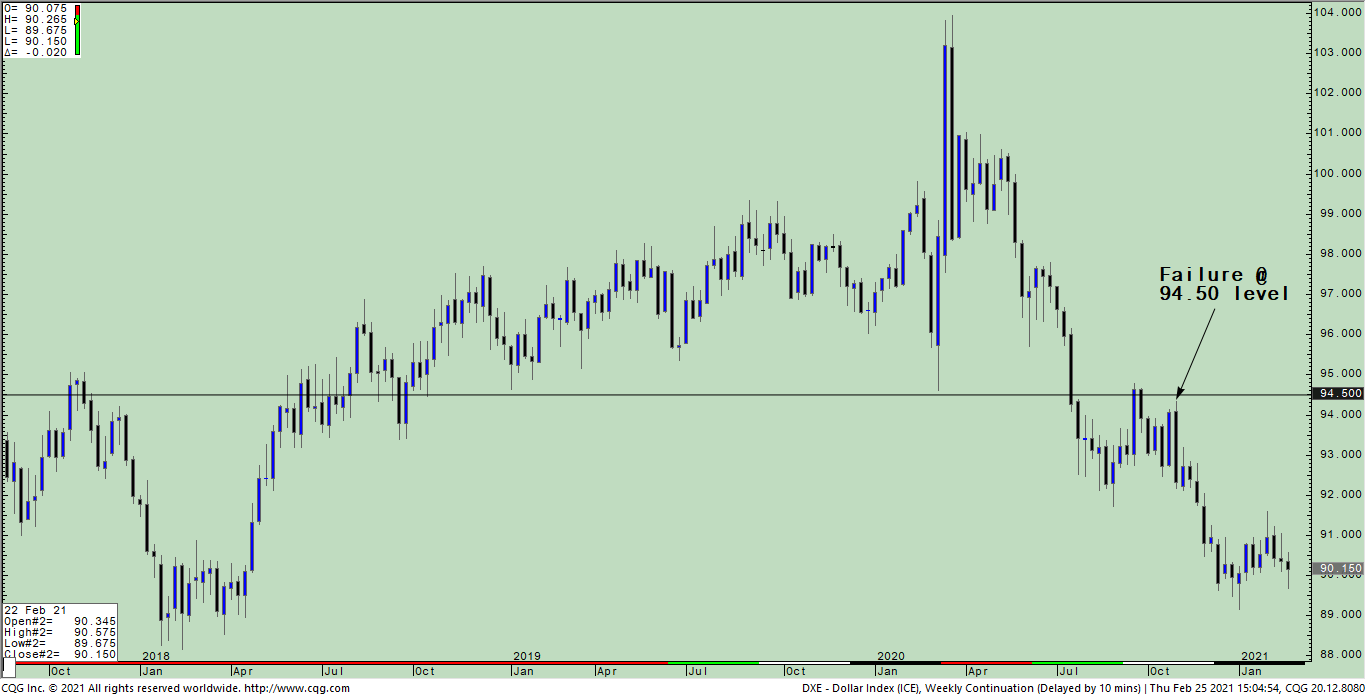

Over the past few months there’s been an increasing buzz about commodity prices… grains, crude oil, industrial and precious metals have all broken to the upside and one of the most uttered phrases… more

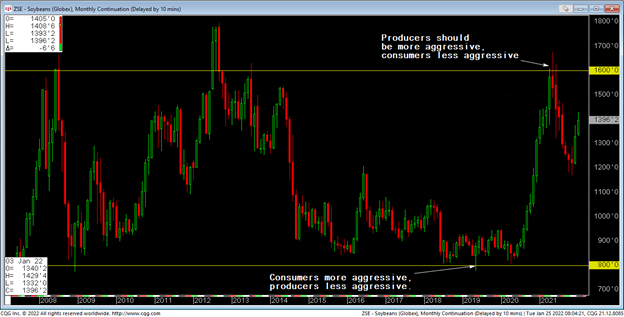

Most commercial hedgers begin their analysis and hedge decisions with a look at the long-term trend and this means a monthly continuation chart (aka rolling front-month futures chart). As of… more

This article examines how technical analysis can aid in trading around news events. One of the biggest misconceptions is that technical analysis is a “standalone” method and therefore,… more

