Blogs

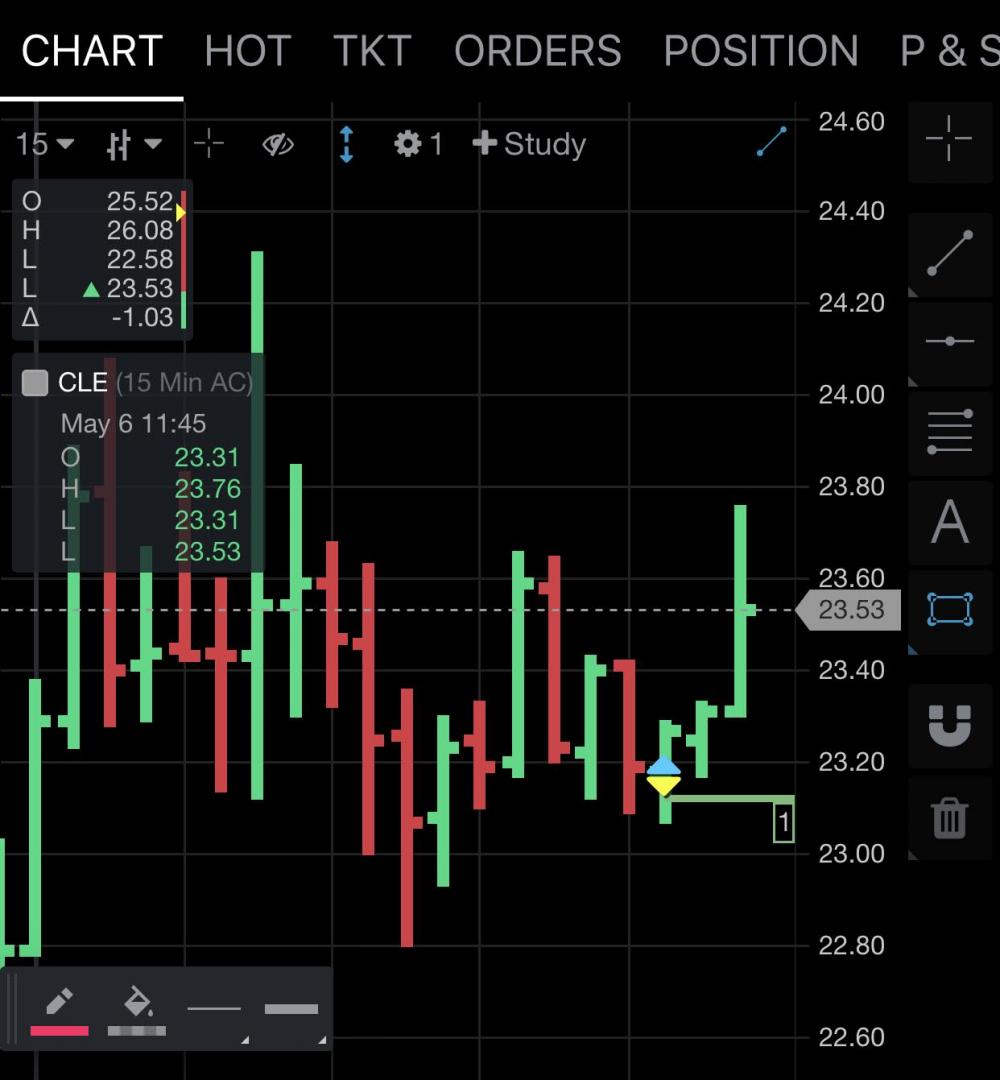

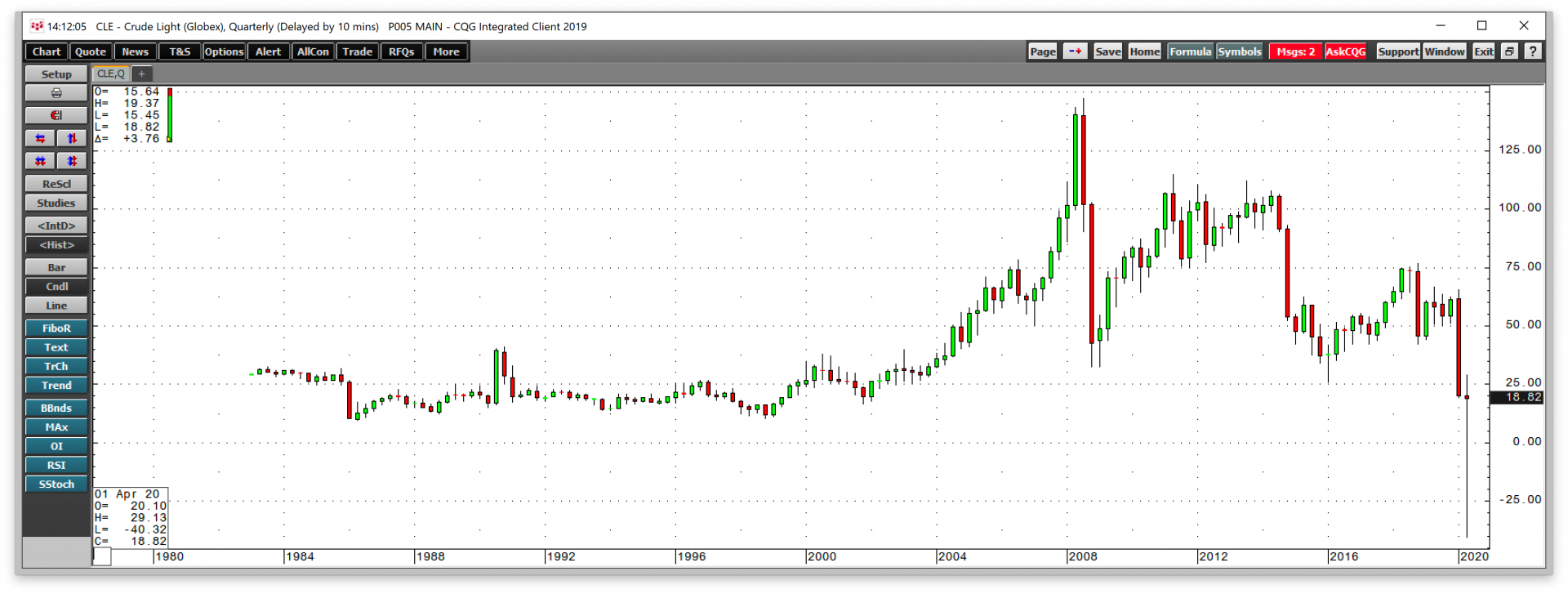

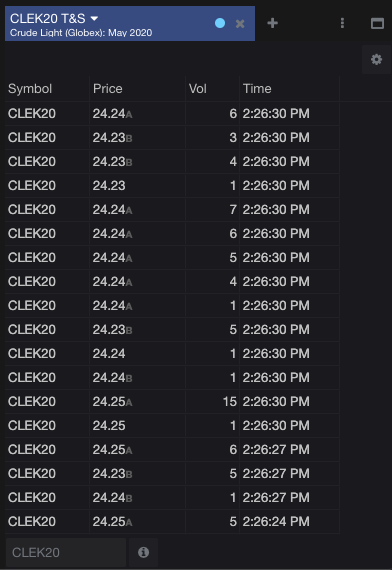

April 2020 will go down in history as the month that the price of crude oil fell to a low that most market participants did not believe possible. West Texas Intermediate crude oil began trading on… more

Optimism ran high at the start of 2020. The United States and China were about to sign the “phase one” trade deal that de-escalated the trade war that hung over markets in 2018 and 2019. The… more

Everything was humming along in the equities and commodities markets in mid-February. The S&P 500 made its latest record high on February 20. On the same day, the price of crude oil traded to… more

In 2008, the global financial crisis caused by a housing meltdown in the US and sovereign debt issues in Europe caused a risk-off period that sent the prices of all assets appreciably lower. Crude… more

The Average True Range (ATR) study takes the moving average of the true range over the specified period.

Definitions:

True Range = True High - True Low True High = The greater of the… more