In 2008, the global financial crisis caused by a housing meltdown in the US and sovereign debt issues in Europe caused a risk-off period that sent the prices of all assets appreciably lower. Crude… more

Andy Hecht

A weaker dollar and de-escalation in the trade war between the US and China lifted commodity prices in the final quarter of 2019. In Q4, a composite of 27 commodities prices that trade on the… more

The coffee futures market can be one of the most volatile markets in the world. The world’s leading producer and exporter of Arabica beans is Brazil. The weather conditions in the South American… more

So far, in 2019, the price of nearby NYMEX crude oil futures has traded in a range from $44.35 to $66.60 per barrel. However, the low came at the very start of the year, and since the week of… more

A strong dollar, escalating trade war between the US and China, and many other factors caused increased volatility in the commodities asset class over the third quarter of 2019. However, the… more

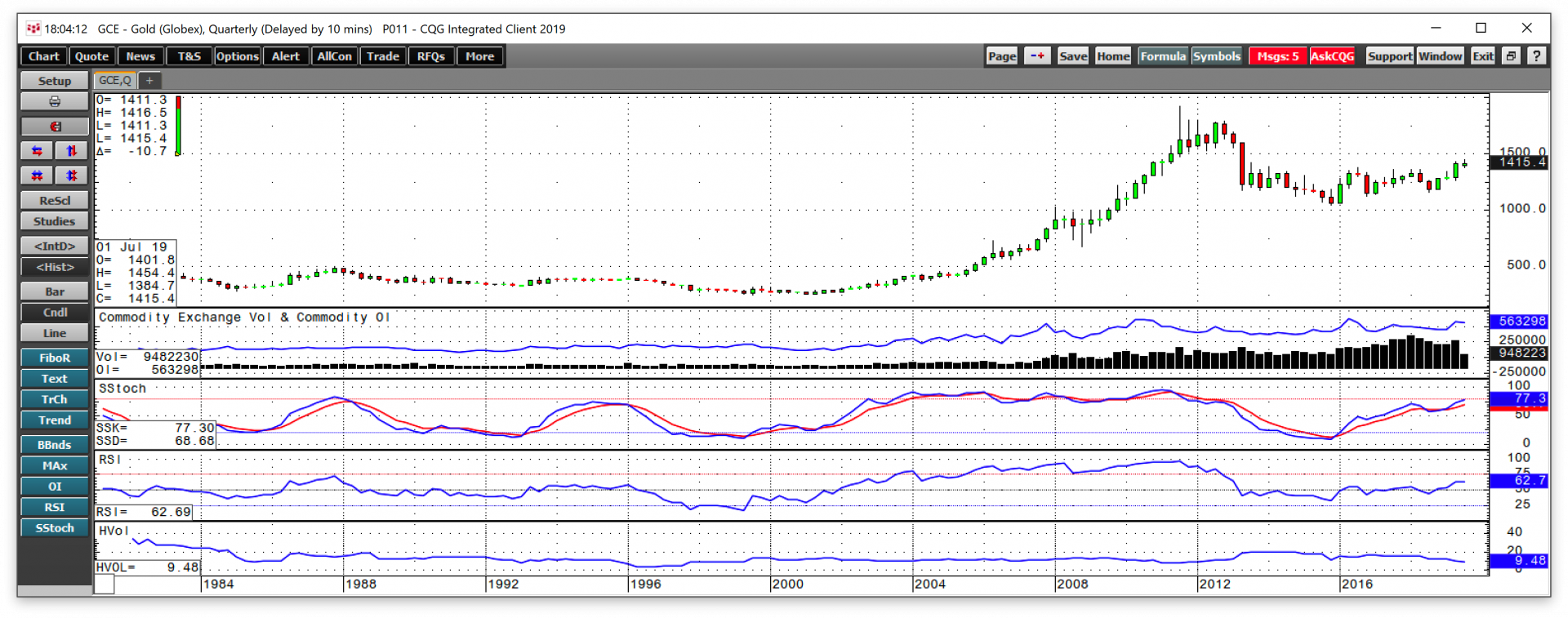

With fear and uncertainty mounting over the prospects of a global recession, interest rates have been falling. Even though the dollar index is in a bull market trend, the price action in the gold… more

Gold has a long history as a currency. The yellow metal has been a store of value for thousands of years. Gold is both a financial and an industrial commodity. Central banks around the world hold… more

The dollar index moved lower by 1.22% in the second quarter of 2019, but the commodities asset class posted a loss in Q2. Two of the six major sectors posted gains while four moved to the downside… more

Commodities are global assets. Raw material production is a local affair as minerals, ores, metals, and energy output comes from parts of the world where the earth's crust is rich in… more

Crude oil is the energy commodity that powers the world. Over the past six months, the international oil market provided a rollercoaster of volatility for market participants. A ride to the… more