February 2019 was an excellent month for the prices of two high-profile metals that trade on the futures exchanges. Gold is a metal that has many roles. The yellow metal is a go-to favorite when… more

Blogs

Gold fell to a low at $1161.70 in mid-August, but silver waited until mid-November to find its bottom at $13.86 per ounce. Since the lows, the precious metals have been making higher lows and… more

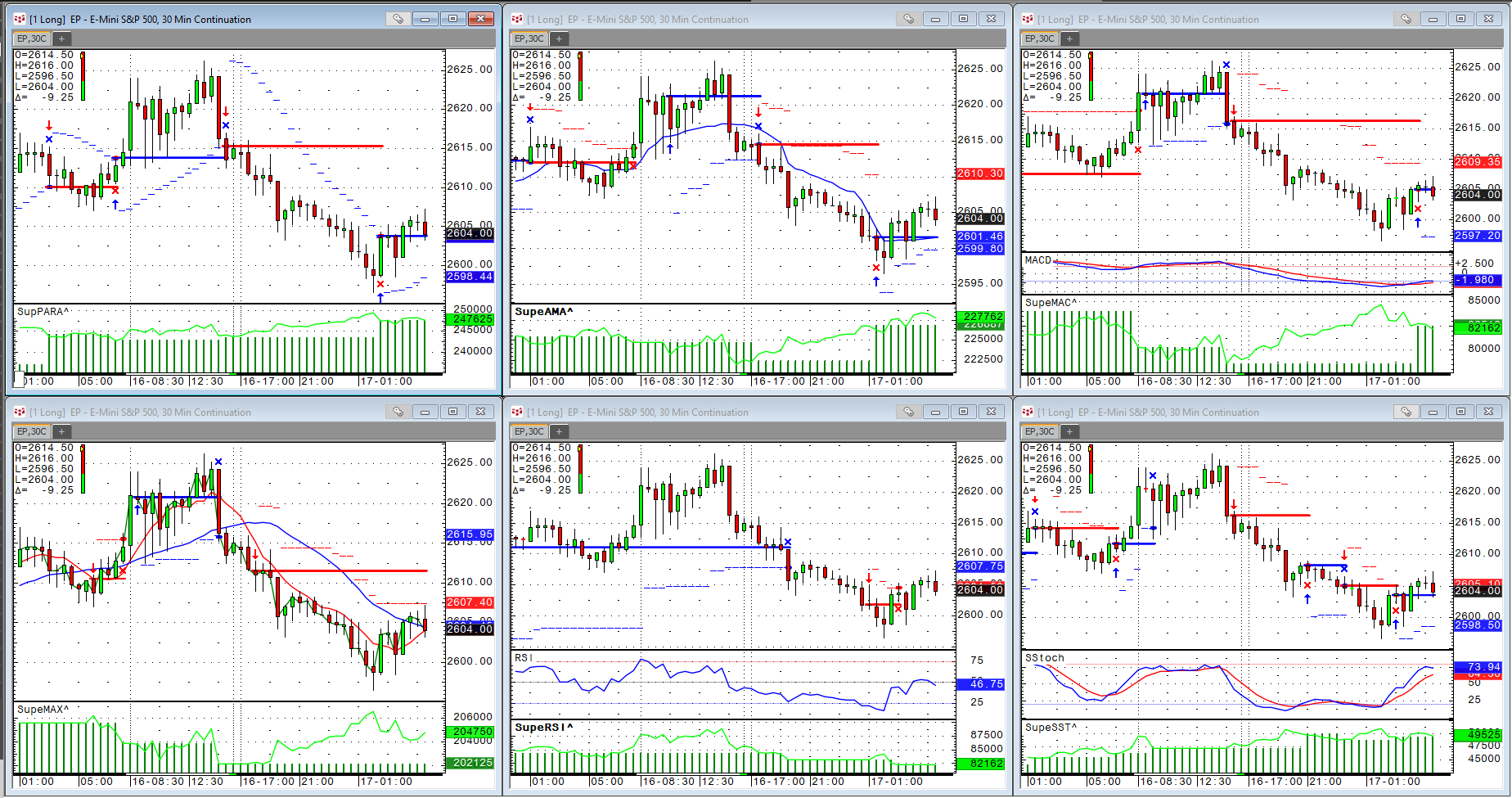

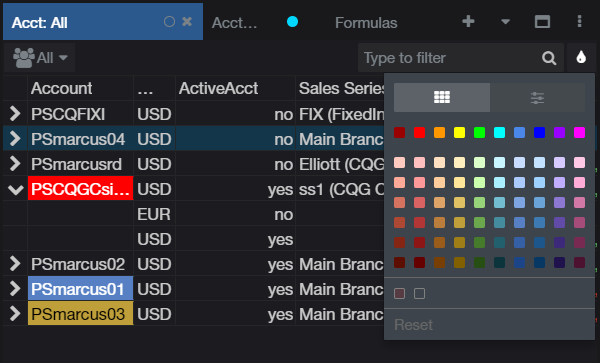

Related: Using the Super Template

The idea is to have a few standard trading systems that have many customizable exits already built in:

