There is a big difference between price and value. Price is a transparent number where buyers and sellers meet to transact. Value is a concept that often goes much deeper. We can all watch asset… more

Andy Hecht

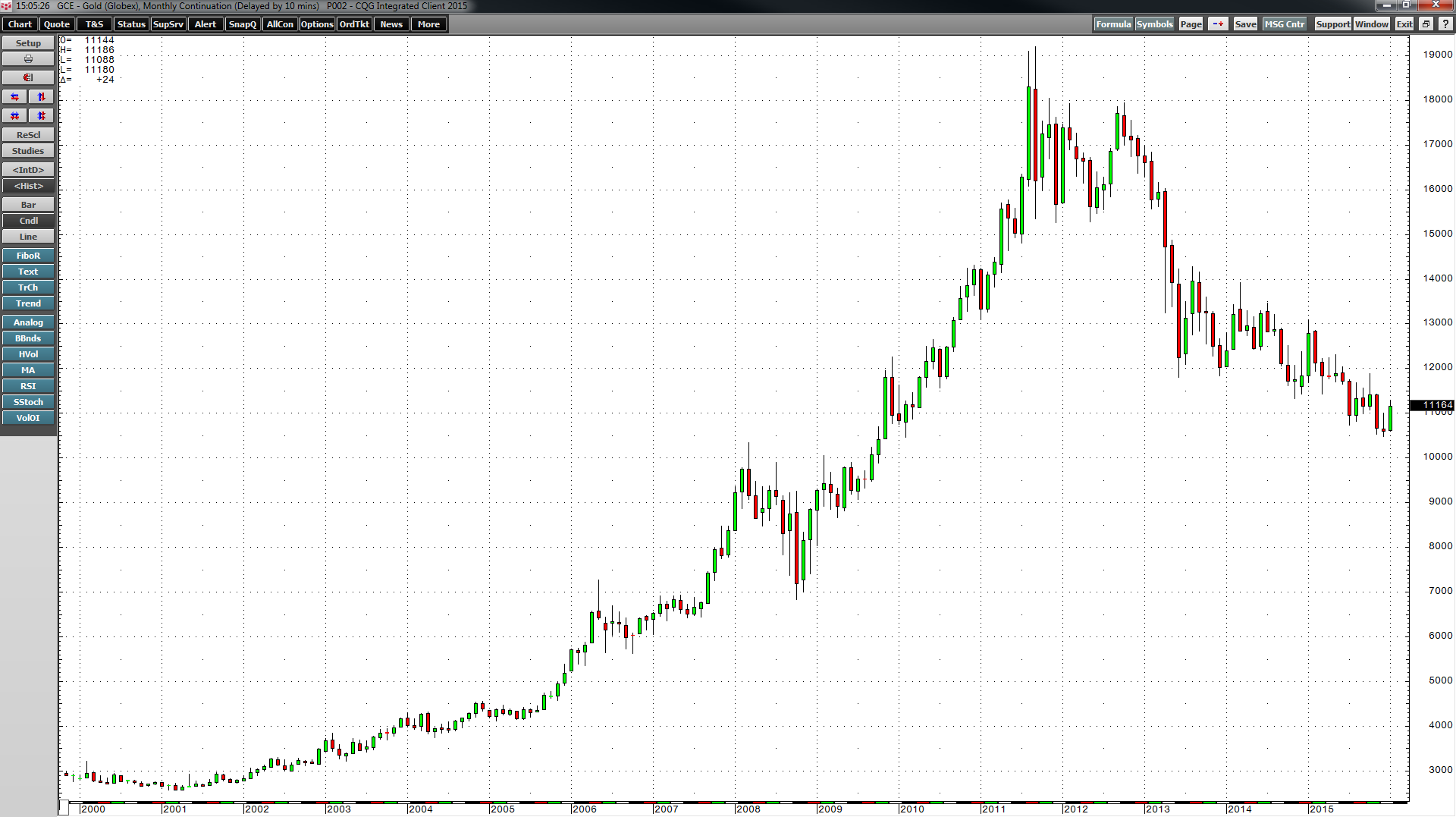

The final quarter of 2015 is now in the books and for the most part, it was more of the same for commodity prices. Overall, a composite of over thirty commodities moved lower once again in a… more

