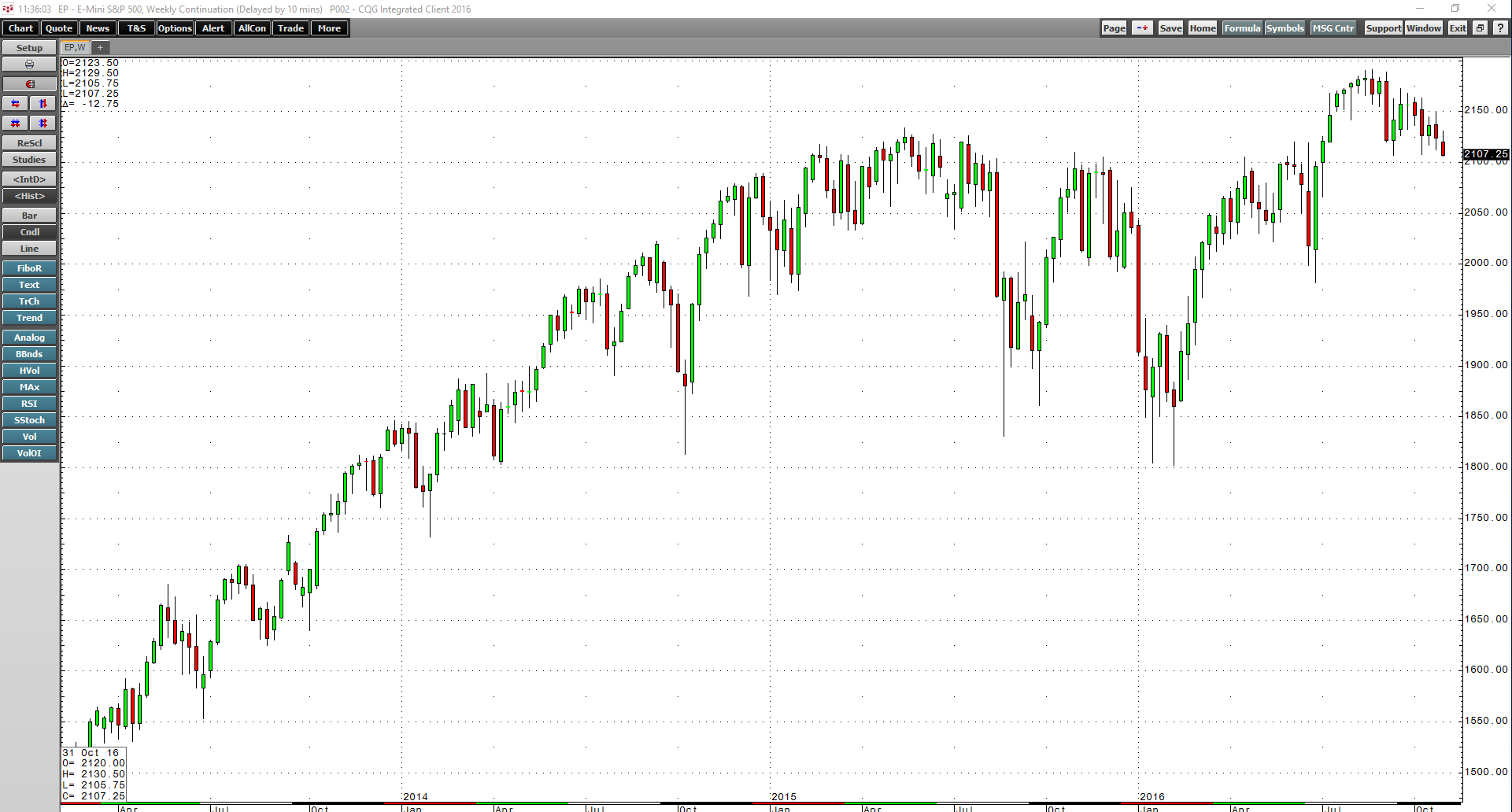

An election is always a time of uncertainty; however, when an incumbent’s term ends and the election for a new and unknown leader occurs, it often leads to an increase in volatility. The 2016… more

Andy Hecht

These upcoming events will impact commodities:

