Sentiment in the leading grain and oilseed markets remains bearishSigns of bullish life in CBOT soybeans, corn, and wheatThe weather is critical, as each year is a new adventure in the agricultural… more

Andy Hecht

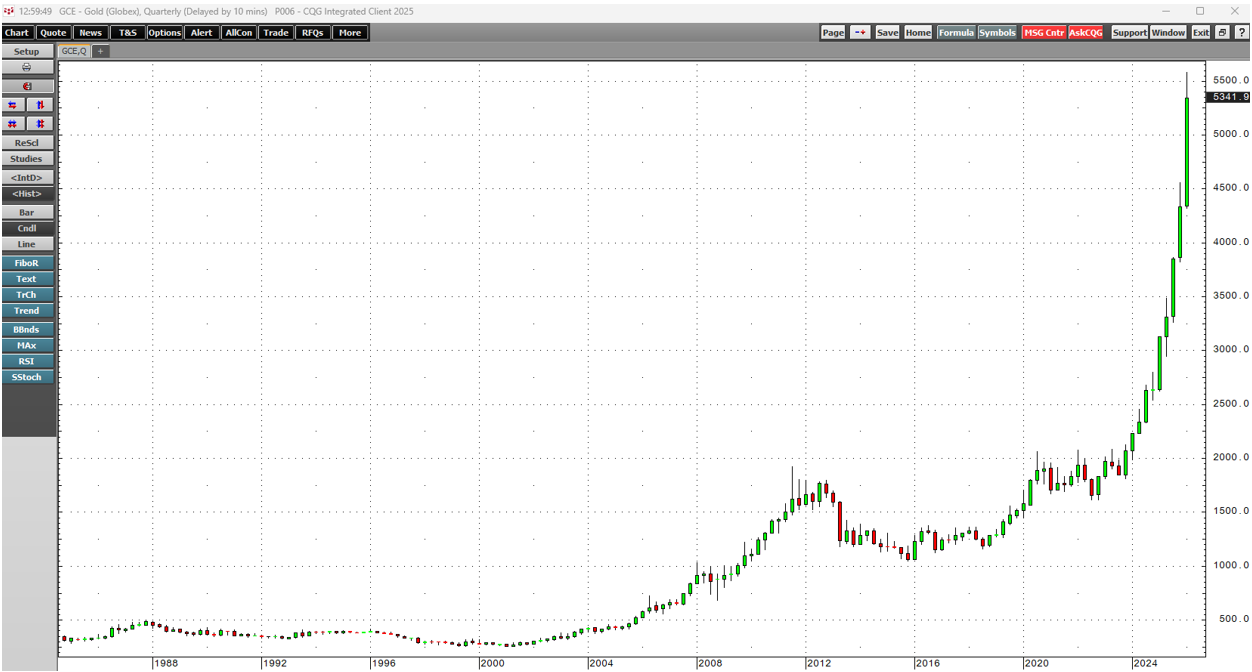

Newton's First and Third Laws of MotionGold's rally continues- 10 Consecutive Quarterly HighsSilver's price explodesPlatinum and Palladium followRisk rises to an unacceptable level

Gold, silver,… more

Gold soars to new highsSilver goes parabolicPlatinum and palladium take off on the upsideA commentary on fiat currency valuesThe prospects for 2026- Cyclicality versus fundamental trends