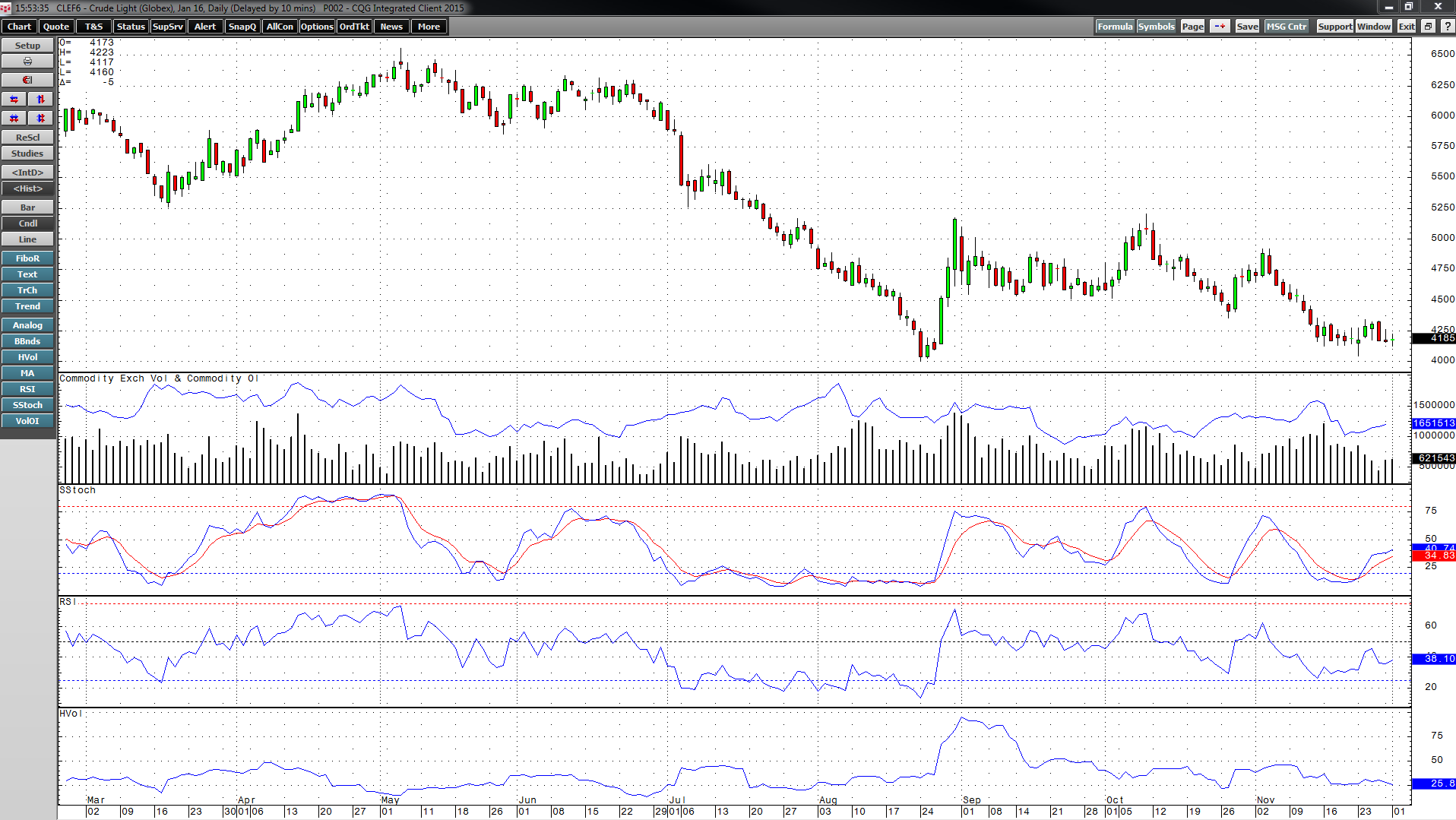

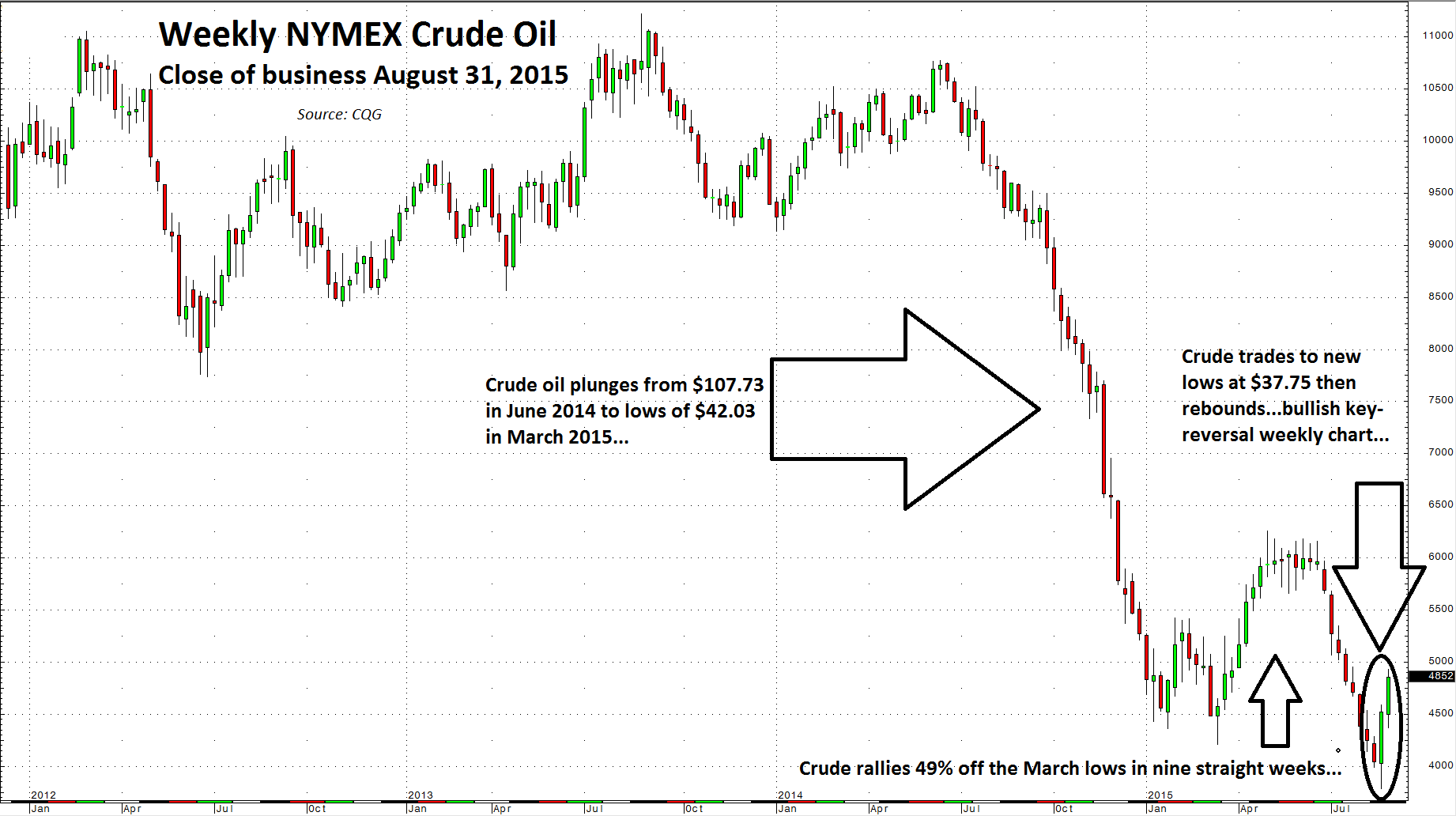

It has been a rough ride for crude oil since June of 2014 when the price of active month NYMEX crude was trading above $107 per barrel. Since then, the price has been making lower highs and lower… more

The price of active month NYMEX natural gas futures closed on September 30, 2015 at $2.524 per mmBtu. The fourth and first quarters are generally a positive seasonal period for the energy… more

