COMEX gold futures reached a record high in 2011 at $1,911.60. After a four-year correction, the price reached a bottom at $1046.20 in late 2015. In August 2020, the price eclipsed the 2011 high,… more

Andy Hecht

The raw material markets moved lower in Q2 but were still higher than the level at the end of 2021. The commodity asset class consisting of 29 primary commodities that trade on US and UK exchanges… more

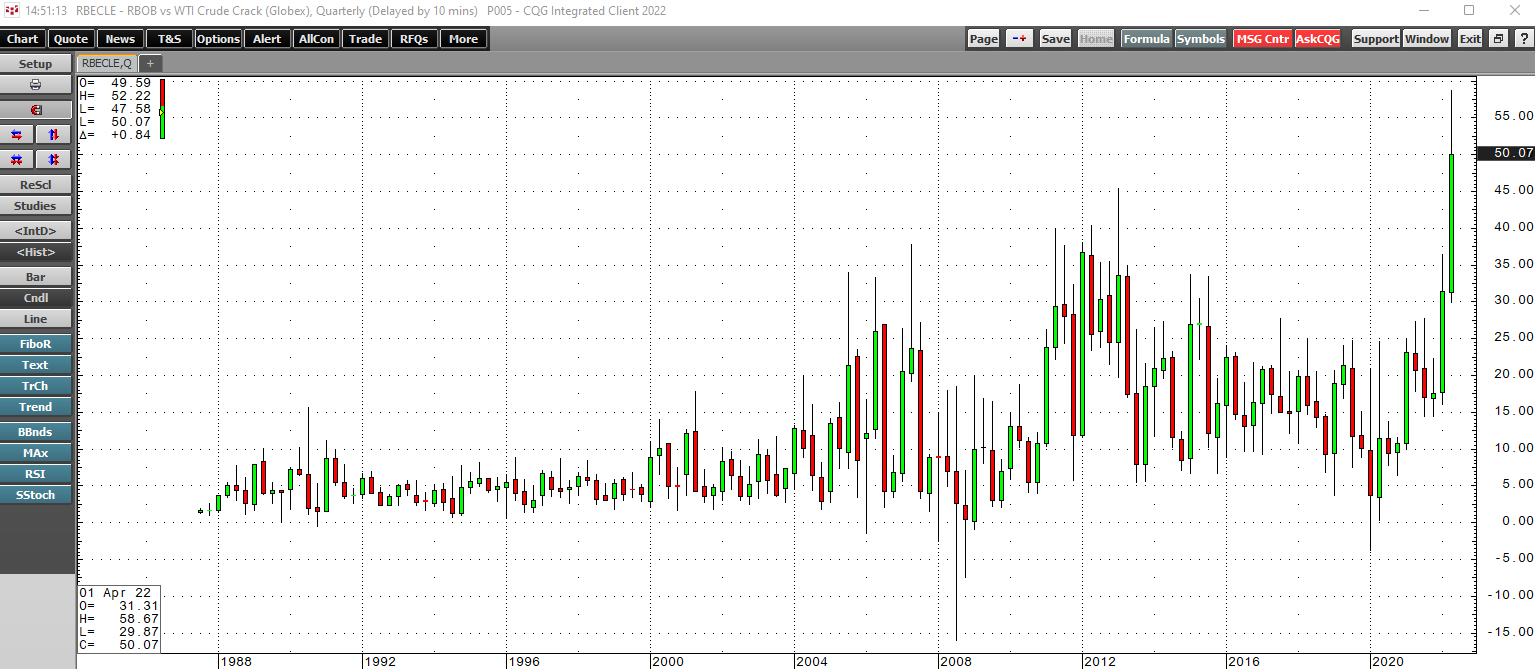

In early March, crude oil prices rose to their highest levels since 2008 when nearby NYMEX futures rose to $130.50, and Brent futures hit $139.13 per barrel. While crude oil reached a fourteen-… more

Natural gas futures began trading on the CME’s NYMEX division in 1990. Over the past thirty-two years, the price has traded from a low of $1.02 to a high of $15.65 per MMBtu. Wild price swings are… more

The raw material markets asset class moved higher in the first quarter of 2022 after posting gains throughout 2021. The commodity asset class consisting of 29 of the primary commodities that trade… more

The first major war in Europe since WW II broke out in February with Russia’s invasion of Ukraine. At the beginning of March, the Ukrainian military and citizens continued to hold off the Russian… more

At the most recent Fed meeting, the US central bank set the stage for ending quantitative easing in early March and liftoff from a zero percent short-term Fed Funds Rate at the March FOMC meeting… more

