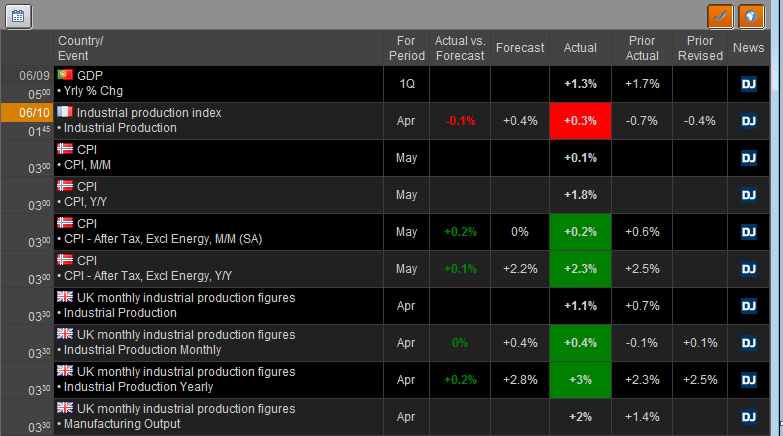

Have you used CQG's new Calendar of Events? The Calendar of Events allows you to track economic releases with a concise calendar. It provides details for key global macroeconomic indicators,… more