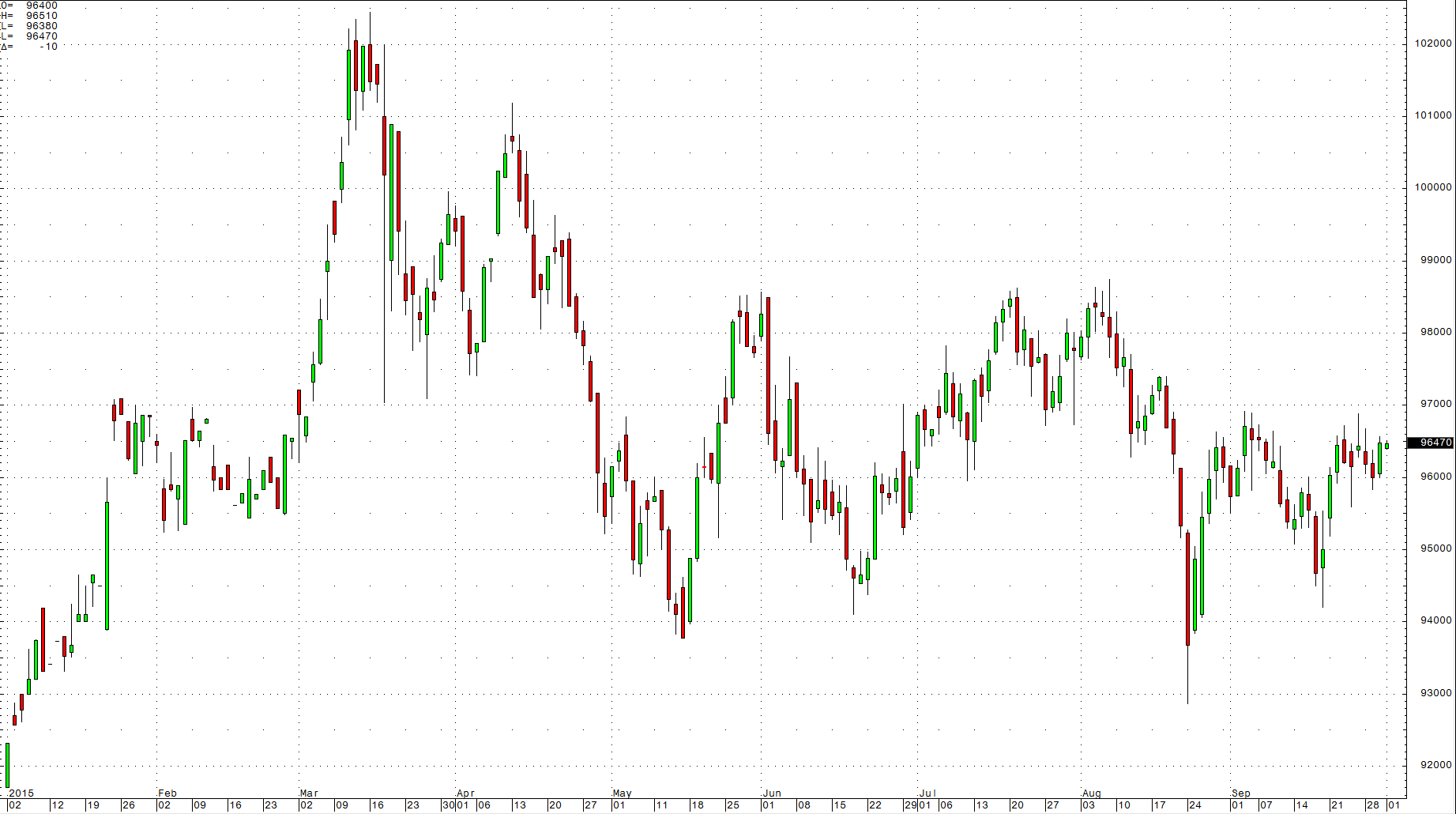

The Inverse Relationship Could Mean the Next Leg Down

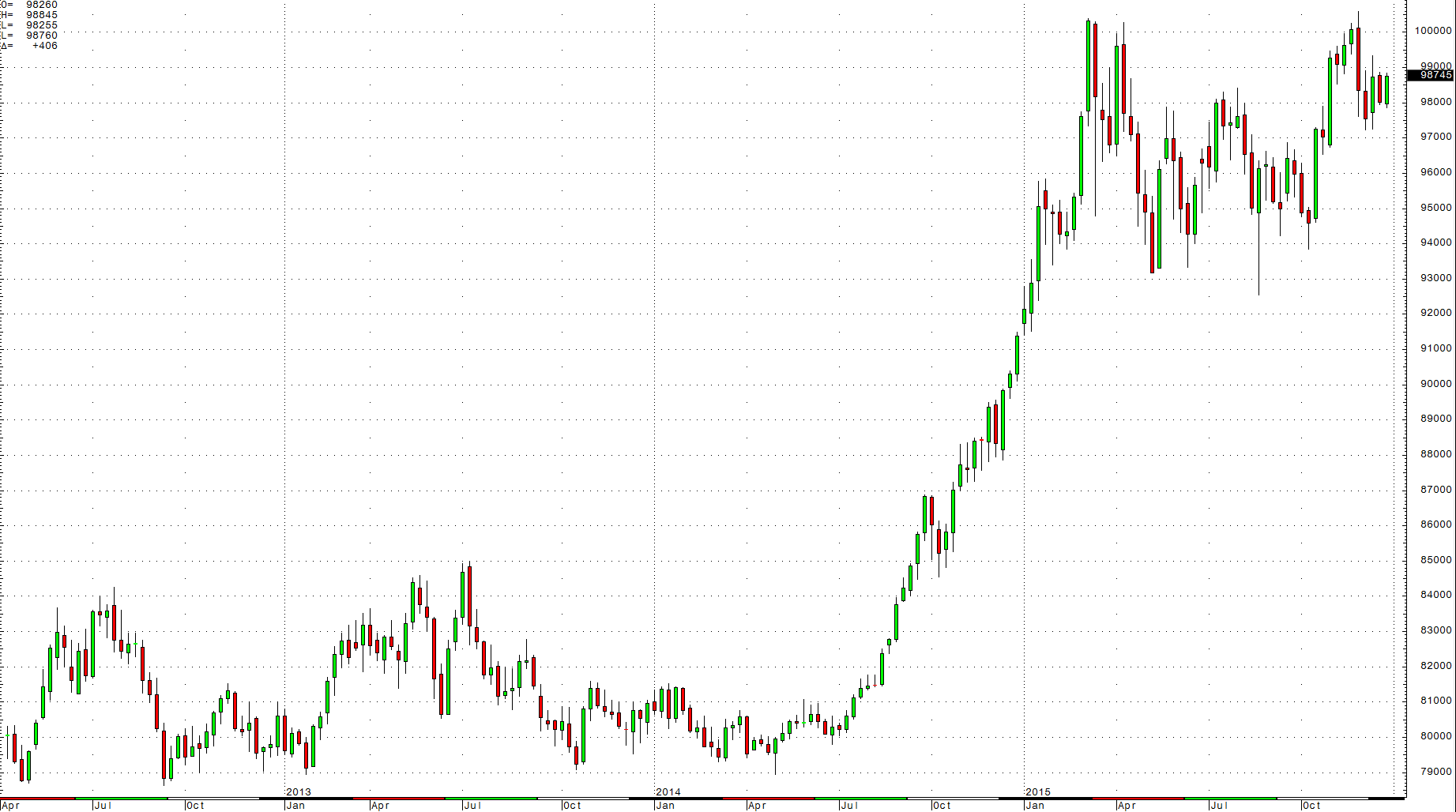

The US dollar is the reserve currency of the world. As such, it is the pricing mechanism for most important raw material markets.… more

Third quarter of 2015 is now in the books, and the results were not pretty for commodity bulls. Overall, a composite of over thirty futures-market-traded commodities moved lower, making the last… more

Volatility is an investor's nightmare, but at the same time, it is a seasoned trader's paradise. During the final weeks of August, markets are traditionally quiet. As the vacation season ends,… more

