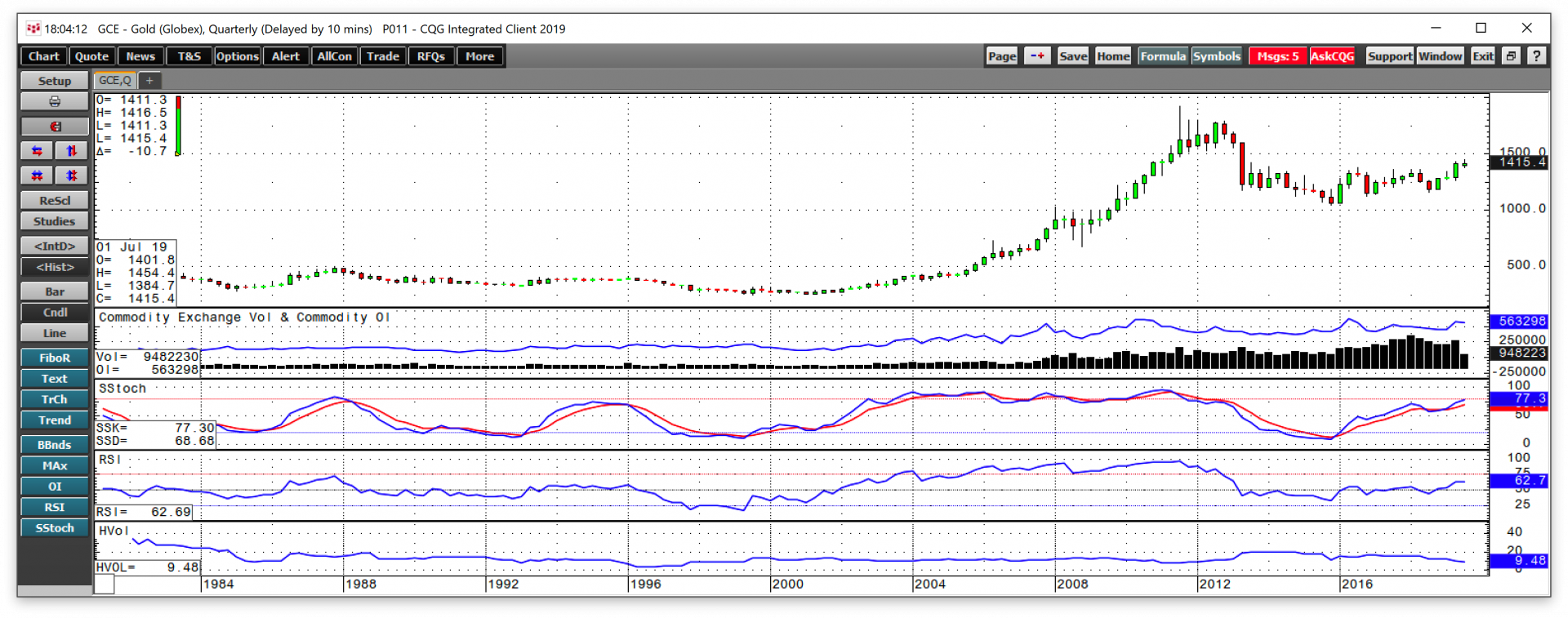

With fear and uncertainty mounting over the prospects of a global recession, interest rates have been falling. Even though the dollar index is in a bull market trend, the price action in the gold… more

Blogs

Quotes

Added columns filters for SpreadSheet Trader

Trading

Pre-Trade Mid-Market Mark

Charting

Drawing tools now available in mobile layout

General

Ability to use password-protected RSS feeds… more

General UpdatesImproved iPad compatiblityAdd symbols dialog now displays futures contracts with monthsVarious bug fixesTradingPrice scale compression control on HOTPurchase and Sales view'Auto'… more

Profiles and Logins

Multiple trade-routing logins can now be added to a profile.

Added ability to send welcome mails with credentials for both trade-routing and system logins

Added ability to clone… more

Quotes

Added columns to display yield values for fixed income symbols

Trading

Added ability to hide market order buttons

When HOT is in focus, typing in a number changes the order size… more

Gold has a long history as a currency. The yellow metal has been a store of value for thousands of years. Gold is both a financial and an industrial commodity. Central banks around the world hold… more

The dollar index moved lower by 1.22% in the second quarter of 2019, but the commodities asset class posted a loss in Q2. Two of the six major sectors posted gains while four moved to the downside… more

Quotes

Added the ability to filter by any column in QSS

Added exchange as a column in QSS and SpreadSheet Trader

Added ISIN number to CSPEC

Trading

Child orders in a bracket can now have… more

General UpdatesFull screen chart when phone is horizontal

TradingImproved workflow when tapping on a position in the Positions tab to get to details viewAdded a setting to display OTE and P/L… more

TradingImproved workflow when tapping on a position in the Positions tab to get to details viewAdded a setting to display OTE and P/L… more

General

Improved layout of the Home Page

Action buttons now turn color when content is changed

Improved search performance

Improved layout for smaller screen sizes

Market Limits

Added greater… more