Blogs

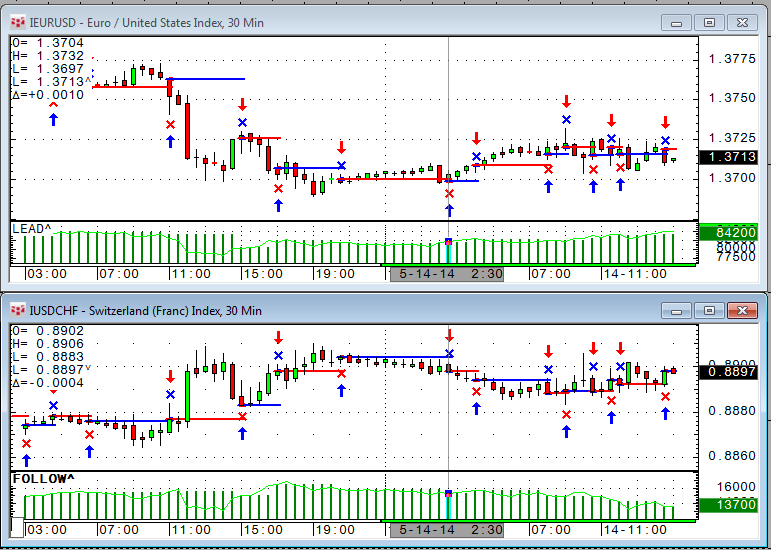

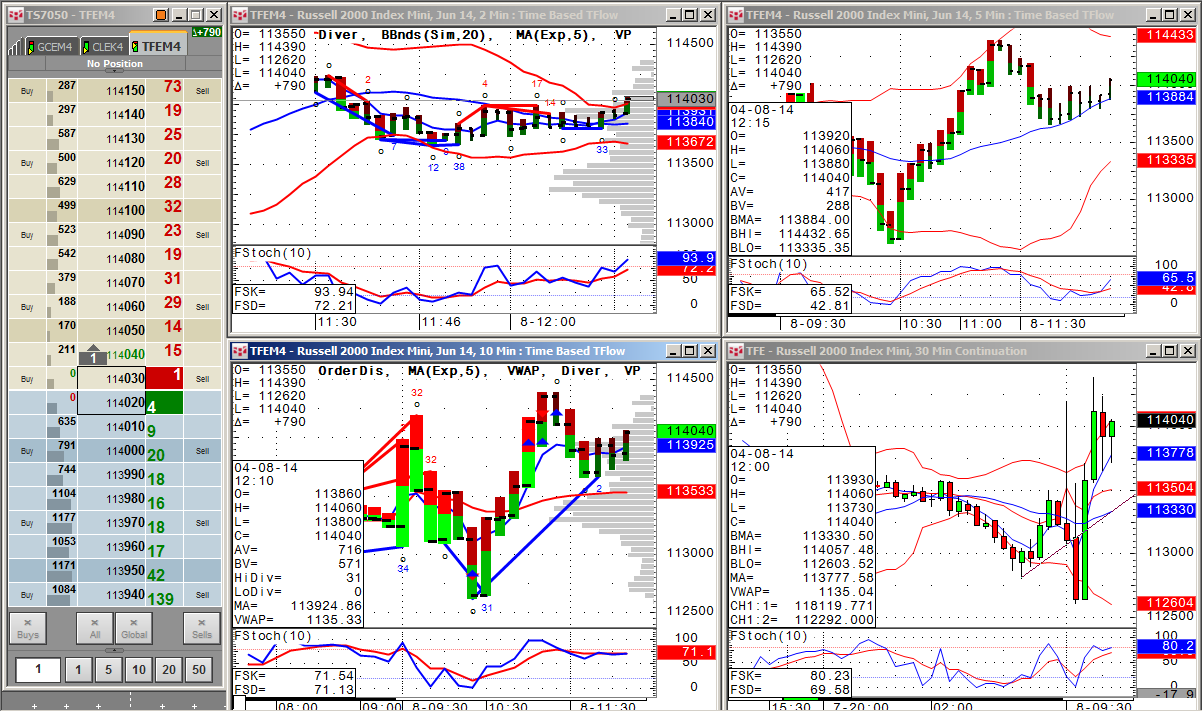

Many speculative traders are attracted to short-term or intraday trading for a wide array of reasons. These reasons include the fact that trades executed are typically lower risk as well as… more

Part of a series of interviews with traders who use CQG Integrated Client, this interview is with Jeanette Schwarz Young, CFP, CMT , M.S., who has been trading since 1981. She is author of The… more

One of my first backtesting tips featured a piece of code to limit a trading system only to one trade per day.

My colleague Doug came up with a smarter way to do this and even added the… more

One of the questions we received recently was if it is possible to trigger a trade in a certain market based on another trading system trading a different market. The answer is yes. Here is how to… more