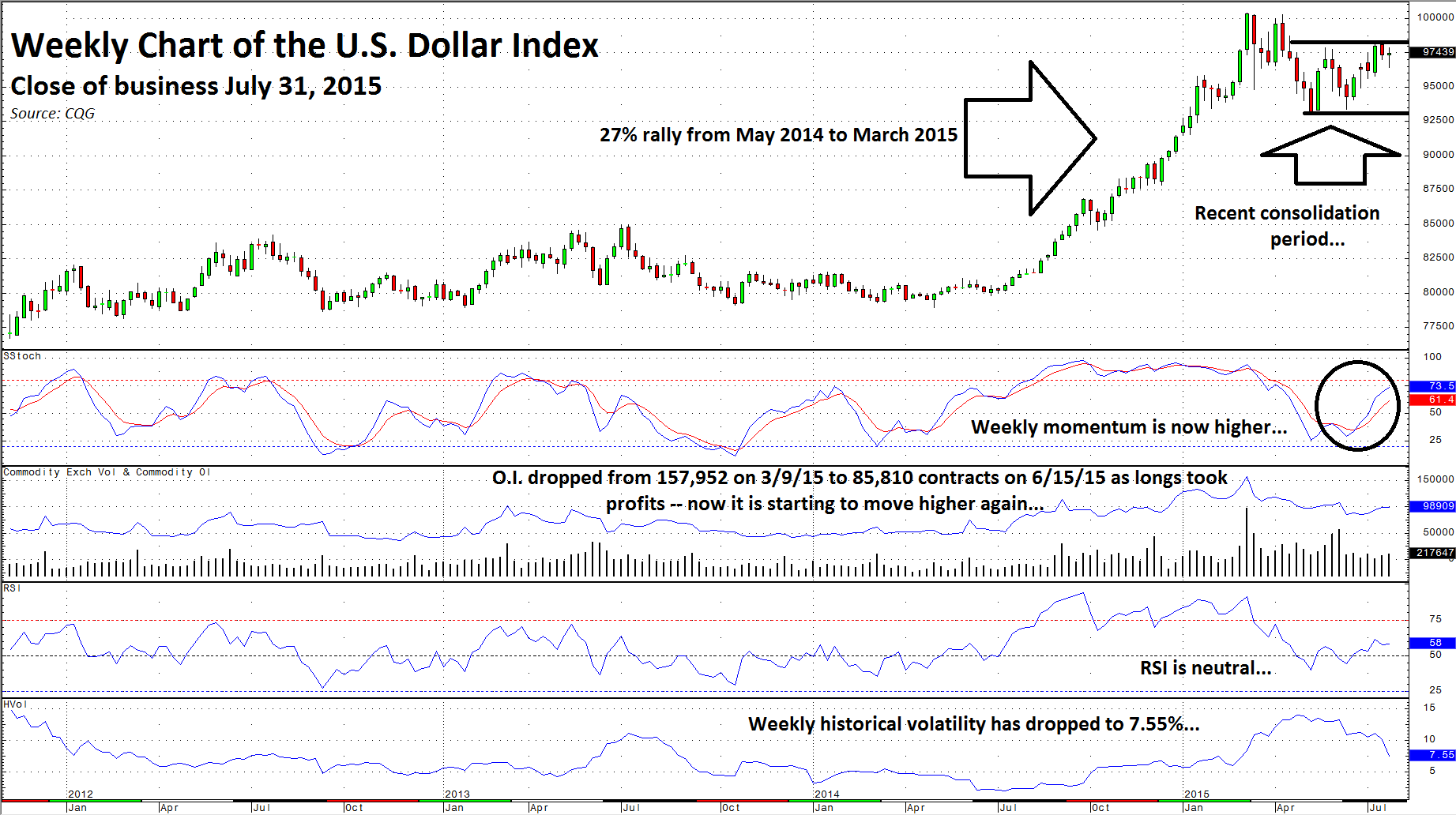

The US dollar is the pricing mechanism for almost all raw material prices around the globe. As the reserve currency of the world, the vast amount of liquid trading in commodity futures and forward… more

The rally in the US dollar that commenced in May 2014 saw a period of correction and consolidation during the second quarter of 2015. The world's reserve currency has an inverse relationship with… more