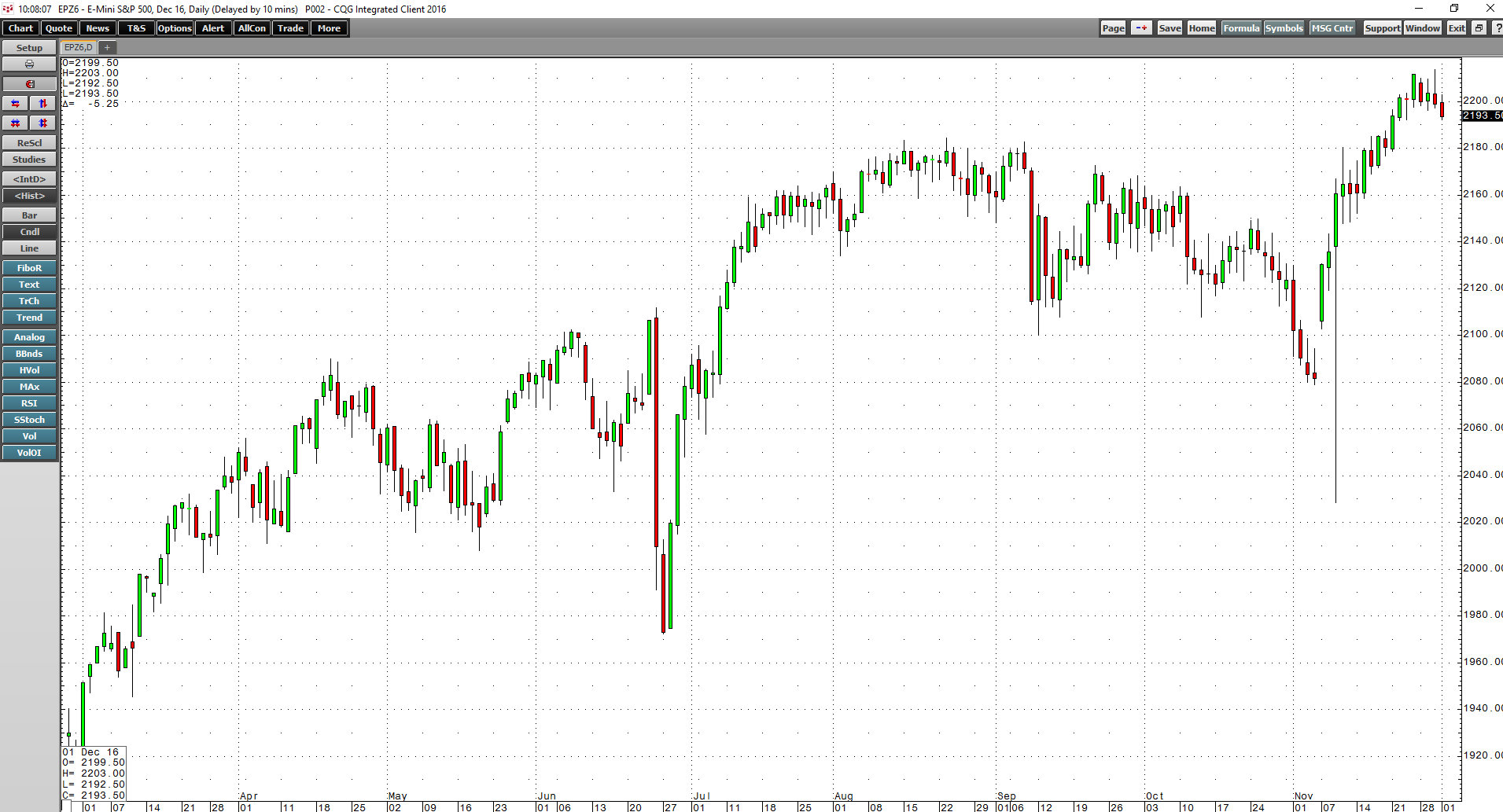

Election Day on November 8 OPEC meeting on November 30 Fed Funds rate decision in mid-DecemberIt has been a busy year, beginning… more

