As the markets head into 2024's second quarter, the North American agricultural planting season is getting underway. Farmers are now planting the grains that feed and increasingly power the world… more

Andy Hecht

Gold has a long history as an alternative asset, while Bitcoin and digital currencies only burst on the scene starting in 2010. Gold has been a low-volatility asset over the past few years, in a… more

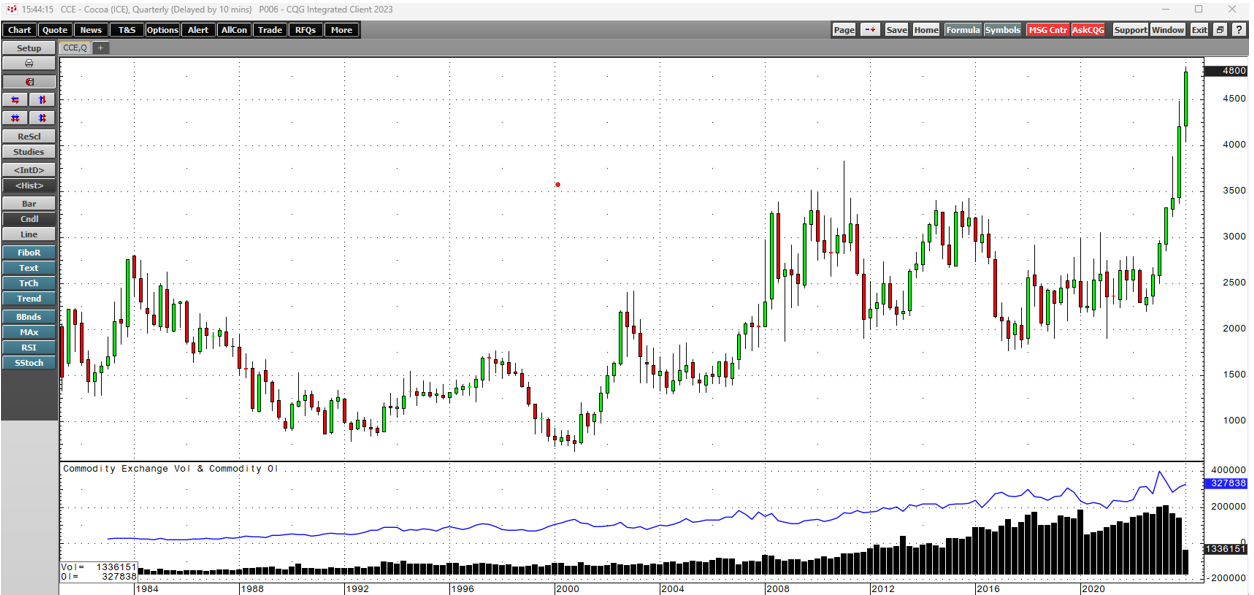

Cocoa was the leading soft commodity in 2023, gaining 61.4% for the year that ended on December 29, 2023. While other soft commodities, including cotton and Arabica coffee futures, rose to multi-… more

The raw material markets declined in Q4. The commodity asset class consisting of 29 primary commodities traded on U.S. and U.K. exchanges moved 3.91% lower in Q4 2023. At the end of 2023, the… more

Gold is a hybrid, part commodity, and part financial asset. The precious yellow metal has industrial applications but has been a means of exchange for thousands of years.

London is the hub… more

Markets reflect the economic and geopolitical landscapes. In October 2023, elevated inflationary pressures and hawkish central bank monetary policies sent the short-term Fed Funds Rate from zero… more

The raw material markets edged higher in Q3. The commodity asset class consisting of 29 primary commodities traded on U.S. and U.K. exchanges moved 1.91% higher in Q3 2023. Over the first nine… more

Stocks compete with bonds for capital flows, and rising rates tend to weigh on the stock market. Meanwhile, high interest rates increase the cost of carrying commodity inventories, which tends to… more

The nearby NYMEX crude oil futures price reached a fourteen-year high in March 2022 after Russia invaded Ukraine. After running out of upside steam at $130.50 per barrel, the continuous contract… more

A composite of the 29 primary commodity markets traded on the U.S. and U.K. exchanges edged only 0.21% higher in Q2, thanks to gains in animal proteins and soft commodities. Over the first six… more