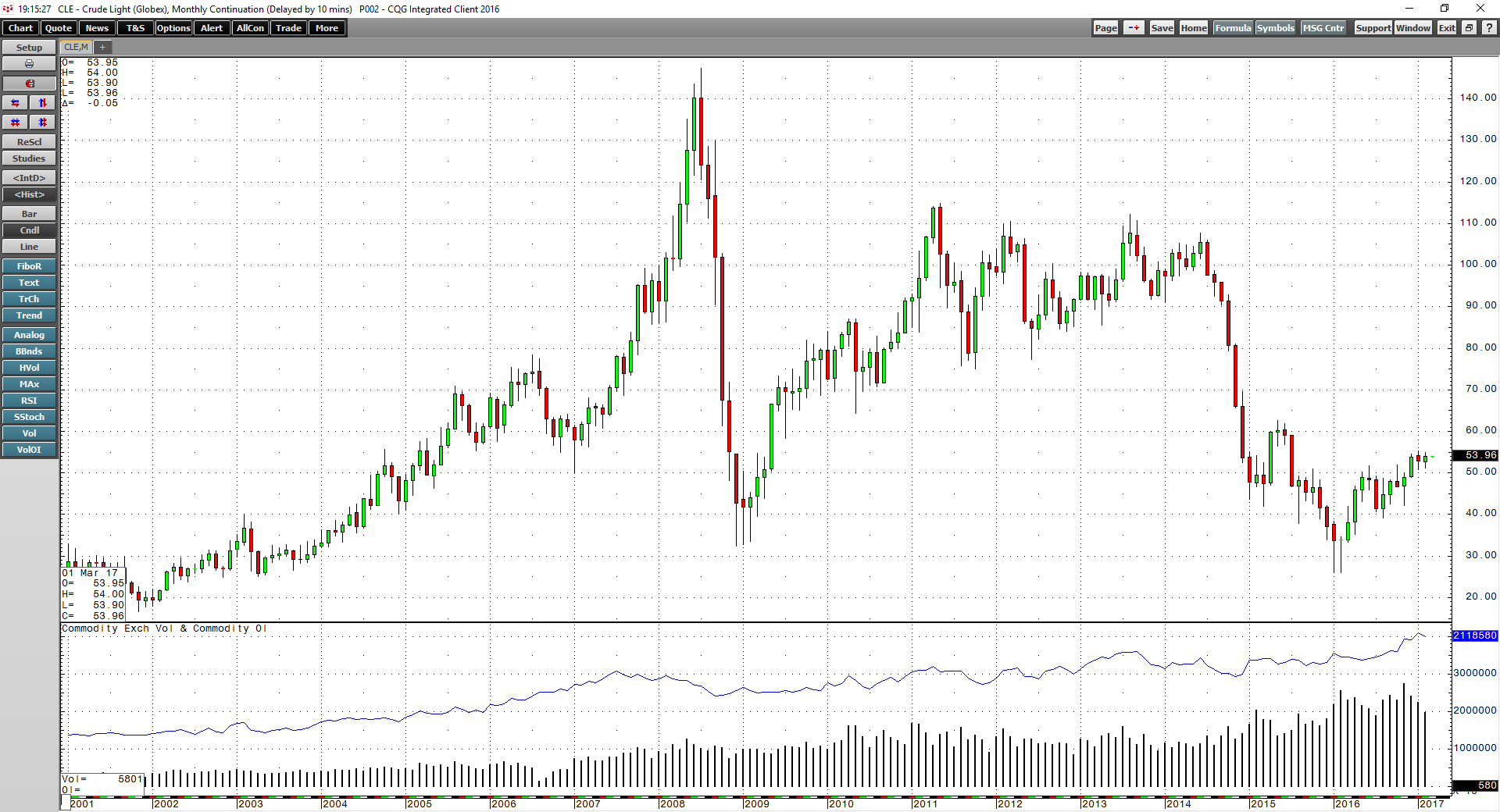

Crude oil is the energy commodity that continues to power the world. While many new and exciting energy products will likely take away some of oil’s market share in the years to come, the fact is… more

