In this article we take a look at two examples where trades are placed on or around significant lines. The first idea is to change the classic daily pivot lines into intraday pivot lines and trade… more

Blogs

Today's Lows are Tomorrow's Highs

Copper fell 15.78% on COMEX and 14.59% on the London Metal Exchange in 2014. Copper has been making lower highs and lower lows since July 2014. The copper… more

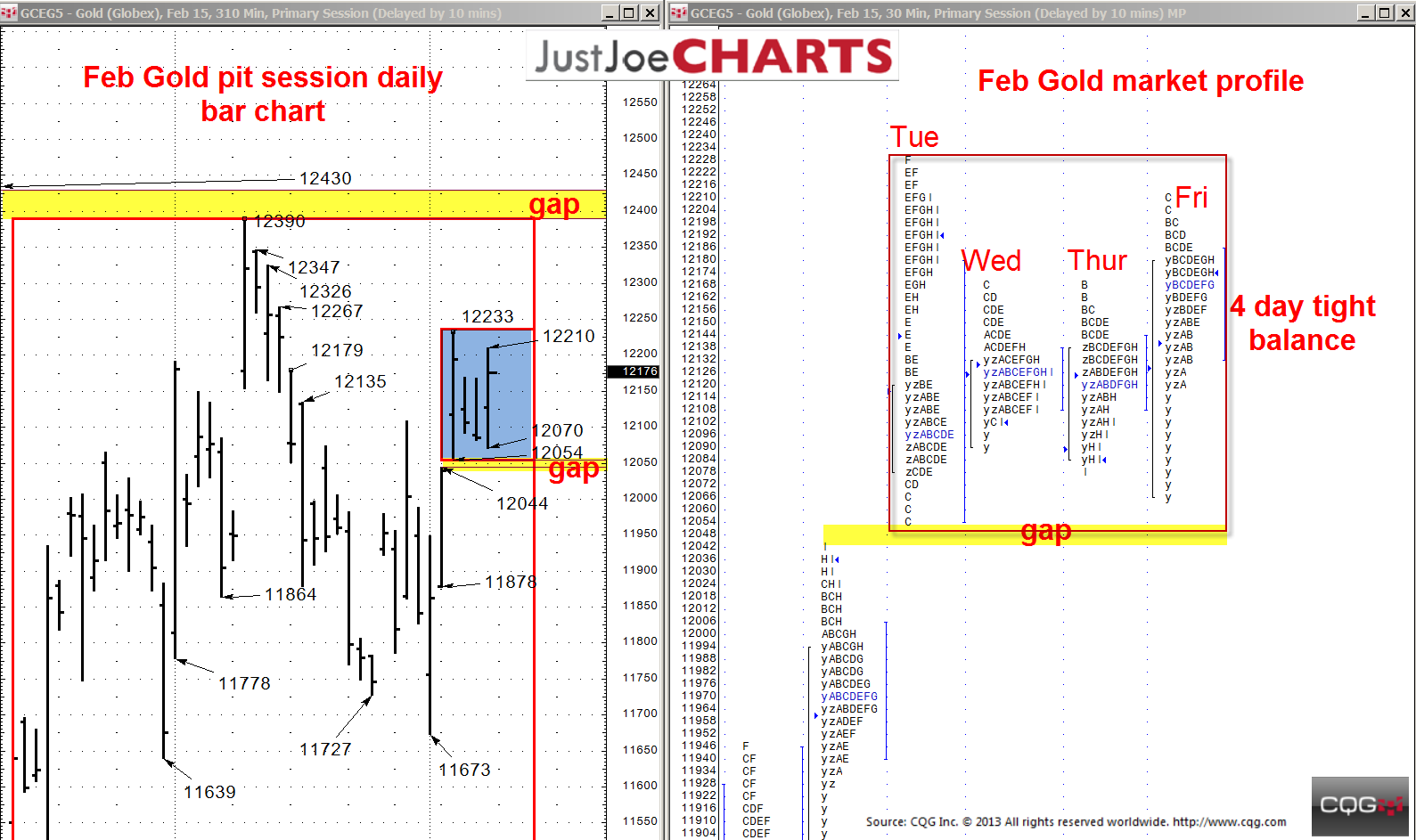

Over the past two months, February gold has been rotating within a 11469-to-12390 balance range. However, over the past four trading days, gold was confined to a relatively tight 12054-to-12233… more