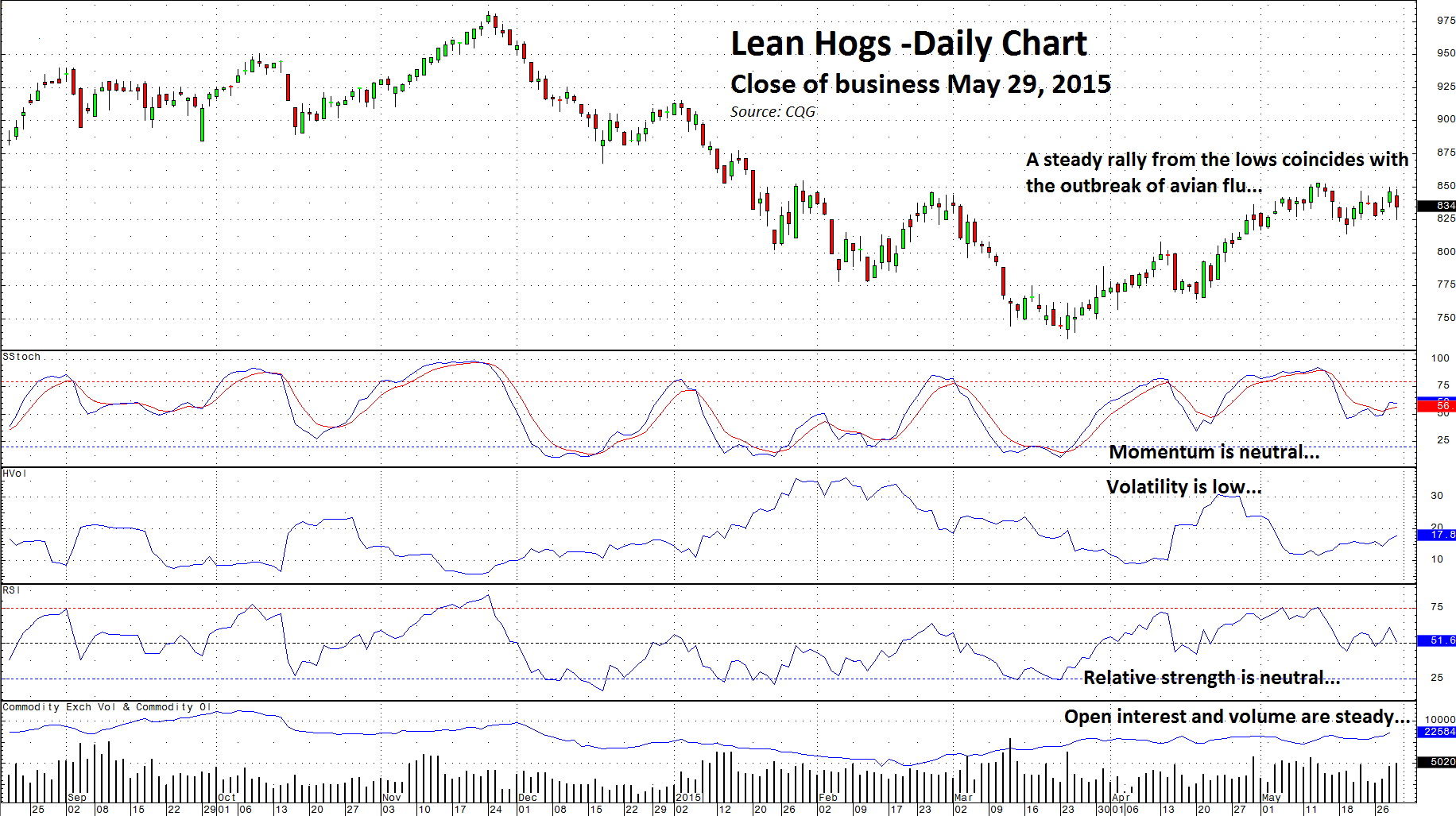

It is now grilling season in the United States, which commences each year during the Memorial Day holiday weekend and runs through Labor Day. As Americans spend the next few months enjoying warm… more