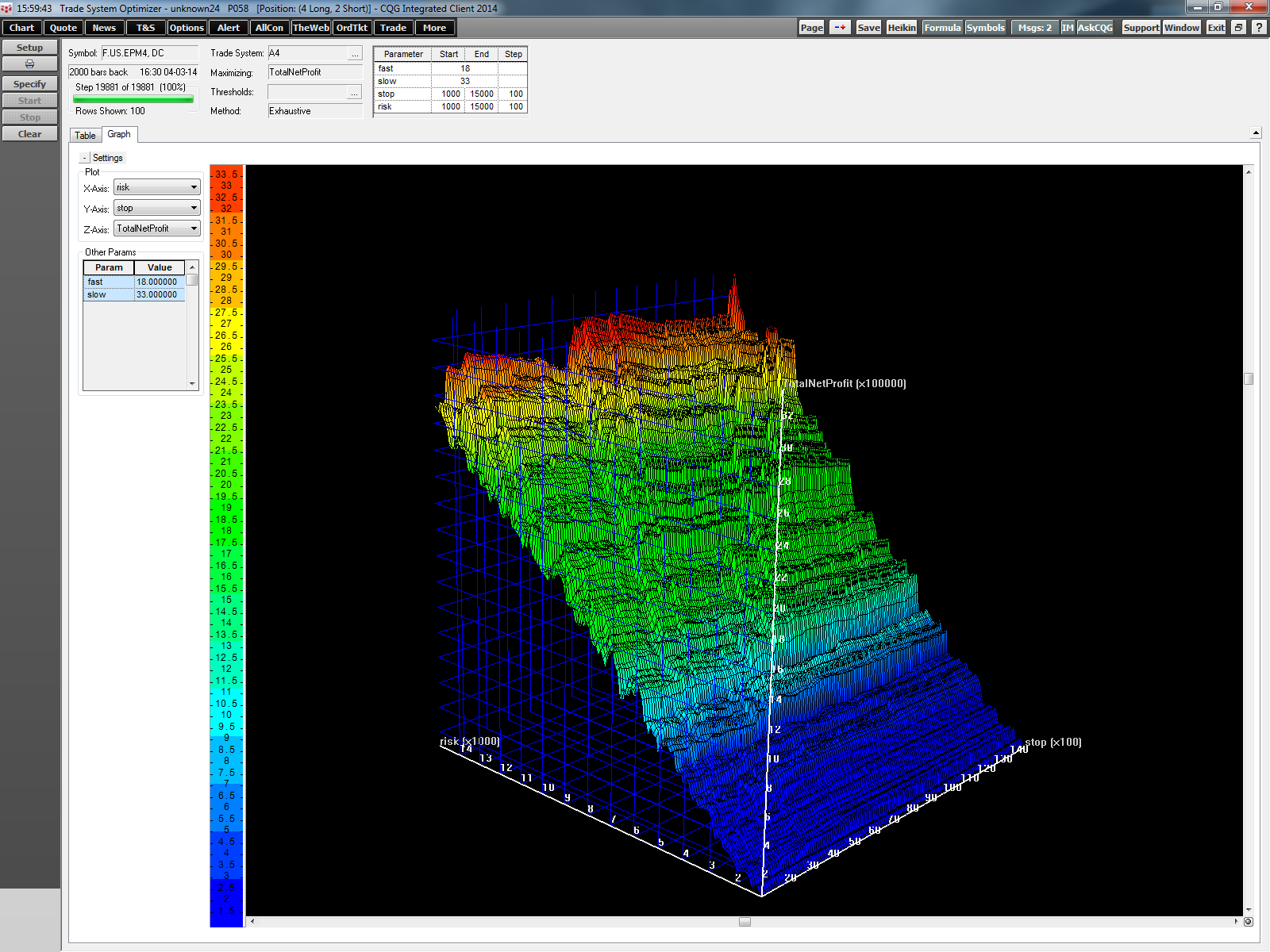

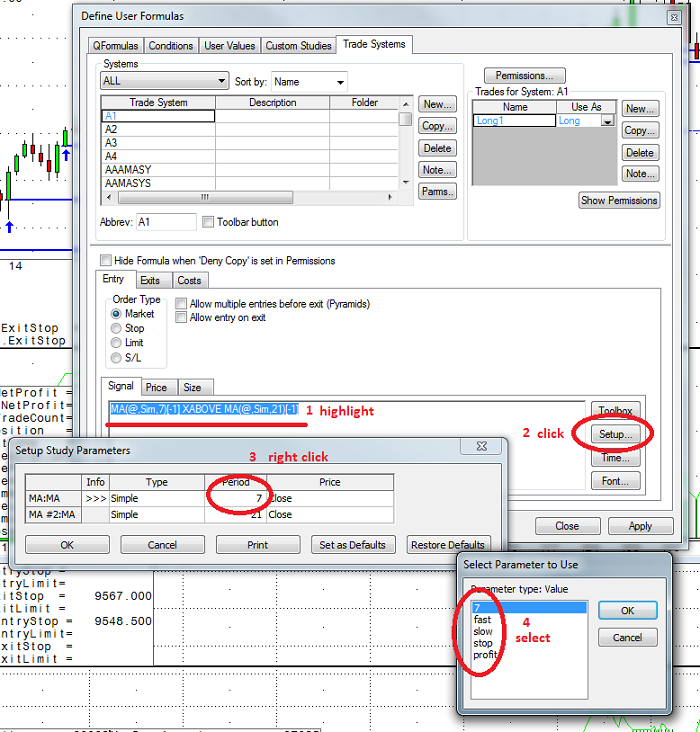

In my previous article, Backtesting Tip: Parameters inside CQG Code, I discussed the different parameter types and how to use them. This is important for all backtesting users because only values… more

We are getting a lot of questions about CQG parameters (Parms). In CQG, parameters are used for everything that needs to be controlled from the user interface and only Parms can be optimized.… more

The Peak-Ahead Problem

For most people the quick and dirty method of building trading systems using the signal bar closing price is good enough to judge a trading system… more

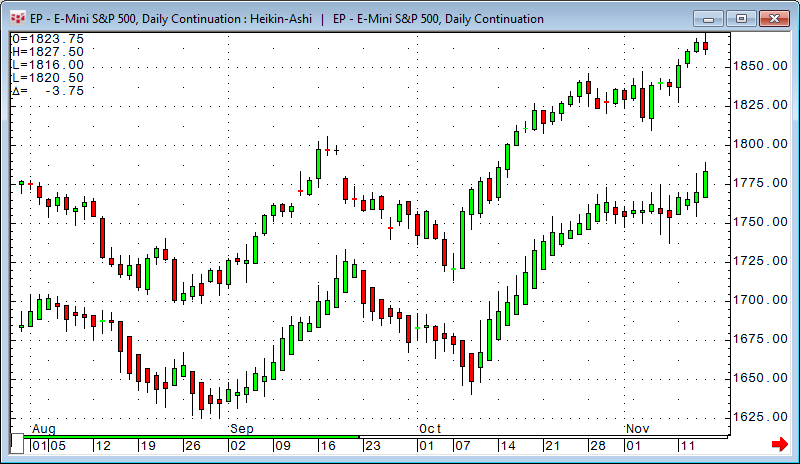

In CQG 2014 we will introduce three new chart types plus sub-minute bars, such as ten-second bar charts. In the next few articles we will have a short look into each one of them, starting with… more

As a devoted CQG trader, investor, portfolio manager, hedger, etc., how does high frequency trading (HFT) affect the way you do business? Some might say that you can't get a good fill at your… more