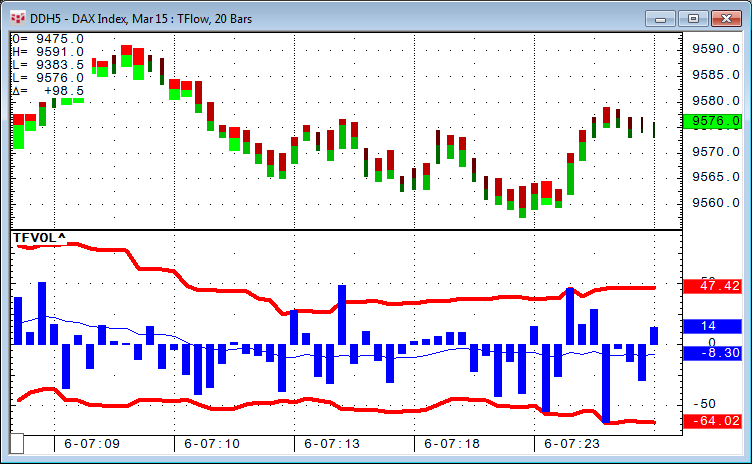

Recently, we had a request to show, in real time, how many contracts are available on the buy and sell side in the order book. This can be accomplished with a very simple study: DOM Ask Volume (… more