This article will try to illuminate why most retail traders fail at speculative trading. I would argue that the simplest reason for failure is that they are fighting the path of least resistance.… more

Many speculative traders are attracted to short-term or intraday trading for a wide array of reasons. These reasons include the fact that trades executed are typically lower risk as well as… more

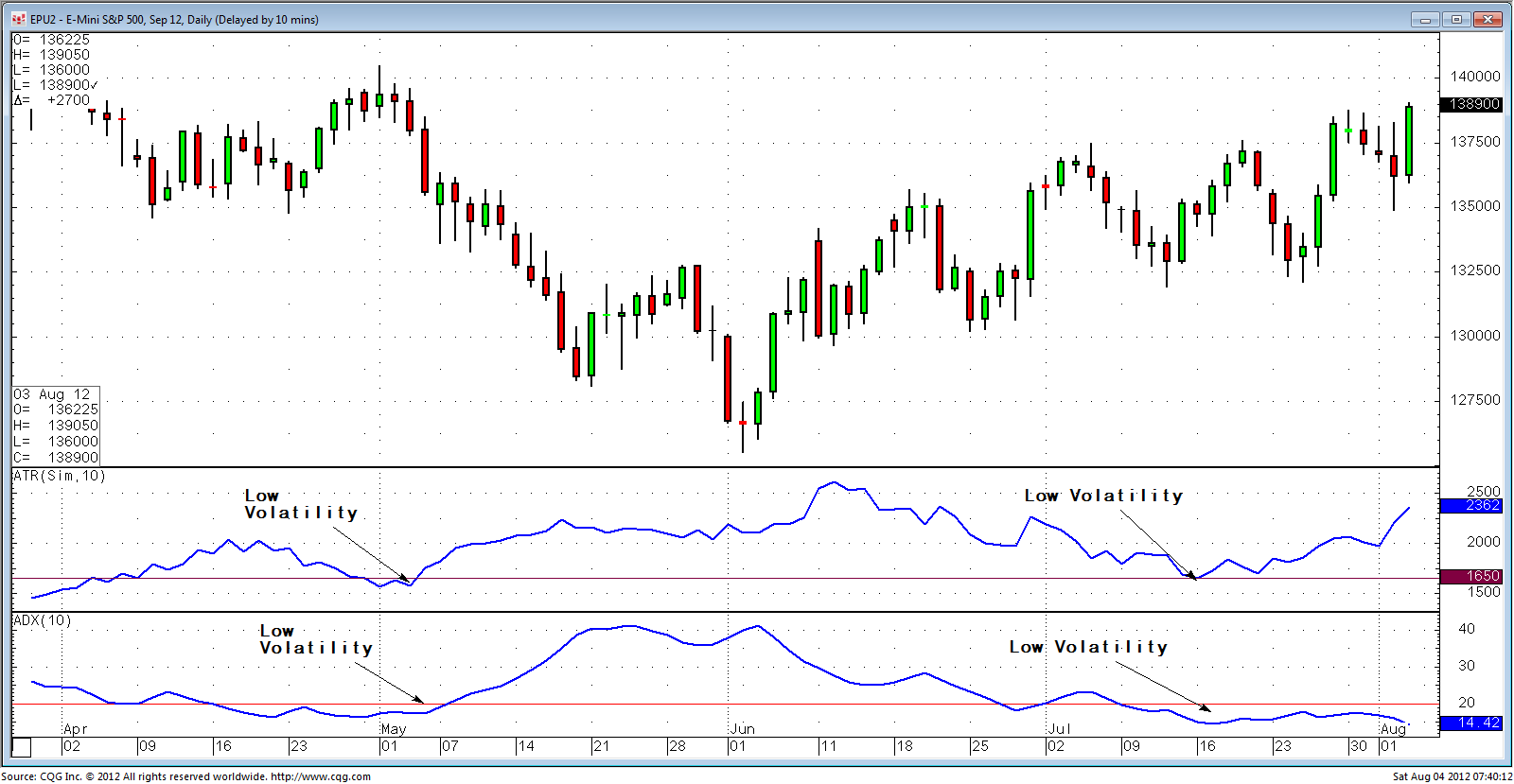

Although most mathematical technical indicators focus on capitalizing on either trending behavior by using tools like moving averages (see Trend Following Kept Simple: The 200-Day Simple… more