Andy Hecht

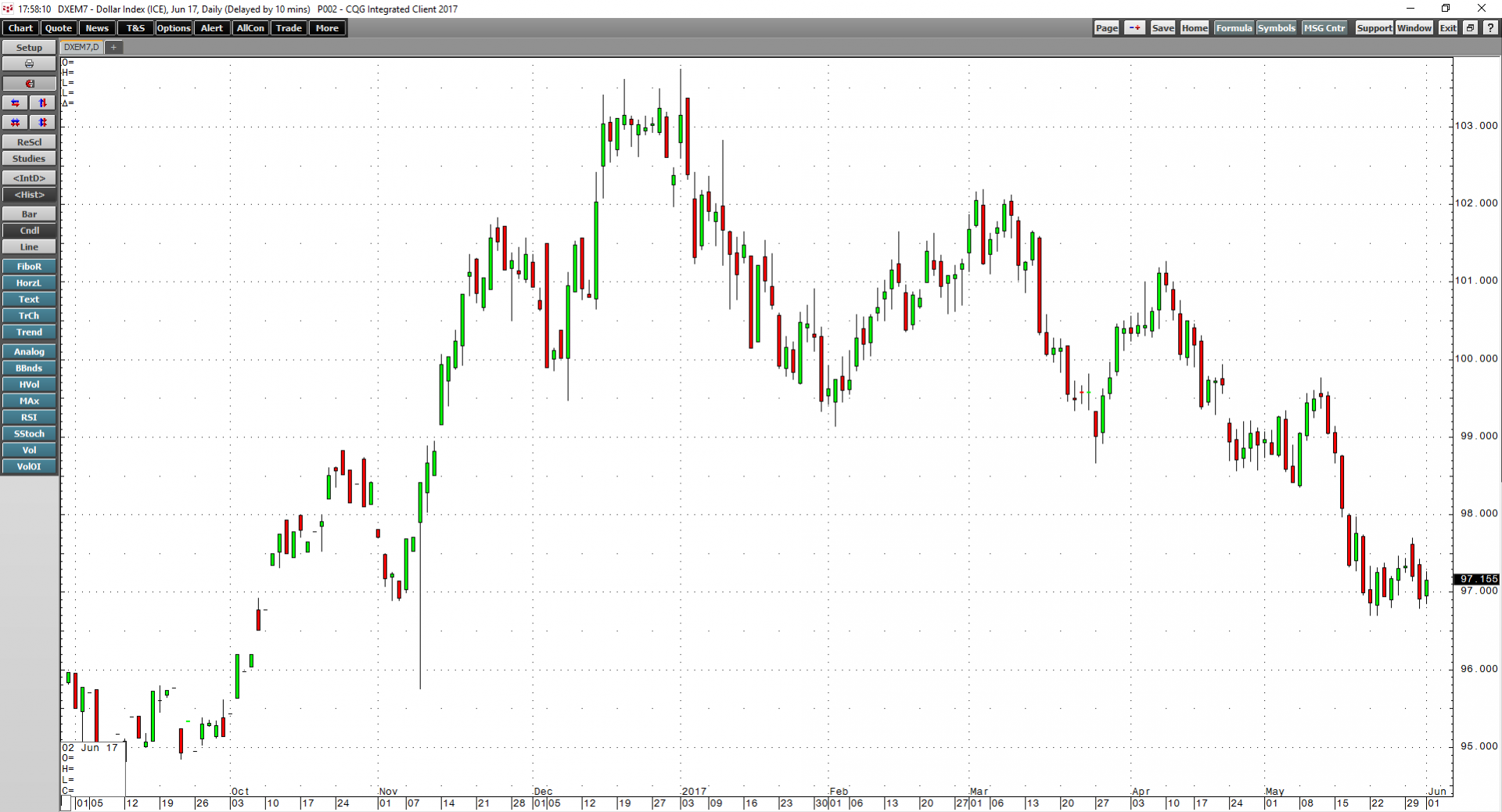

The dollar index moved lower by 2.66% in the third quarter of 2017, and commodities prices moved higher with four of the six major sectors posting gains. Out of the 29 commodities that I follow,… more