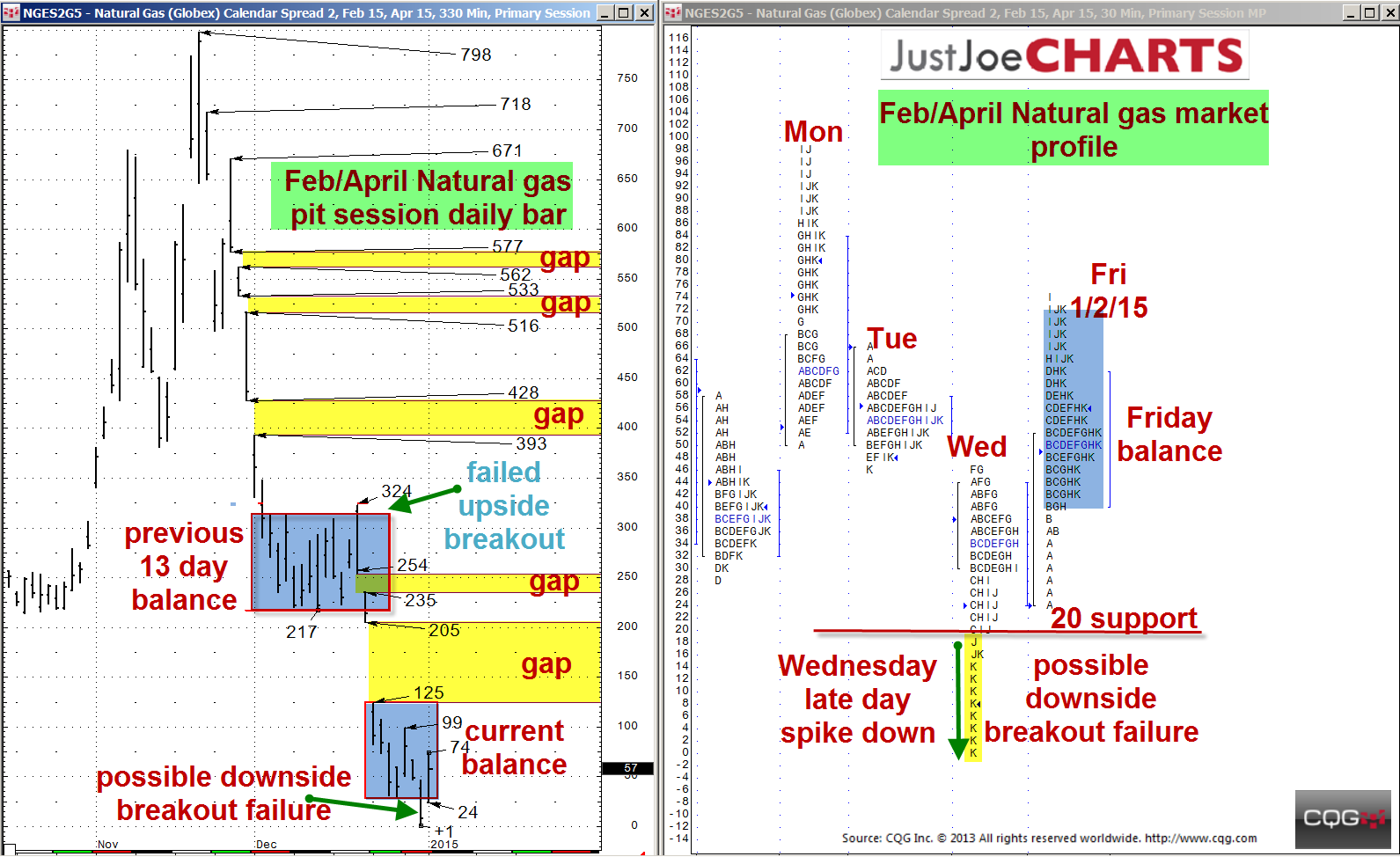

Over the last thirty trading days, the February/April natural gas spread has come off sharply about 800 points, leaving several gaps along the way. A few weeks ago, after the spread fell about 500… more

The dollar is still the world's reserve currency and there is an inverse relationship between the greenback and commodity prices.

The Dollar and Commodities

In 2014, the dollar was a… more

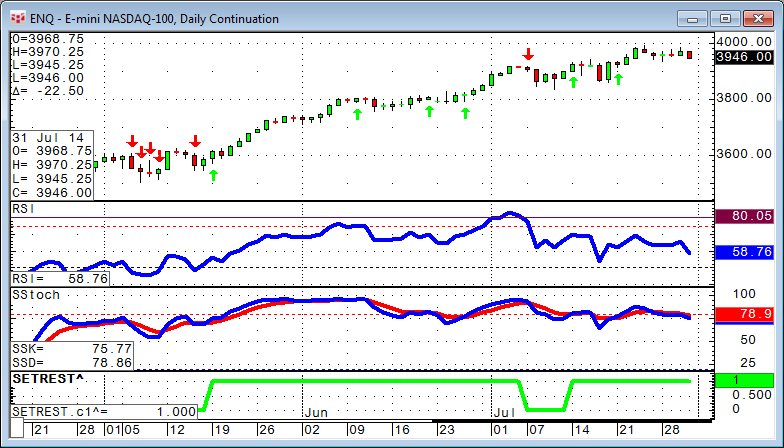

In this article, we will review a CQG indicator that has been available for many years and is still very relevant. It is possible to find divergence using the CQG formula toolbox, but it usually… more

This article will try to illuminate why most retail traders fail at speculative trading. I would argue that the simplest reason for failure is that they are fighting the path of least resistance.… more

CQG's Formula Builder Toolbox gives you the ability to use parameters (variables) inside your CQG code in order to control studies, conditions, and trade systems externally without the need to… more

In this article we will look into different ways to use an event to set up a trading opportunity. We will review the differences between BarsSince, Happenedwithin, and Set/Reset.

… more