The dollar index moved lower by 1.22% in the second quarter of 2019, but the commodities asset class posted a loss in Q2. Two of the six major sectors posted gains while four moved to the downside… more

Andy Hecht

Commodities are global assets. Raw material production is a local affair as minerals, ores, metals, and energy output comes from parts of the world where the earth's crust is rich in… more

Crude oil is the energy commodity that powers the world. Over the past six months, the international oil market provided a rollercoaster of volatility for market participants. A ride to the… more

The dollar index moved higher by 1.16% in the first quarter of 2019, but the commodities asset class posted a gain over the first three months of the quarter that ended on March 29. Two of the six… more

February 2019 was an excellent month for the prices of two high-profile metals that trade on the futures exchanges. Gold is a metal that has many roles. The yellow metal is a go-to favorite when… more

Gold fell to a low at $1161.70 in mid-August, but silver waited until mid-November to find its bottom at $13.86 per ounce. Since the lows, the precious metals have been making higher lows and… more

The dollar index moved higher by 1.05% in the fourth quarter of 2018, and the commodities asset class posted a loss over the final three months of the year that ended on December 31. Two of the… more

In early October it looked like the price of crude oil was heading for triple-digit territory on the back of sanctions on Iran that were coming in early October. At the same time, the price of… more

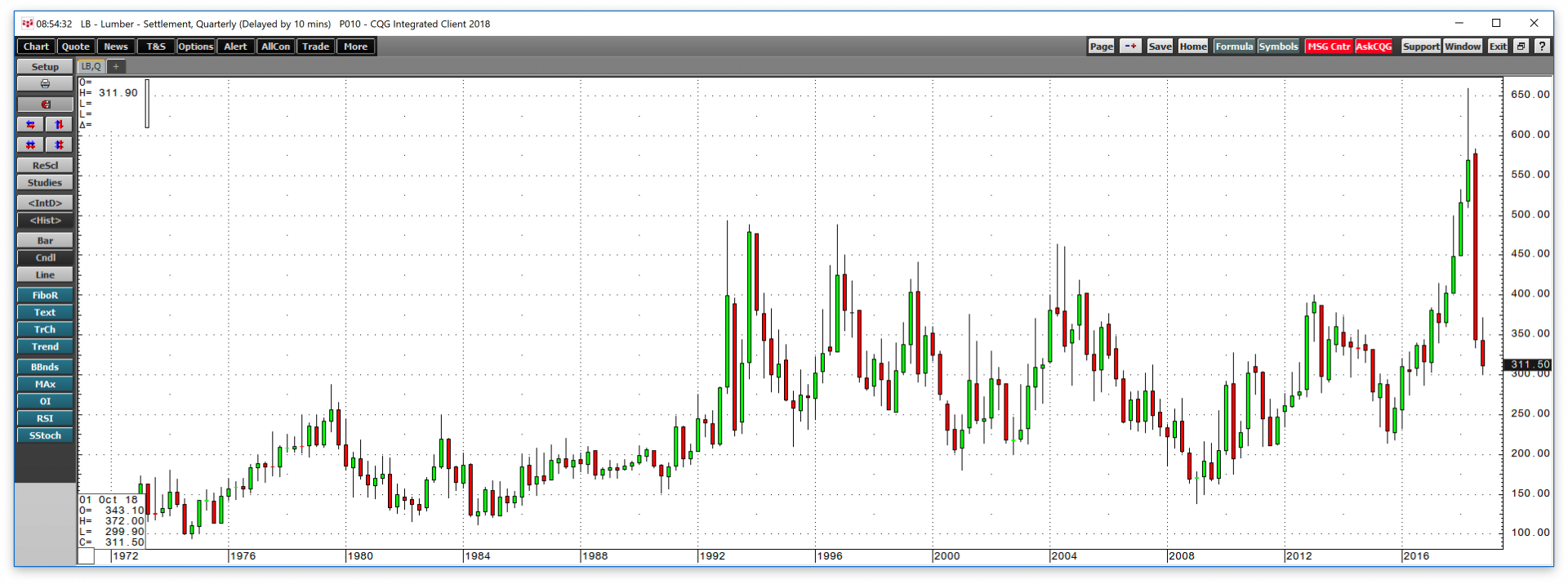

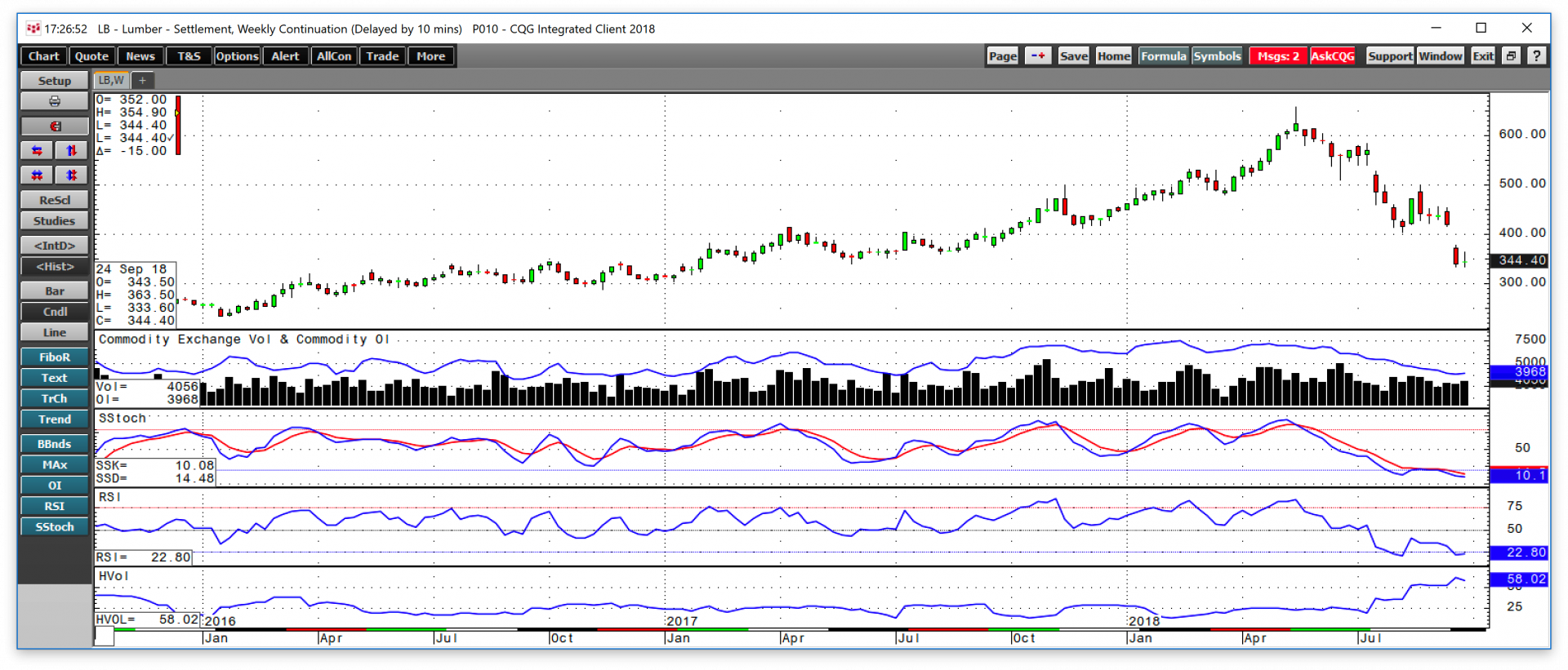

There are many lessons that we can learn from the price action in commodities markets. Commodities tend to rise to prices where output increases, inventories build, and demand declines. At lofty… more

The dollar index moved higher by 0.41% in the third quarter of 2018, and commodities prices moved lower, with all six major sectors posting losses. The composite of 29 raw material markets that… more