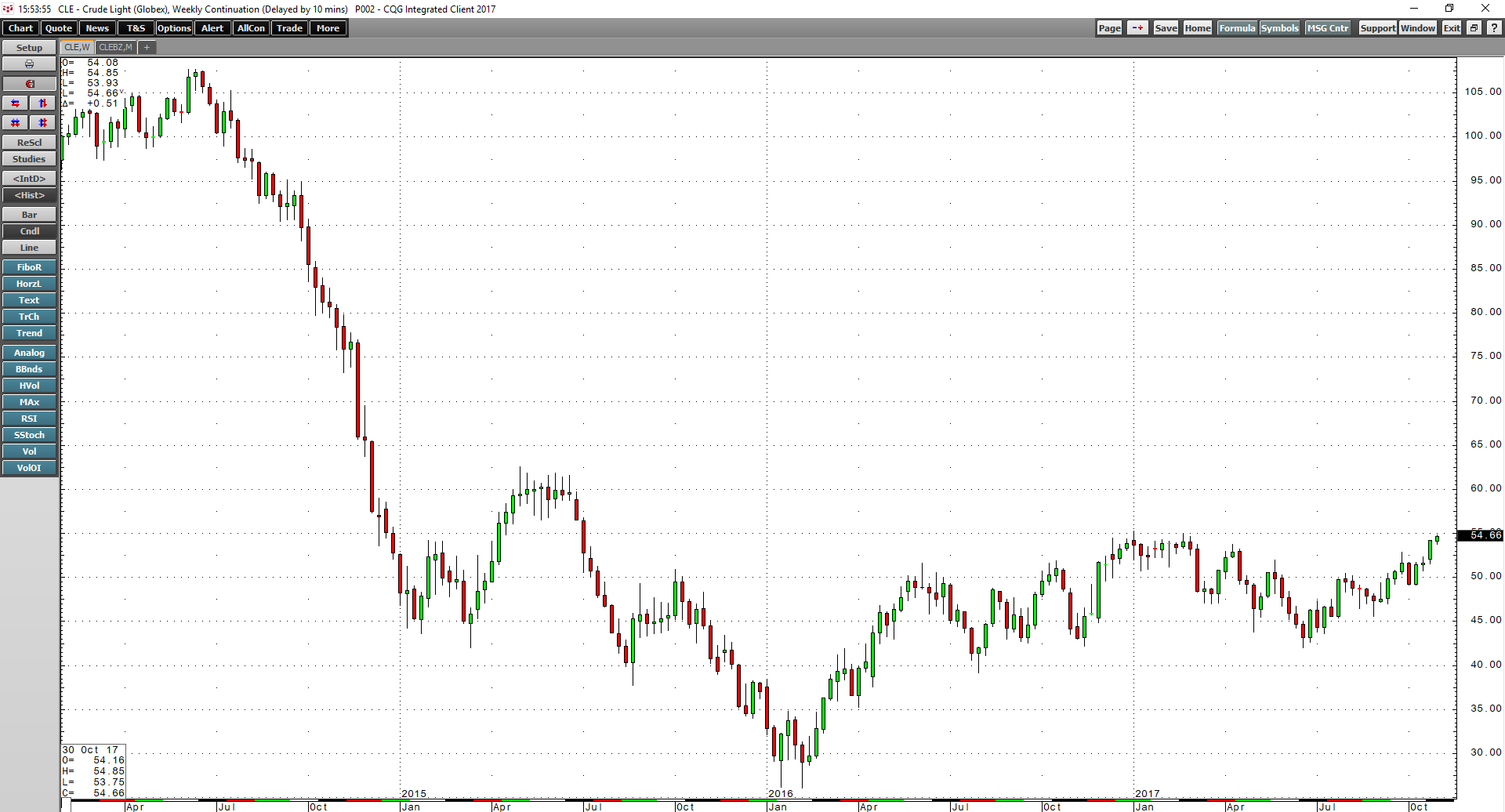

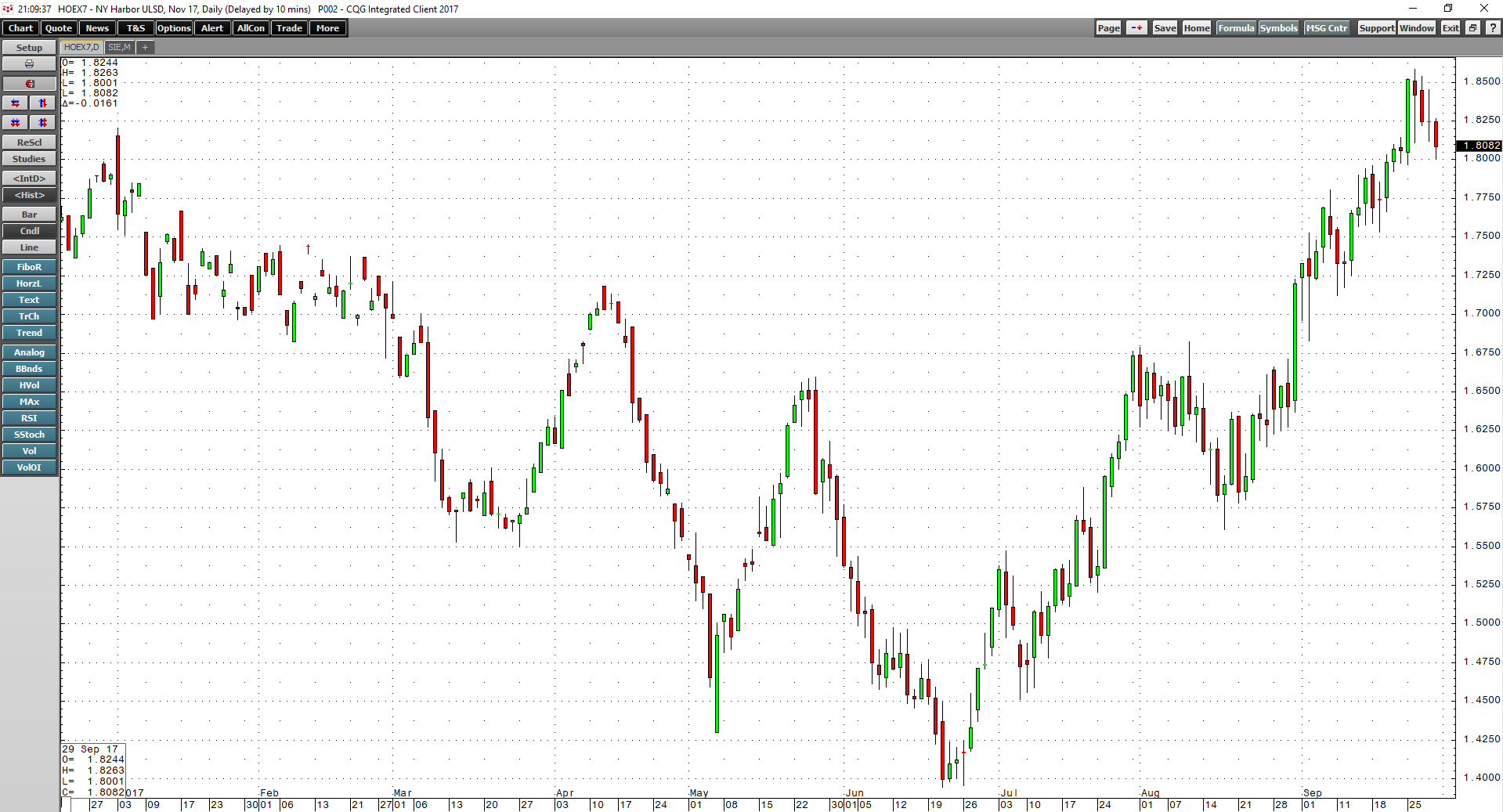

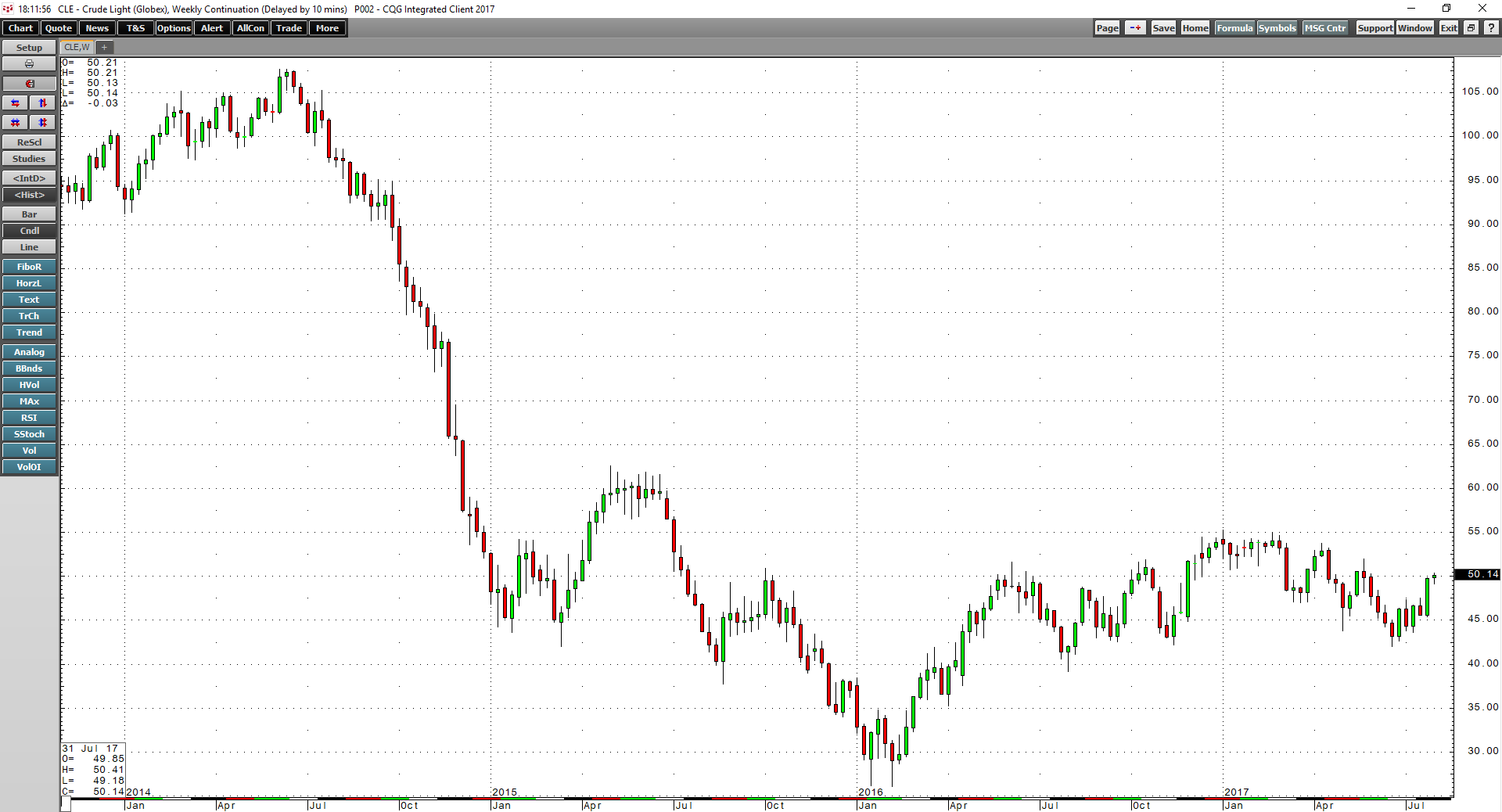

In the world of commodities futures, crude oil is the most closely watched and heavily traded market. We are all oil consumers in some form as we drive cars, heat our homes during the cold season… more

The dollar index moved lower by 4.79% in the second quarter of 2017. Out of the 29 commodities that I follow, 22 posted losses during the three-month period that ended last Friday, June 30.… more

The US dollar is the reserve currency of the world, and it is also the benchmark pricing mechanism for most raw material prices. Typically, a weak dollar results in strong commodities prices… more