The raw material markets asset class moved higher in the fourth quarter of 2021 after posting gains throughout the year. The commodity asset class consisting of 29 of the primary commodities that… more

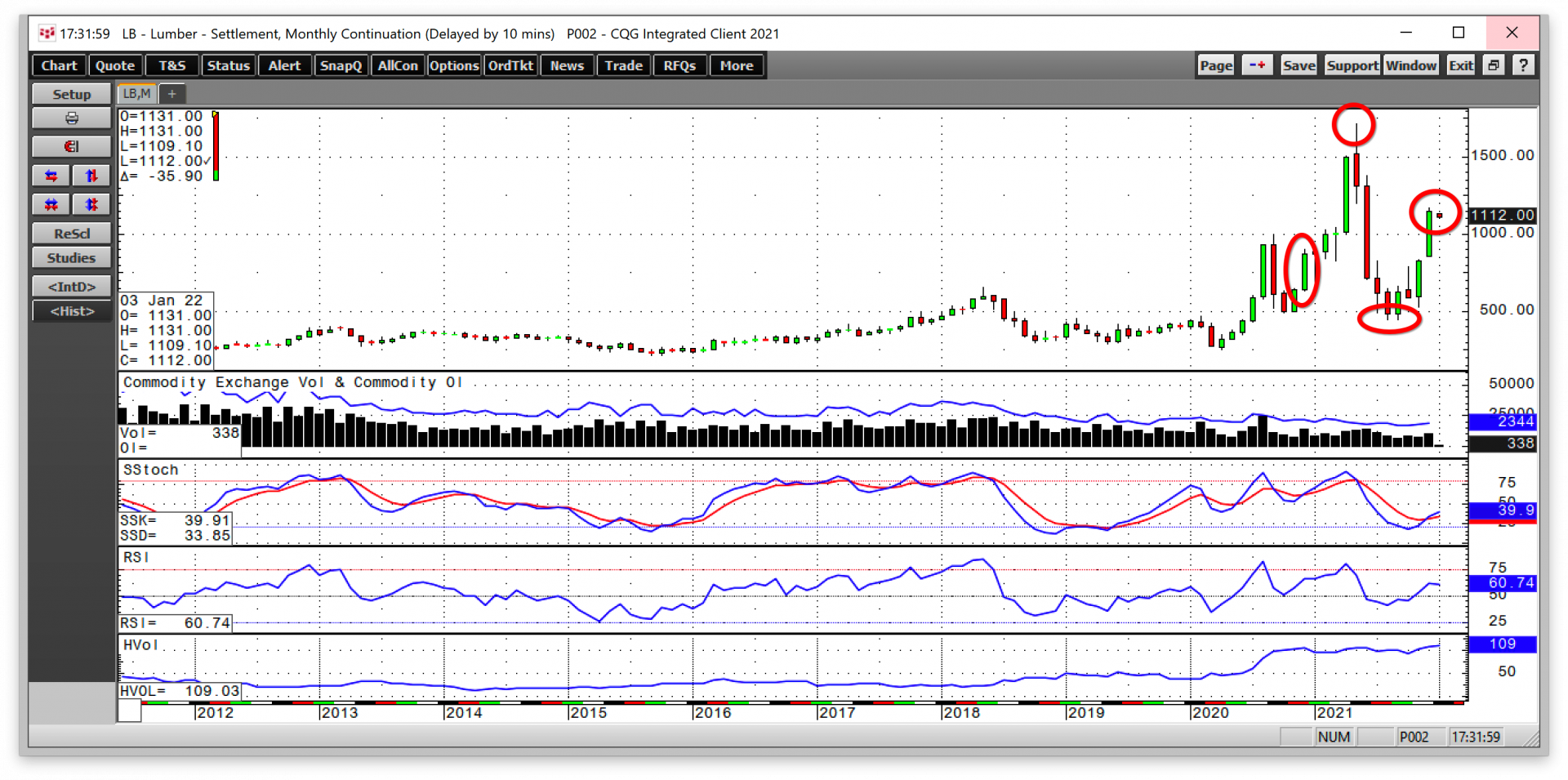

Commodities are highly volatile assets. Price often below rational, logical, and reasonable levels. In April 2020, nearby NYMEX crude oil prices fell to negative $40.32 per barrel. Anyone holding… more

Gold and silver are the oldest means of exchange, far outdating dollars, euros, pounds, and all current traditional fiat and cryptocurrencies. The Bible’s old testament makes many references to… more