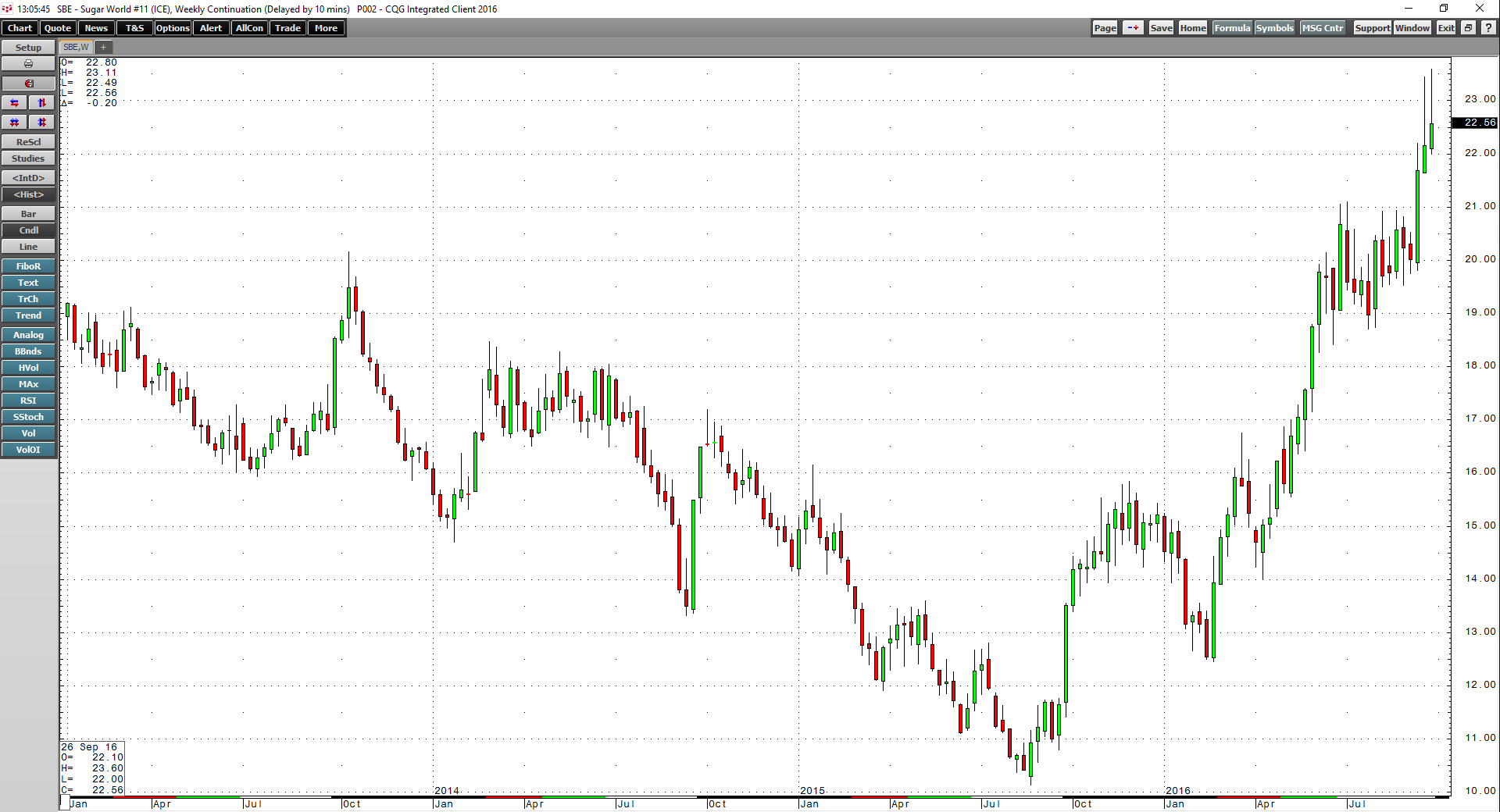

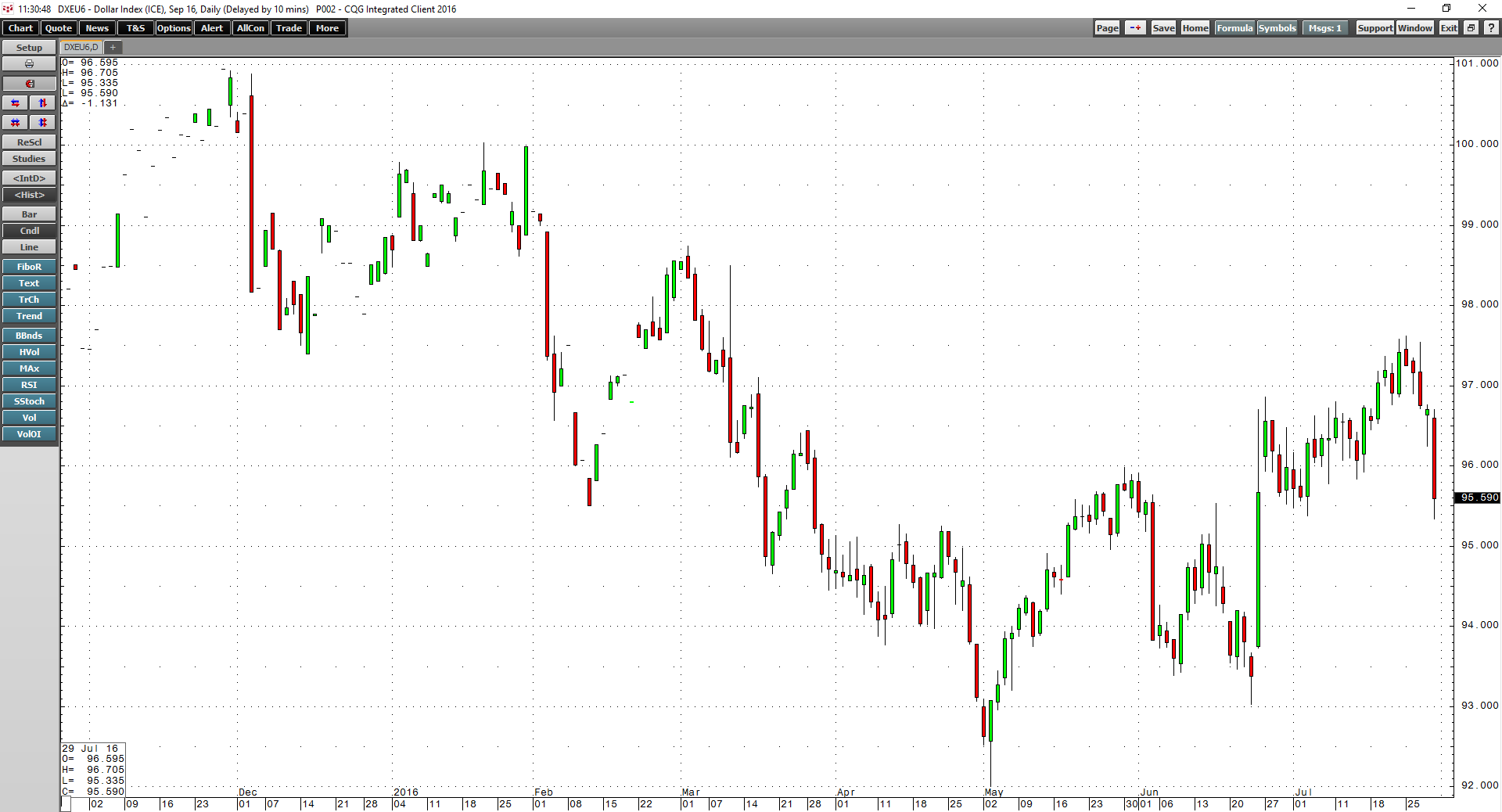

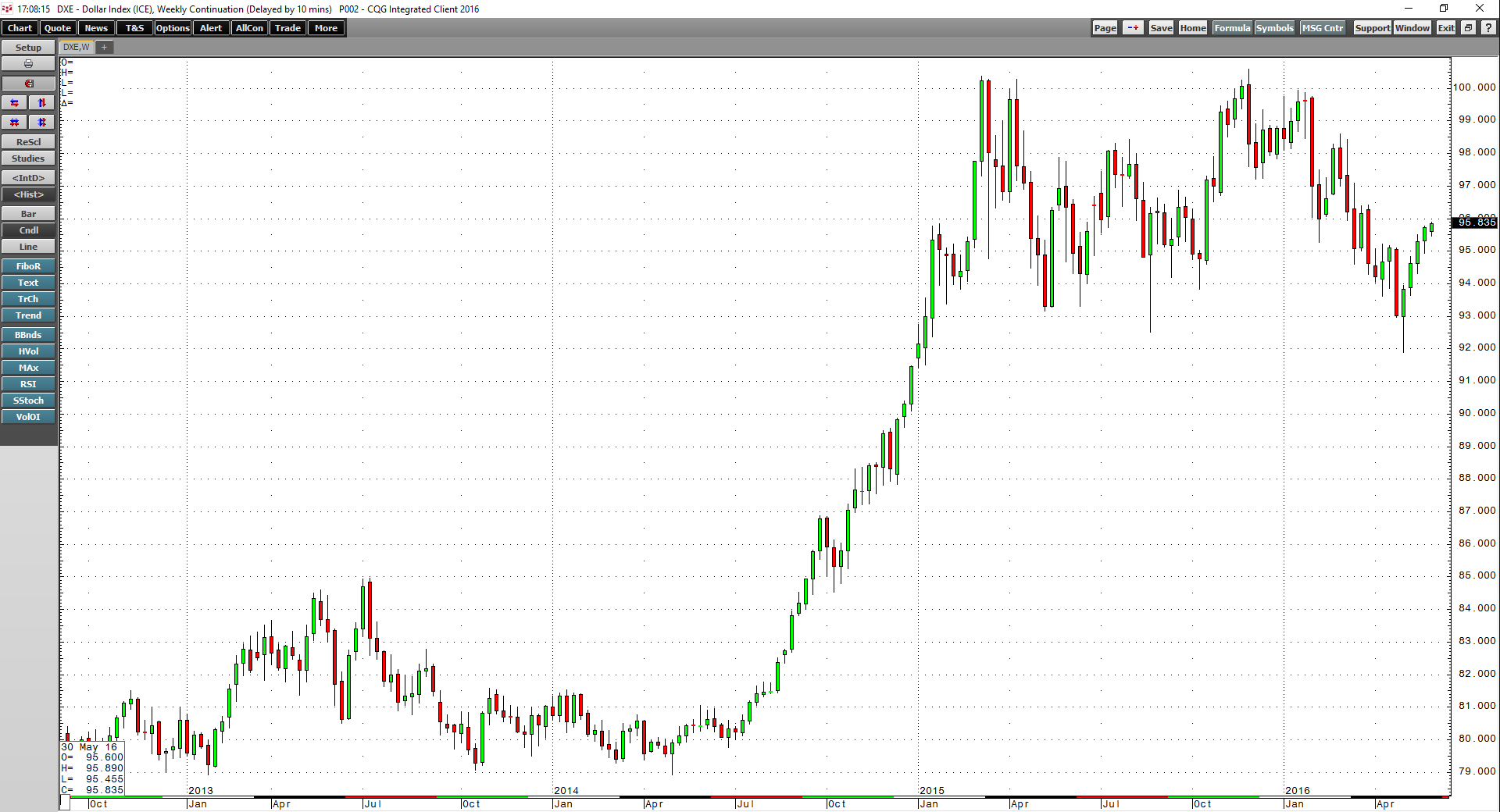

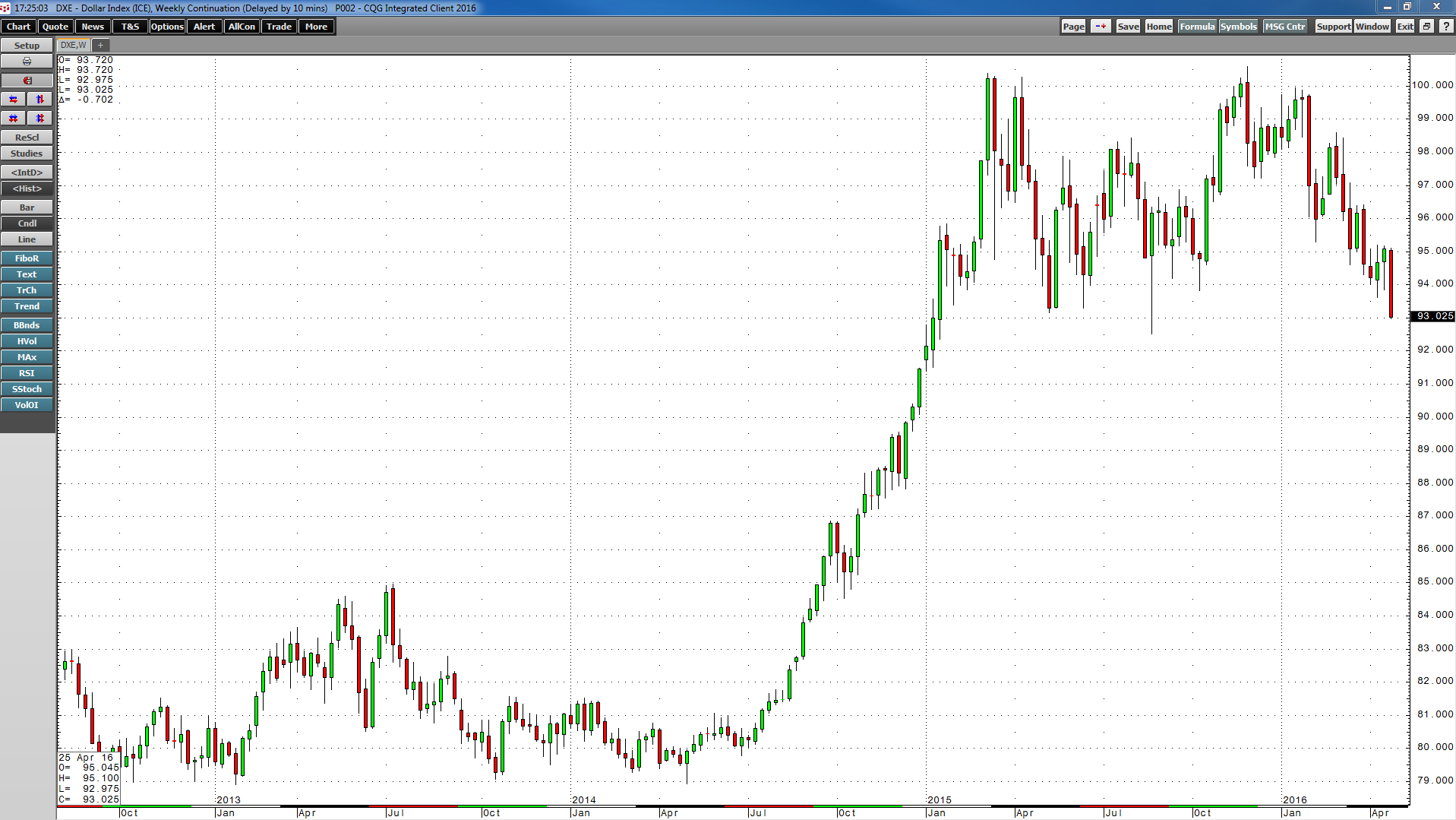

The dollar index posted a small loss of 0.85% in the third quarter of 2016, but that did not help the composite of commodities during the three-month period. The principal raw materials that trade… more

Natural gas was one of the dogs of 2016. The commodity's price reached a low of $1.6110 per MMBtu in March, the lowest price since 1998. There were many reasons for the price swoon.… more

Last week we heard from the US Federal Reserve and for the seventh straight month, the central bank left interest rates unchanged. In December 2015, the Fed hiked the short-term Fed Funds rate for… more