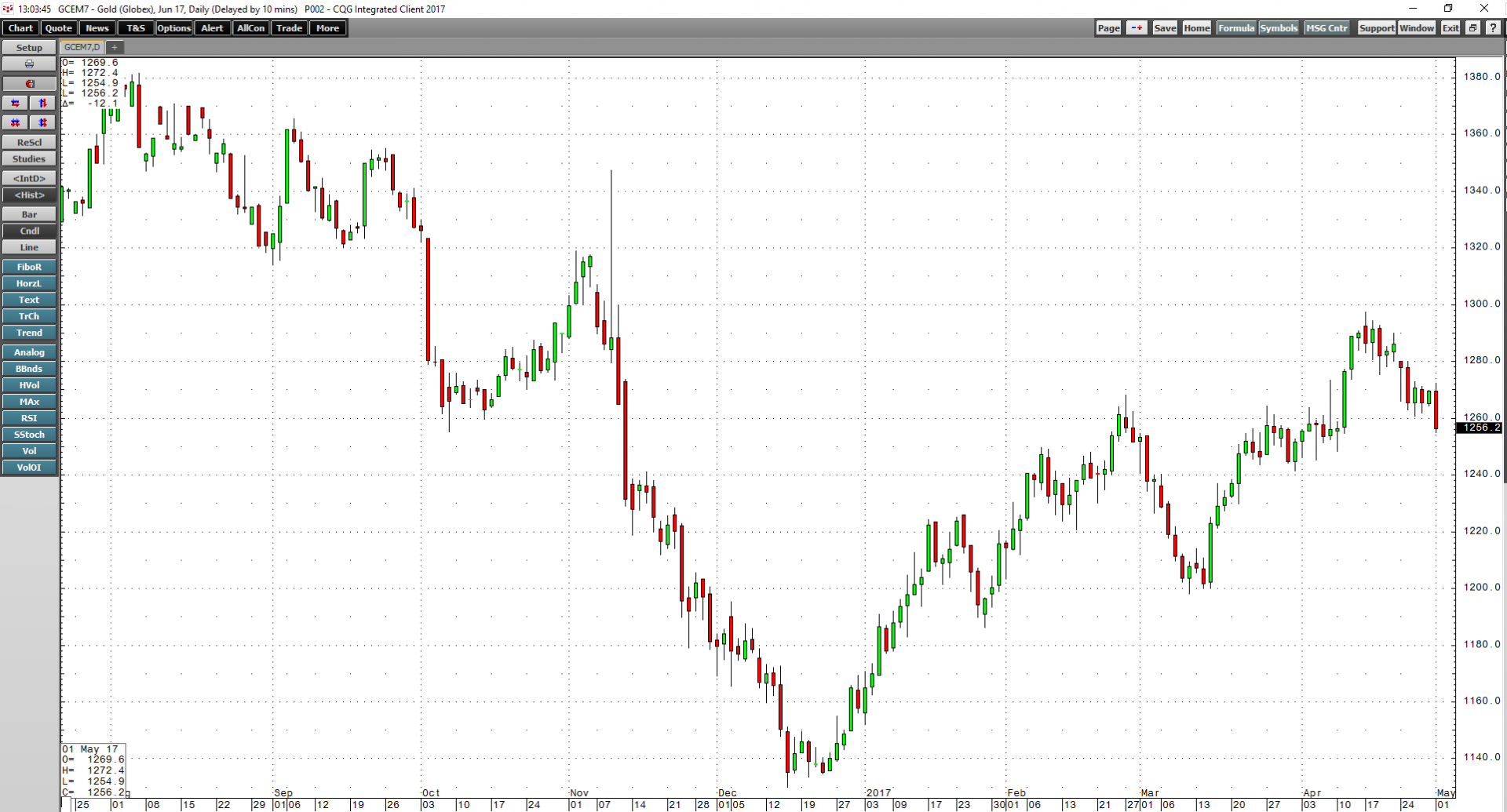

Gold opened 2017 with a roar after hitting lows in December. The price of the yellow metal has made higher lows and higher highs so far with the most recent peak coming on April 17, when the… more