Precious… more

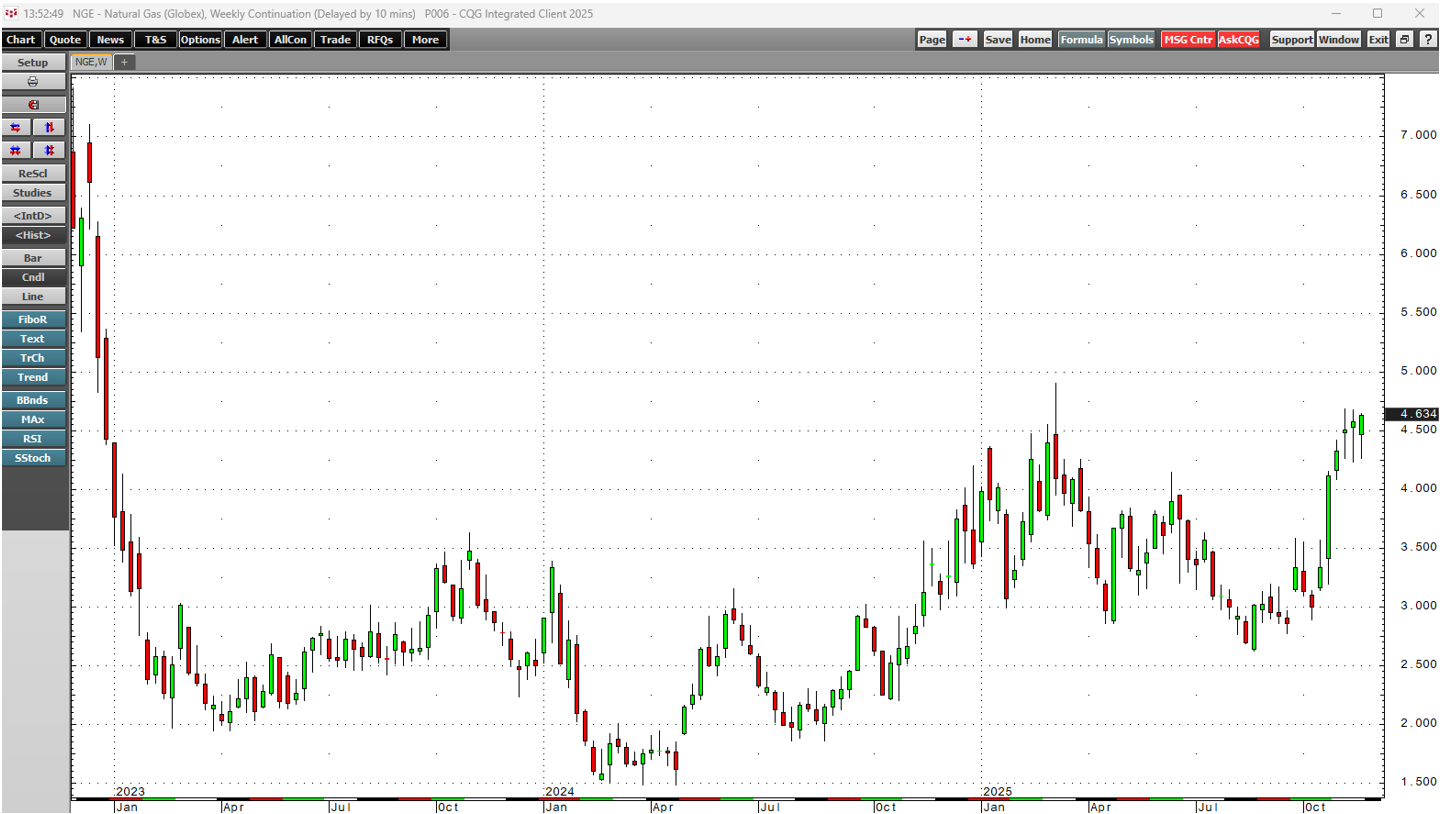

A bullish trend in natural gas at the beginning of the peak demand seasonThe withdrawal season began in mid-NovemberGeopolitics and LNG could support pricesThe winter temperatures are critical for… more