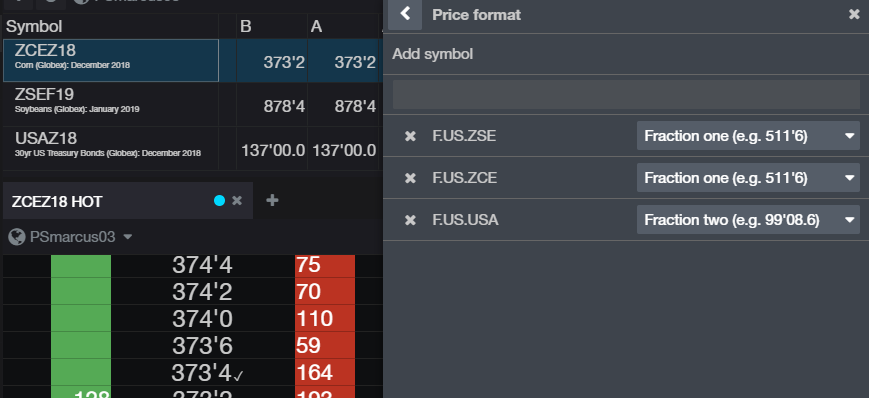

EOD - End Of Day will exit any position… moreThis is a collection of frequently requested studies, which are not part of CQG’S standard offering. These studies are open source and detailed descriptions can be easily found on the internet.… more

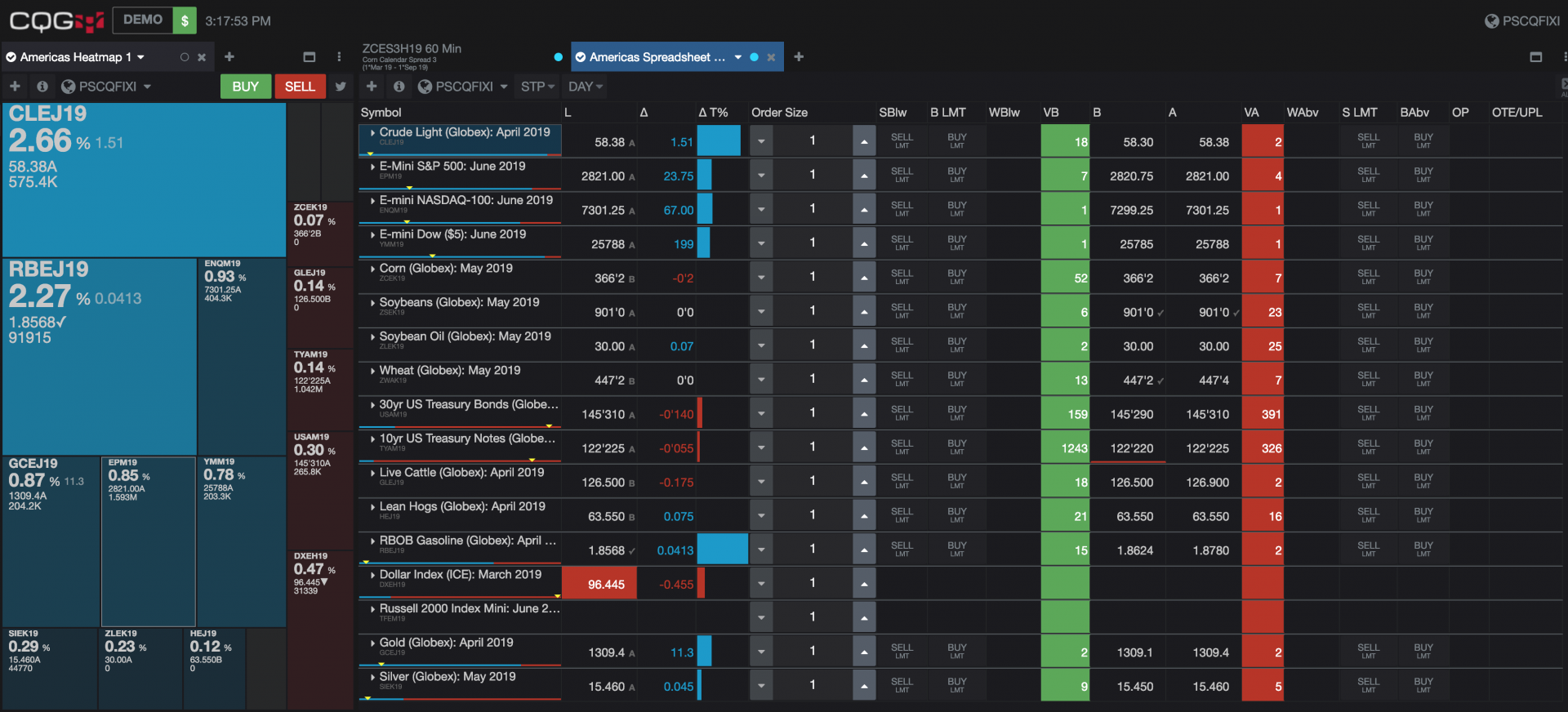

The dollar index moved higher by 1.05% in the fourth quarter of 2018, and the commodities asset class posted a loss over the final three months of the year that ended on December 31. Two of the… more

In early October it looked like the price of crude oil was heading for triple-digit territory on the back of sanctions on Iran that were coming in early October. At the same time, the price of… more

There are many lessons that we can learn from the price action in commodities markets. Commodities tend to rise to prices where output increases, inventories build, and demand declines. At lofty… more