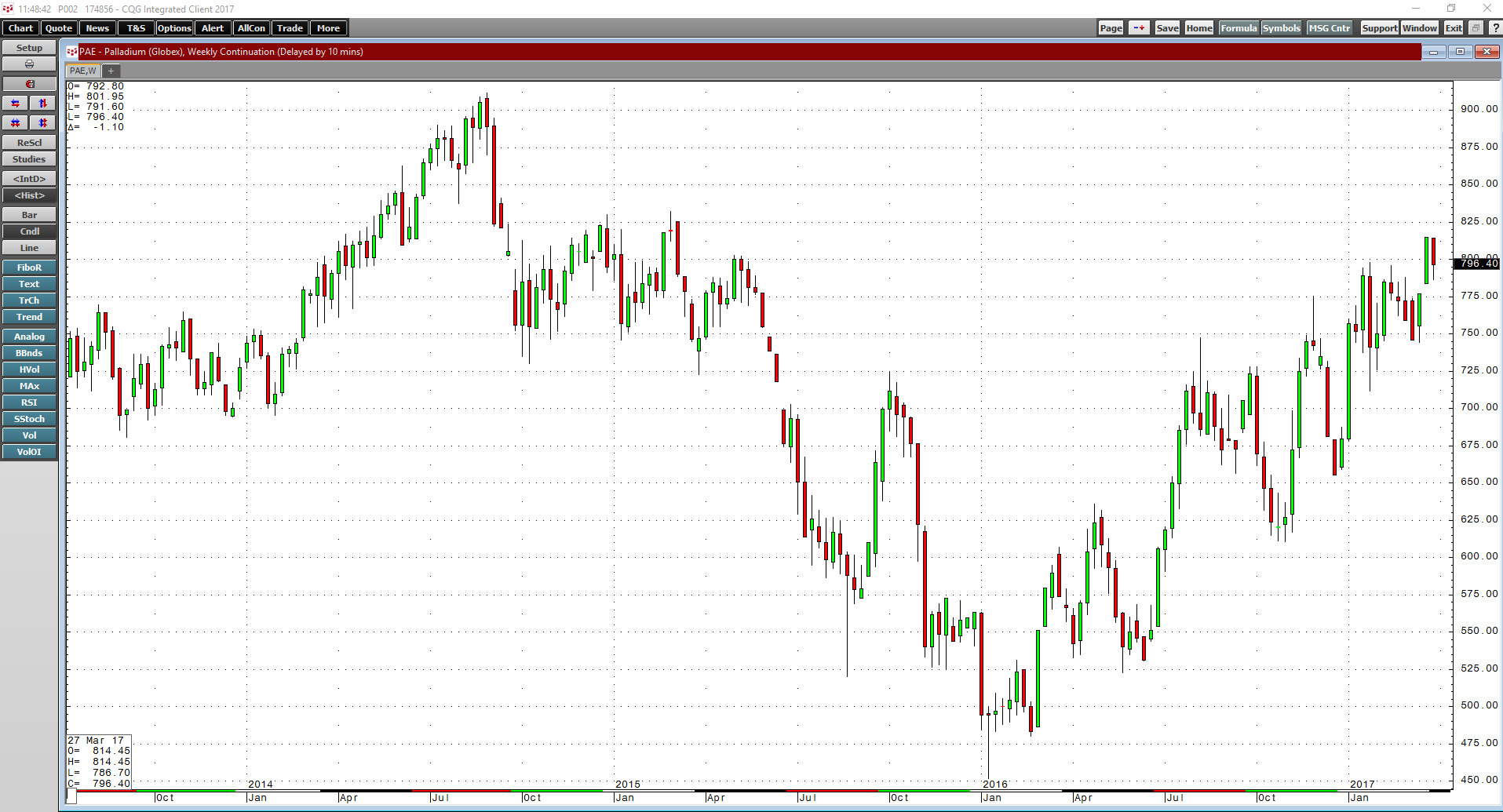

The dollar index moved lower by 2.02% in the first quarter of 2017, and commodities prices moved higher with four of the six major sectors posting gains. Many raw materials made multiyear lows in… more

The trading range in crude oil has been narrow since the middle of December 2016. From high to low