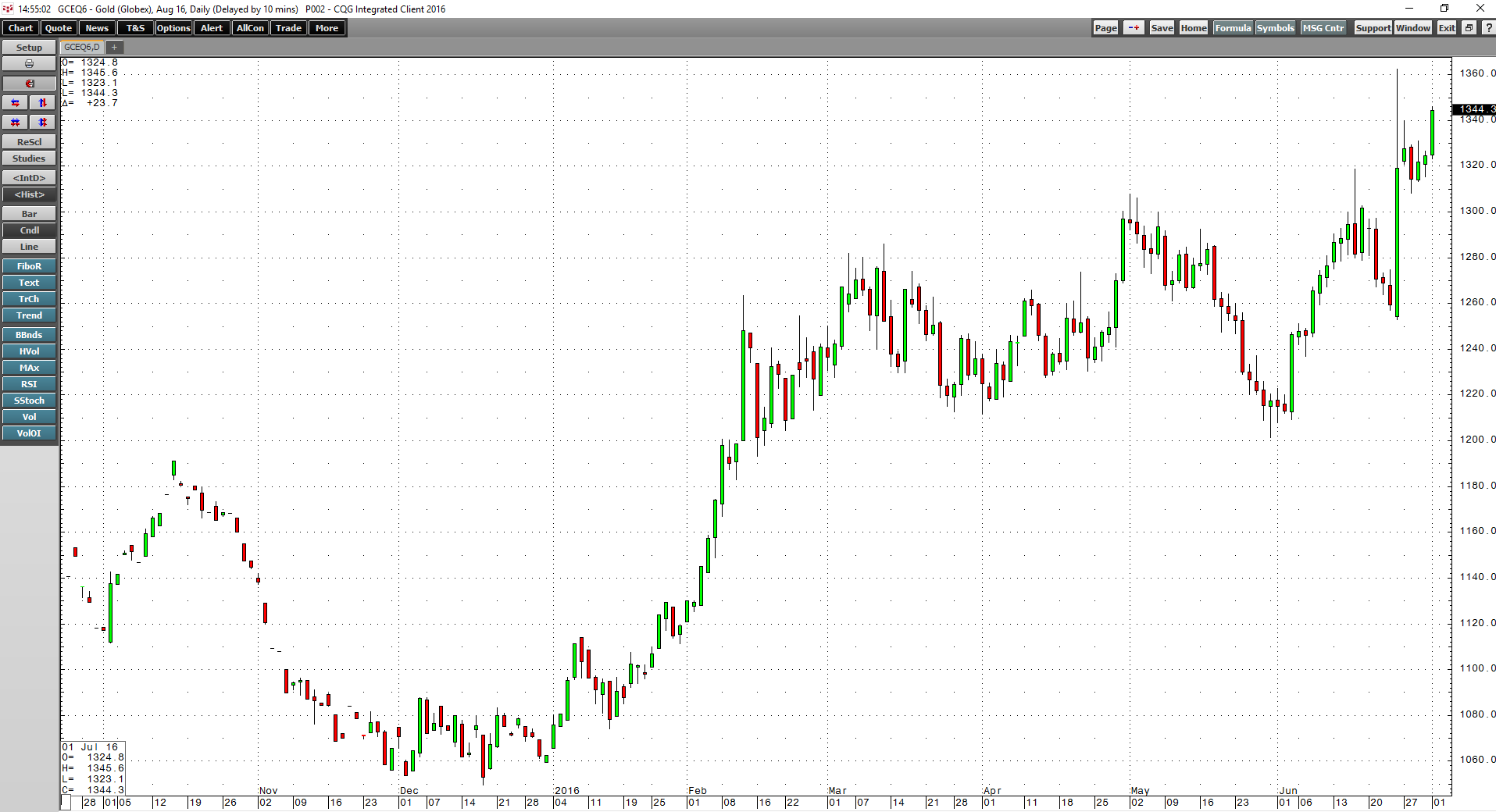

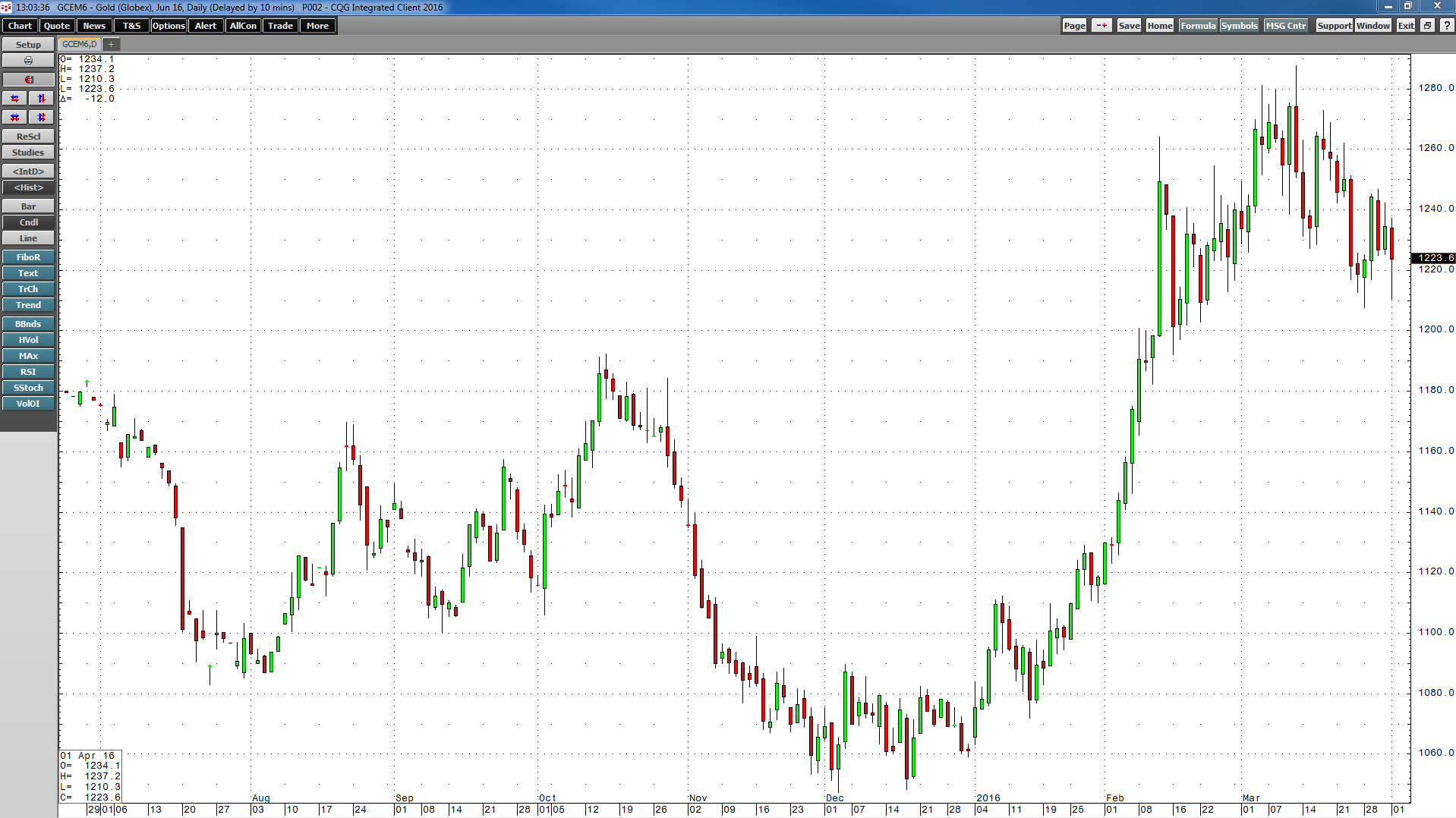

The second quarter of 2016 is now in the books. It was a quarter of fear of uncertainty, volatility, and gains for commodities. Overall, a composite of the 29 primary commodities that trade on… more

The US economy is the world’s largest. The US dollar has been the world’s most stable currency, and it is universally accepted as the reserve currency around the globe. The dollar is the benchmark… more

The 2012 drought sent grain prices to dizzying heights. Soybeans reached almost $18 while corn traded to highs of almost $8.50 and wheat moved above $9.45 per bushel. Since then, grain prices… more

First quarter of 2016 is now in the books. It was a quarter of fear, of uncertainty, of losses, and redemption. Overall, a composite of the twenty-nine major commodities traded on futures markets… more

As it is now the beginning of March, the spring season is fast approaching. Across the fertile farmlands of the United States, farmers are preparing to seed their acreage for the 2016 crop year.… more