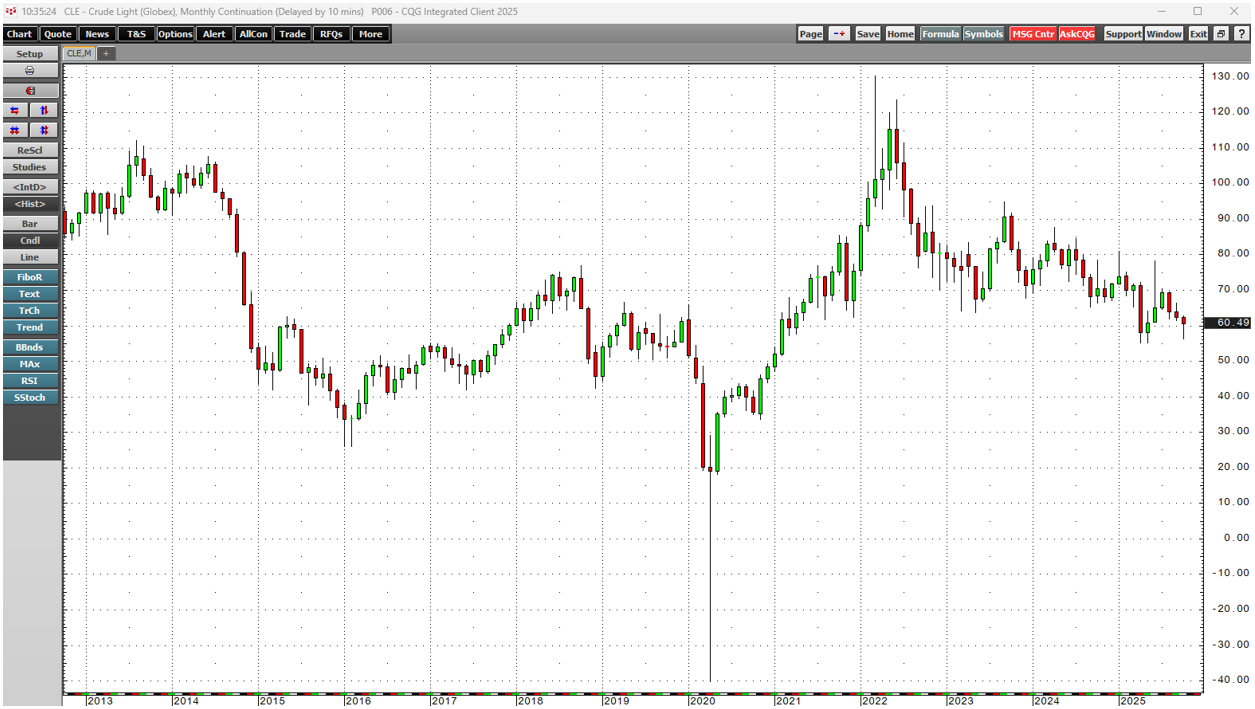

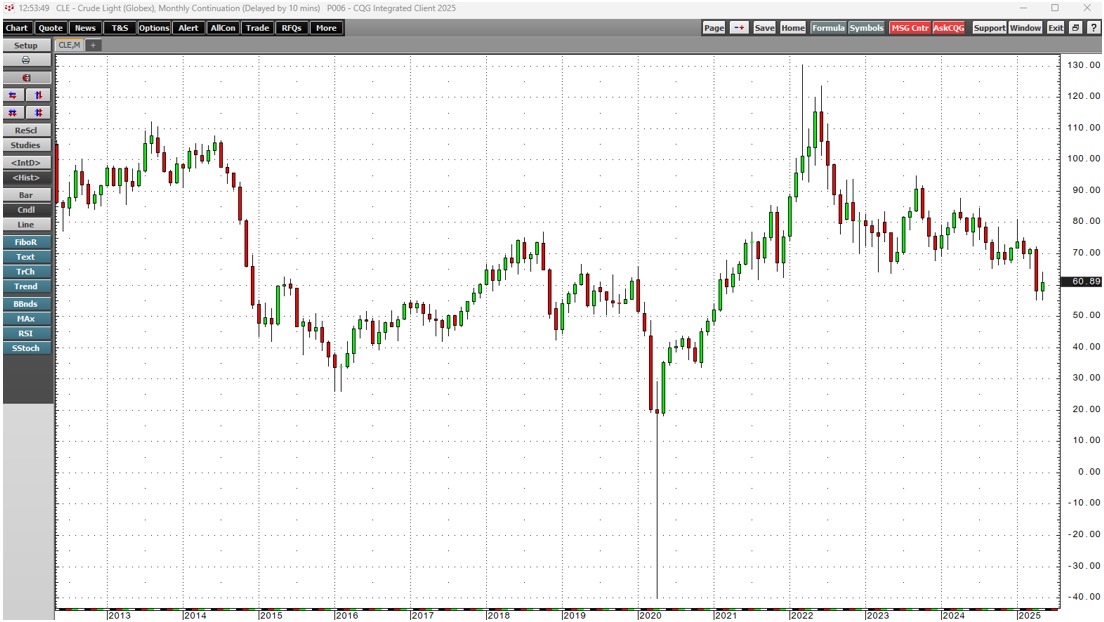

The bearish trend since the 2022 peak continuesSeasonality favors lower oil pricesU.S. energy policy is bearish- OPEC+ production weighs on pricesGeopolitics remains bullishA break of critical… more

A bullish trend since the 2020 lowSilver rises to the highest price in fourteen years- The 2011 and 1980 highs are the upside targetsFundamentals support higher silver pricesGold supports rising… more

NYMEX platinum futures reached their all-time high in 2008 at $2,308.80 per ounce. Meanwhile, the NYMEX palladium futures rose to a record high of $3,380.50 in 2022.

For nearly a decade, the… more

New highs in COMEX copper futures in July 2025 before price carnage on July 30Tariffs had been bullish for the U.S. futuresDivergence with the LME three-month Copper ForwardsFundamentals remain… more

A bullish trend since the 2020 low- Silver breaks above a critical technical resistance level with a powerful Q2 signalA bullish key reversal on the quarterly platinum chart in Q2 2025A bullish key… more

Crude oil prices have been falling since 2022, when they reached the highest price since 2008 at $130.50 on the nearby NYMEX WTI futures contract. Meanwhile, the energy commodity's pivot point has… more