since December 19, the price of active month NYMEX crude oil futures have traded in a range of… more

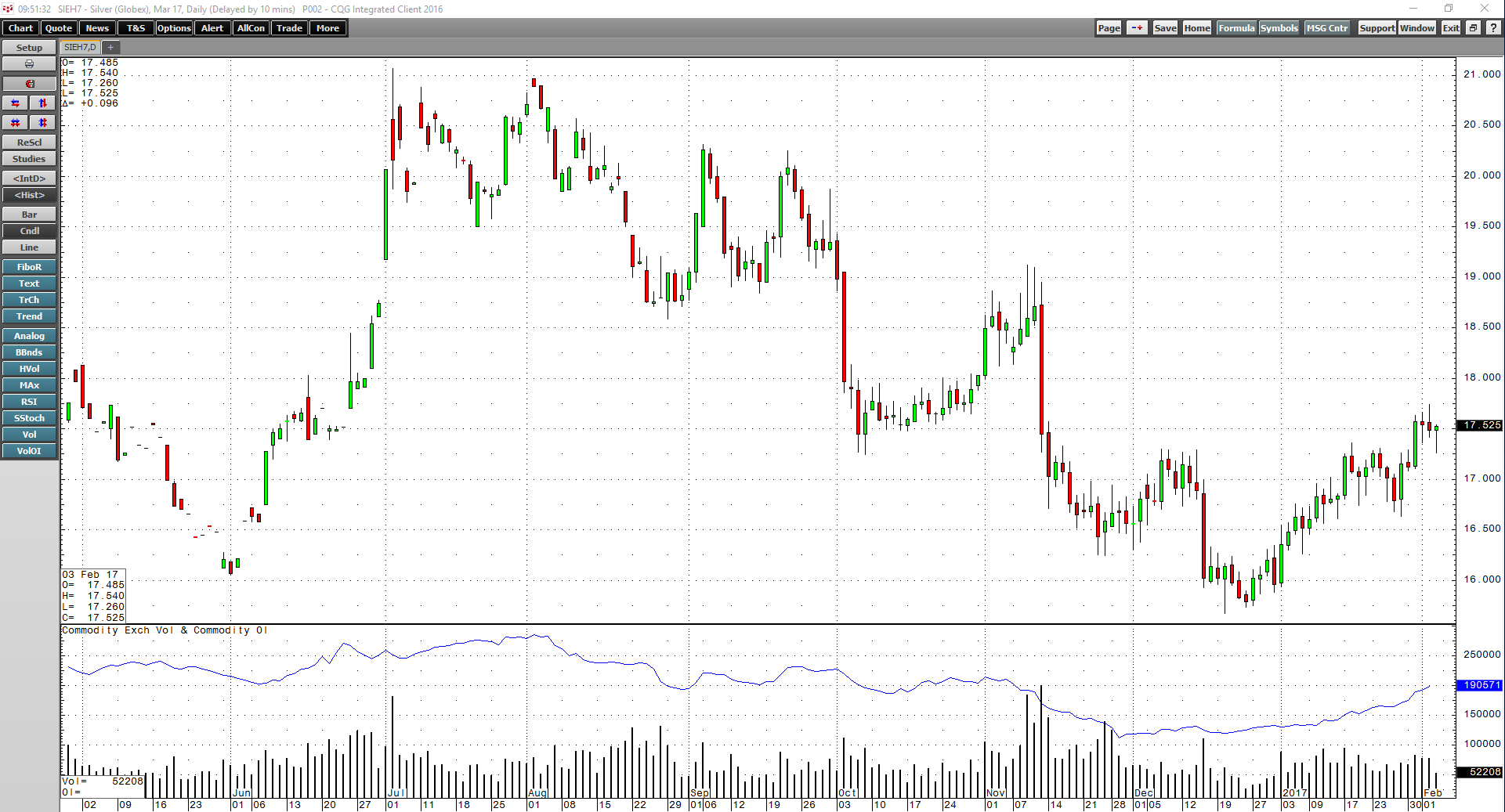

After Election Day in November, it looked like the rallies in gold and silver that took place over the course of 2016 were over and done. Nearby gold futures fell to lows of $1,123.90 and silver… more

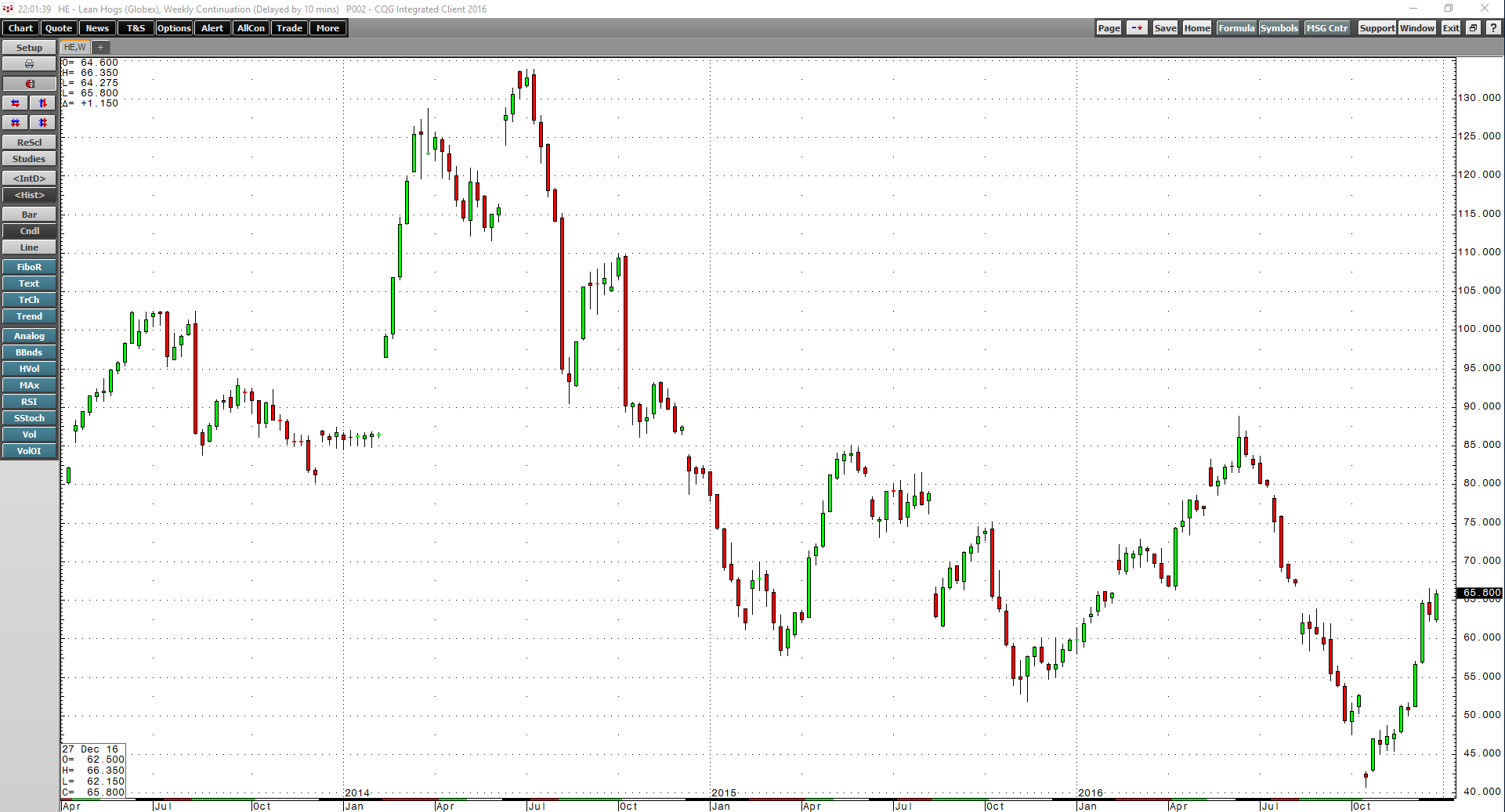

The dollar index exploded higher by 7.23% in Q4 2016, but most raw material prices ignored the greenback. The principal raw materials traded on US and UK futures exchanges rose by 3.75% in Q4. The… more